Fafsa 2024 Tax Year: Your Ultimate Guide To Navigating The Financial Aid Process

Listen up, folks! If you're stressing about FAFSA 2024 and wondering which tax year applies, you're not alone. Millions of students and parents find themselves scratching their heads over this financial aid application every year. But don’t sweat it—we’ve got your back. Let’s break it down so you can focus on what matters: getting that education.

FAFSA is like the golden ticket to accessing federal student aid, scholarships, grants, and work-study programs. It’s a crucial step in your academic journey, but it can feel like navigating a maze if you’re not prepared. Understanding which tax year applies for FAFSA 2024 is the key to making sure you don’t mess up the application process.

So, grab a cup of coffee, sit tight, and let’s dive deep into the world of FAFSA. We’ll make sure you’re ready to rock this application and secure the funds you need for school. Let’s go!

- Projocom Obituary A Comprehensive Guide To Honoring Lives

- Matthew Rhys The Actor Who Turned Passion Into Stardom

Here's a quick table of contents to help you jump around:

- What is FAFSA?

- FAFSA 2024 Tax Year: What You Need to Know

- Who’s Eligible for FAFSA?

- The FAFSA Application Process

- Common Mistakes to Avoid

- Which Tax Documents to Prepare

- FAQs About FAFSA 2024

- Resources to Help You

- Final Thoughts on FAFSA 2024

What is FAFSA?

Alright, let’s start with the basics. FAFSA stands for Free Application for Federal Student Aid, and it’s basically the first step to unlocking financial aid for college or grad school. This form helps schools determine how much financial aid you qualify for, whether it’s grants, loans, or work-study opportunities.

Think of FAFSA as the gatekeeper to your dream of higher education. Without it, you might miss out on some sweet funding options. The cool thing is, it’s free to apply, so there’s no reason not to give it a shot.

- Harry Potters Severus Snape Actor A Deep Dive Into His Life And Legacy

- Santa Fe Klan The Rising Star Of Latin Music Scene

Now, let’s talk about why understanding the FAFSA 2024 tax year is so important. It’s all about timing and knowing which financial data to use. Get it wrong, and you could end up with an incomplete or inaccurate application. So, buckle up because we’re about to explain it all.

FAFSA 2024 Tax Year: What You Need to Know

Why Does the Tax Year Matter?

Here’s the deal: the FAFSA requires you to report your income and tax information from a specific tax year. For FAFSA 2024, you’ll need to use the tax data from the 2022 tax year. Why 2022? Because the FAFSA uses the previous year’s tax info to calculate your Expected Family Contribution (EFC).

Let’s say you’re applying for the 2024-2025 academic year. You’ll need to pull out your 2022 tax returns and any other financial documents from that time. This ensures that the information you provide is accurate and up-to-date.

What If You Haven’t Filed Your Taxes Yet?

No worries! Even if you haven’t filed your taxes yet, you can still estimate your numbers based on your W-2 forms or pay stubs. Just remember to update your FAFSA once you’ve officially filed your taxes. It’s all about being proactive and staying on top of things.

Who’s Eligible for FAFSA?

Not everyone qualifies for FAFSA, but the good news is that most students do. Here’s a quick rundown of the eligibility requirements:

- Be a U.S. citizen or eligible non-citizen.

- Have a valid Social Security Number.

- Be enrolled or accepted into an eligible degree or certificate program.

- Maintain satisfactory academic progress.

- Not owe a refund on a federal student grant or be in default on a federal student loan.

Oh, and one more thing: males between the ages of 18 and 25 must register with the Selective Service to be eligible. Yeah, it’s one of those rules that just is.

The FAFSA Application Process

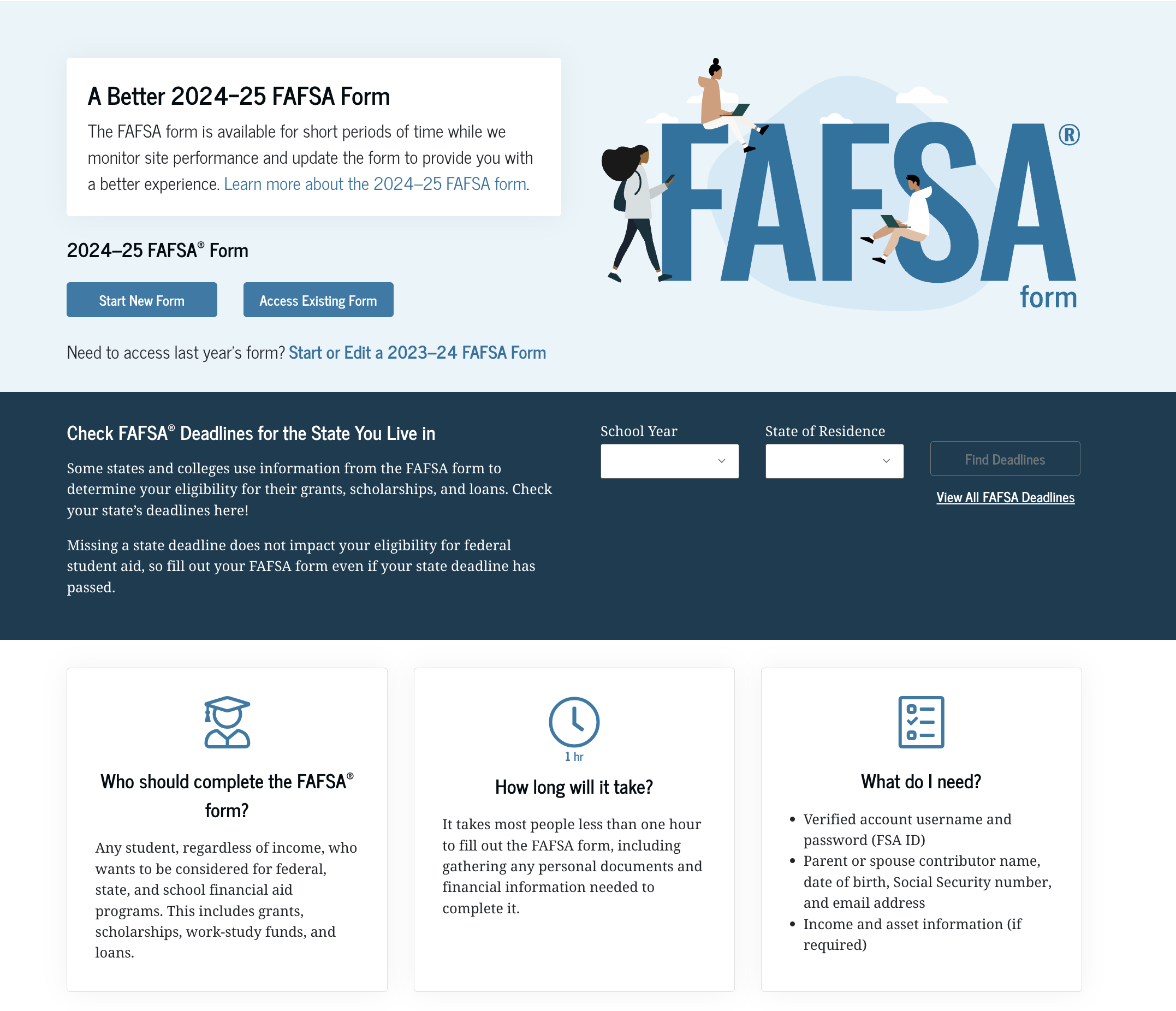

Step 1: Create an FSA ID

Before you even think about filling out the FAFSA, you’ll need to create an FSA ID. This is like your digital key to accessing the application and signing it electronically. Both students and parents need their own FSA IDs, so don’t forget to set one up for everyone involved.

Step 2: Gather Your Documents

You’ll need a few key documents to complete the FAFSA:

- Your Social Security Number (or Alien Registration Number if you’re not a U.S. citizen).

- Your federal income tax returns, W-2s, and other records of earnings.

- Bank statements and records of investments.

- Records of untaxed income.

Having all this info ready will save you a ton of time and frustration. Trust me, it’s worth the prep work.

Step 3: Fill Out the Application

Once you’ve got everything in order, it’s time to tackle the FAFSA itself. You can apply online at fafsa.gov or via the myStudentAid app. The online version is usually faster and easier, but the choice is yours.

As you fill out the form, make sure to double-check all your entries. A small typo can lead to big headaches later on. Take your time and stay focused.

Common Mistakes to Avoid

Even the best of us can slip up when filling out forms. Here are some common FAFSA mistakes to watch out for:

- Using the wrong tax year information.

- Forgetting to list all schools you’re interested in.

- Not signing the application with your FSA ID.

- Making errors in your Social Security Number or date of birth.

- Waiting too long to submit your application.

Pro tip: Submit your FAFSA as early as possible. Some aid is awarded on a first-come, first-served basis, so the sooner you apply, the better your chances of getting what you need.

Which Tax Documents to Prepare

For FAFSA 2024, you’ll need to focus on the 2022 tax year. Here’s a list of the tax documents you should have ready:

- Form 1040 (U.S. Individual Income Tax Return).

- W-2 forms from your employers.

- 1099 forms for any investment income.

- Schedule C if you’re self-employed.

If you’re a dependent student, you’ll also need your parents’ tax info. If you’re independent, you’ll only need your own financial data. Easy, right?

FAQs About FAFSA 2024

Q: Can I use estimated tax information?

A: Yes, you can use estimated numbers if you haven’t filed your taxes yet. Just remember to update your FAFSA once your official tax return is ready.

Q: What happens if I miss the deadline?

A: Deadlines vary by state and school, so it’s crucial to know yours. Missing a deadline could mean losing out on some forms of financial aid, so don’t procrastinate!

Q: Do I have to apply every year?

A: Yep, you’ll need to submit a new FAFSA each year you’re in school. Your financial situation can change, so it’s important to update your info annually.

Resources to Help You

Don’t go it alone! There are tons of resources available to help you navigate the FAFSA process:

- The official FAFSA website offers tons of guides and FAQs.

- Many schools have financial aid offices that can answer your questions.

- There are also online communities where students share tips and advice.

Take advantage of these resources—they’re there to help you succeed.

Final Thoughts on FAFSA 2024

Alright, we’ve covered a lot of ground here. Let’s recap the key points:

- FAFSA is your ticket to accessing federal student aid.

- For FAFSA 2024, use the 2022 tax year information.

- Be mindful of deadlines and eligibility requirements.

- Double-check your application for errors before submitting.

Now that you know the drill, it’s time to take action. Apply for FAFSA, gather your documents, and get ready to chase your academic dreams. Remember, knowledge is power, and the more you understand about the process, the smoother your journey will be.

So, what are you waiting for? Hit that submit button and let’s make this happen. And hey, if you’ve got questions or feedback, drop them in the comments below. Let’s keep the conversation going!

- Who Is The Lead Singer For Korn Unveiling The Voice Behind The Iconic Sound

- 58 In Cm Height Your Ultimate Guide To Understanding And Converting

Fafsa 2024 2024 Application Form Print Celina Brigitte

When Does Fafsa Open For 202425 School Year Cassy Dalenna

Last Day To Do Fafsa 2024 Kiah Selene