Riverside County Tax Assessor Property Tax: The Ultimate Guide For Homeowners

Property taxes can be a tricky business, especially when you're dealing with Riverside County. But don't sweat it, because we've got you covered. Whether you're a first-time homeowner or a seasoned property owner, understanding Riverside County tax assessor property tax is crucial for your financial planning. So, let's dive in and break it down in a way that makes sense, even on a lazy Sunday afternoon.

Imagine this: you're chilling at home, sipping your coffee, and suddenly you remember that pesky property tax bill is coming up. You start wondering, "How much am I really paying? What does the Riverside County tax assessor even do?" Well, my friend, those questions are about to get answered. This guide is here to demystify the whole process and help you navigate the world of property taxes like a pro.

Now, I know what you're thinking. "Property tax? That sounds boring!" But trust me, it's more interesting than you think. Understanding how Riverside County calculates your property tax can save you money and help you make informed decisions. So, let's roll up our sleeves and get into the nitty-gritty of Riverside County tax assessor property tax. It's gonna be a wild ride!

- Cryptopronetwork The Ultimate Guide To Www Cryptopronetworkcom

- Dealing With Itchy Bumps On Inner Thigh A Comprehensive Guide

Why Riverside County Tax Assessor Property Tax Matters

Here's the deal: property tax is not just some random number the government pulls out of a hat. It's actually a big deal, especially in Riverside County. This tax helps fund essential services like schools, public safety, and infrastructure. Think about it – those shiny new roads and well-maintained parks don't just appear out of thin air. They're made possible by the property taxes you pay.

But here's the kicker: if you don't understand how the Riverside County tax assessor determines your property tax, you might end up paying more than you should. And who wants that? By the end of this guide, you'll know exactly how the system works and how to ensure you're paying the right amount. So, buckle up, because we're about to break it down step by step.

Understanding the Role of the Riverside County Tax Assessor

Alright, let's talk about the big player in this game: the Riverside County tax assessor. This is the person or department responsible for evaluating your property's value and determining how much tax you owe. Think of them as the referee in the property tax game. They make sure everything is fair and square, but sometimes, they might need a little help from you to get the numbers right.

- King County Recorder Your Ultimate Guide To Records Services And More

- How Many Seasons Are There In Heartland A Comprehensive Guide For Fans

What Exactly Does the Tax Assessor Do?

Here's a quick rundown of the tax assessor's responsibilities:

- They assess the value of your property based on market conditions and other factors.

- They ensure that property values are updated regularly to reflect current market trends.

- They help maintain the tax rolls, which are basically the official records of all properties in the county.

- They assist homeowners with disputes or appeals if they believe their property value has been incorrectly assessed.

Now, here's the thing: the tax assessor's job is not to make your life harder. They're just doing their job, but sometimes, mistakes happen. That's why it's important for you to stay informed and proactive about your property tax situation.

How Property Tax is Calculated in Riverside County

Okay, let's get into the numbers. Property tax in Riverside County is calculated using a pretty straightforward formula. It's based on your property's assessed value and the tax rate set by the county. Here's the basic equation:

Property Tax = Assessed Value × Tax Rate

The assessed value is usually a percentage of your property's market value. In California, thanks to Proposition 13, property taxes are generally capped at 1% of the assessed value. But don't forget about additional assessments and fees that might be added to your bill. These can vary depending on your specific location within Riverside County.

Breaking Down the Tax Rate

The tax rate in Riverside County is made up of two parts: the general tax rate and any special assessments. The general tax rate is typically around 1%, but the special assessments can add up. These might include things like school district fees, water district charges, or other local improvements.

So, if your property's assessed value is $500,000 and the tax rate is 1%, your base property tax would be $5,000. But if there are additional assessments totaling $1,000, your total tax bill would be $6,000. See how it adds up? It's important to keep an eye on these extra fees to avoid any surprises.

Common Myths About Riverside County Property Tax

Before we go any further, let's clear up some common misconceptions about Riverside County property tax. These myths can lead to confusion and even cost you money, so it's best to set the record straight.

Myth #1: Property Tax is Fixed

Wrong! Property tax can change from year to year based on factors like inflation, market conditions, and new assessments. Just because your tax bill was the same last year doesn't mean it will be the same this year.

Myth #2: The Assessed Value is Always Equal to the Market Value

Not necessarily. The assessed value is usually a percentage of the market value, and it can lag behind if the market is changing rapidly. That's why it's a good idea to periodically check your property's assessed value and compare it to current market trends.

Myth #3: You Can't Appeal Your Property Tax Assessment

Oh, but you can! If you believe your property has been overvalued, you have the right to appeal the assessment. We'll talk more about that later, but for now, just know that it's an option worth exploring if you think you're paying too much.

Key Factors Affecting Your Property Tax Bill

So, what exactly influences how much property tax you pay in Riverside County? There are several factors at play, and understanding them can help you manage your tax burden more effectively.

1. Property Type

Different types of properties are taxed differently. Residential properties, commercial properties, and agricultural land all have their own tax rules and rates. Make sure you know which category your property falls into to avoid any misunderstandings.

2. Location

Where your property is located within Riverside County can also affect your tax bill. Some areas have higher tax rates or additional assessments due to local needs like schools or infrastructure improvements.

3. Market Conditions

The real estate market is constantly changing, and these changes can impact your property's assessed value. If property values in your area are rising, your tax bill might increase as well. Conversely, if values are falling, your tax bill could decrease.

How to Appeal Your Property Tax Assessment

If you believe your property tax assessment is too high, don't despair. You have the right to appeal, and the process is simpler than you might think. Here's a step-by-step guide to help you get started:

Step 1: Gather Your Evidence

You'll need to provide evidence that your property's assessed value is inaccurate. This might include recent sales of comparable properties in your area, photos of any damage or issues with your property, or other relevant documentation.

Step 2: File Your Appeal

Once you have your evidence, it's time to file your appeal with the Riverside County Assessor's Office. Be sure to follow their specific procedures and deadlines to ensure your appeal is considered.

Step 3: Attend the Hearing

If your appeal is accepted, you'll be invited to a hearing where you can present your case. This is your chance to explain why you believe your property has been overvalued and provide your evidence to support your claim.

Strategies to Lower Your Property Tax Bill

Now that you know how property tax works in Riverside County, let's talk about some strategies to help you lower your bill. These tips can save you money and make your tax burden more manageable.

1. Monitor Your Assessed Value

Keep an eye on your property's assessed value and compare it to current market trends. If you notice a significant discrepancy, it might be time to appeal.

2. Take Advantage of Tax Exemptions

Depending on your situation, you might qualify for certain tax exemptions or deductions. For example, homeowners over a certain age or with disabilities may be eligible for reduced property taxes. Check with the Riverside County Assessor's Office to see if you qualify.

3. Stay Informed About Local Assessments

Keep up with any new assessments or fees that might be added to your tax bill. This way, you can plan accordingly and avoid any unexpected increases.

Resources for Riverside County Property Owners

Here are some useful resources to help you stay informed about Riverside County property tax:

- Riverside County Assessor's Office – Official website with information on property assessments, appeals, and more.

- Riverside County Official Website – A wealth of information on local government services, including property tax.

- State of California Official Website – Learn about statewide property tax laws and regulations.

Conclusion: Take Control of Your Property Tax

And there you have it – the ultimate guide to Riverside County tax assessor property tax. Now that you know how the system works, you're armed with the knowledge to make informed decisions about your property taxes. Remember, staying informed and proactive is the key to managing your tax burden effectively.

So, what are you waiting for? Take action today! Check your property's assessed value, explore any available exemptions, and don't hesitate to appeal if you believe your assessment is inaccurate. And don't forget to share this guide with your friends and family so they can benefit from the knowledge too.

Table of Contents

- Why Riverside County Tax Assessor Property Tax Matters

- Understanding the Role of the Riverside County Tax Assessor

- How Property Tax is Calculated in Riverside County

- Common Myths About Riverside County Property Tax

- Key Factors Affecting Your Property Tax Bill

- How to Appeal Your Property Tax Assessment

- Strategies to Lower Your Property Tax Bill

- Resources for Riverside County Property Owners

- Conclusion: Take Control of Your Property Tax

- Alex Lagina The Mysterious Genius Who Cracked The Worlds Codes

- Netflix Servers Status Is Your Fave Streaming Service Down Or Just You

Casey Hillmer for Marshall County Tax Assessor

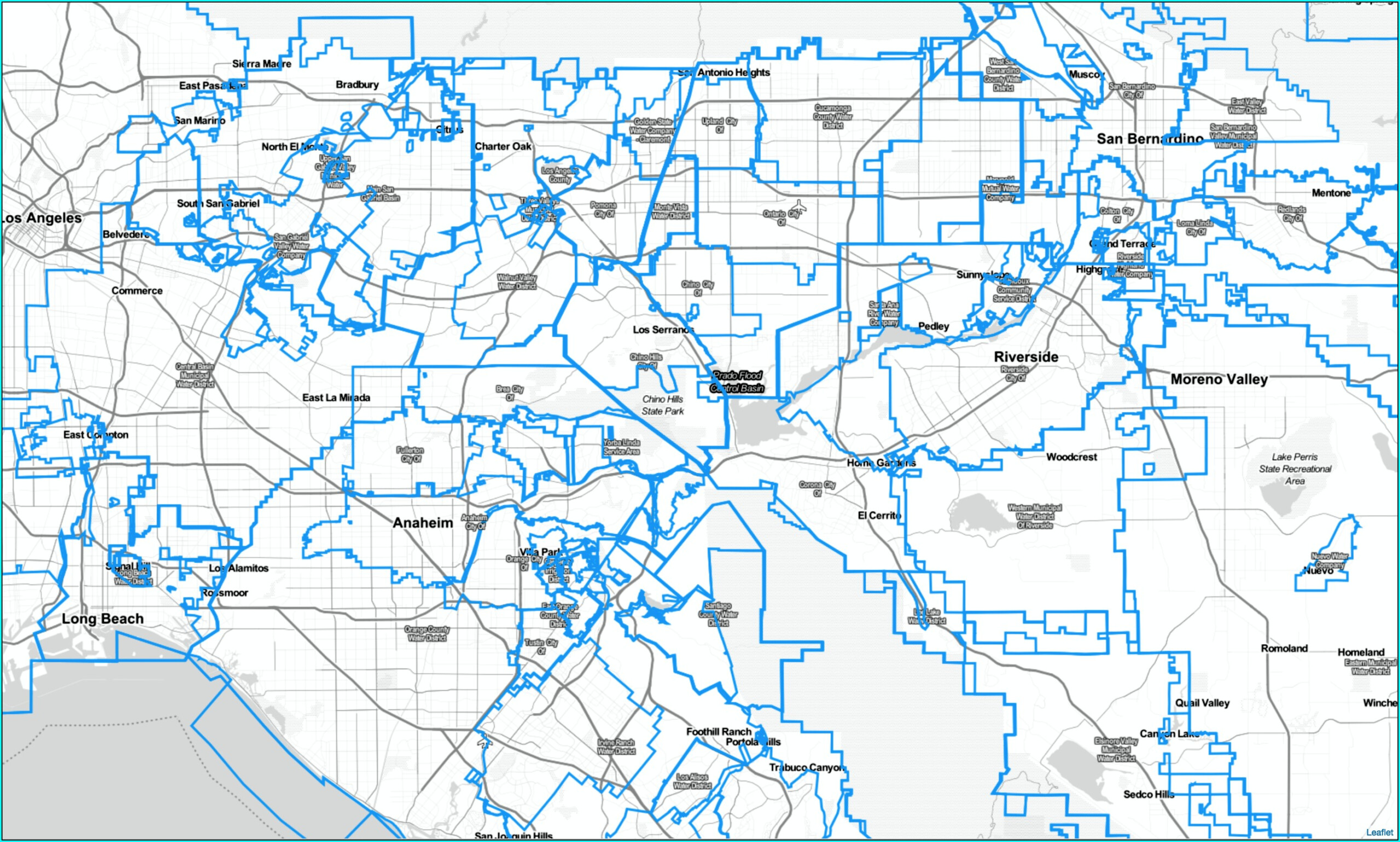

Riverside County Assessor Map Gis Map Resume Examples

Spokane county assessor tax challenge fashionpowen