Chase Bank Cheque Book: Your Ultimate Guide To Managing Payments

Hey there, folks! If you're here, chances are you've been scratching your head about the ins and outs of a Chase Bank cheque book. Well, you're in luck because we’re diving deep into this topic to make sure you walk away with all the info you need. Whether you're new to banking or just brushing up on your cheque book knowledge, this guide has got you covered. So, buckle up and let's get started on this cheque book journey, shall we?

A Chase Bank cheque book is one of those essential tools that can simplify your financial transactions. Sure, digital payments are all the rage these days, but there’s still something about writing out a cheque that feels official and secure. In fact, it's like having a personalized payment method right at your fingertips. And hey, who wouldn’t want that kind of convenience?

Before we dive into the nitty-gritty details, let me assure you that this article isn’t just another boring explanation of banking terms. We’ll break it down in a way that makes sense, so even if you’re not a finance guru, you’ll still be able to understand everything. Ready? Let’s go!

- Travis Barker Real Name The Story Behind The Drummers Identity

- Soaring High The Thrilling World Of French Pole Vault

What Exactly is a Chase Bank Cheque Book?

Alright, let’s start with the basics. A Chase Bank cheque book is essentially a collection of pre-printed sheets, each called a cheque, that allows you to make payments directly from your bank account. Think of it as a physical version of sending money online, except it’s handwritten. It’s super handy for situations where cash isn’t ideal, and digital transfers aren’t possible.

Now, here’s the kicker: Chase Bank makes sure their cheque books come with top-notch security features. Each cheque includes your account details, the bank’s logo, and other anti-fraud measures to ensure your transactions are safe and legit. Plus, it’s a great way to keep track of your expenses since every cheque has a unique number.

Why Choose Chase Bank for Your Cheque Book Needs?

When it comes to banking, Chase is one of the big names in the game. They’ve been around for ages, and they’ve earned a reputation for being reliable and customer-focused. If you’re already a Chase customer, getting a cheque book from them is a no-brainer. It’s like having everything under one roof—your accounts, your cards, and now, your cheque book.

- How Many Seasons Are There In Heartland A Comprehensive Guide For Fans

- Aries Or Taurus Discover The Mystical April 23rd Zodiac Sign

But what really sets Chase apart? For starters, their customer service is top-notch. If you ever run into issues with your cheque book, you can count on their team to help you out quickly. Plus, they offer a variety of account options, so whether you’re a small business owner or just managing personal finances, there’s something for everyone.

How to Order a Chase Bank Cheque Book

Getting your hands on a Chase Bank cheque book is easier than you think. First things first, log in to your Chase online account. From there, navigate to the "Order Checks" section, and follow the simple steps to request your cheque book. It’s like ordering pizza online—just a few clicks, and you’re good to go.

Here’s a quick breakdown of the process:

- Log in to your Chase account

- Go to the "Order Checks" option

- Select the type of cheque book you need

- Confirm your order and wait for it to arrive

And don’t worry if you’re not tech-savvy. Chase also allows you to order cheque books over the phone or by visiting one of their branches. Flexibility is key, right?

How Long Does It Take to Receive Your Chase Cheque Book?

Once you’ve placed your order, it usually takes about 7-10 business days for your cheque book to arrive. Of course, this can vary depending on your location and shipping preferences. But hey, patience is a virtue, and trust me, it’ll be worth the wait.

Pro tip: If you’re in a rush, consider ordering a smaller cheque book. They tend to arrive faster since they’re easier to process and ship. Just something to keep in mind if you’re on a tight schedule.

Understanding the Components of a Chase Cheque

Now that you’ve got your cheque book in hand, let’s talk about what makes up a Chase cheque. Each cheque is designed to include all the necessary details for a smooth transaction. Here’s a quick rundown of what you’ll find on a typical Chase cheque:

- Your Name and Address: This is automatically printed on the cheque for identification purposes.

- Date Line: Where you write the date of the transaction.

- Payee Line: The name of the person or business receiving the payment.

- Amount Section: Both the numeric and written amount of the cheque.

- Signature Line: Your signature to authorize the payment.

- Cheque Number: A unique identifier for each cheque.

It’s important to fill out each section carefully to avoid any issues with the bank. Trust me, nobody likes dealing with bounced cheques!

Security Features of Chase Cheques

Chase takes security seriously, and their cheques are no exception. They incorporate several features to prevent fraud and ensure your transactions are safe. Some of these include:

- Watermark logos

- Security threads

- Microprinting

- Chemical-sensitive ink

These features make it extremely difficult for anyone to tamper with your cheques, giving you peace of mind when making payments.

Common Uses of a Chase Bank Cheque Book

So, when exactly would you use a Chase Bank cheque book? The answer is pretty straightforward: whenever you need to make a payment that can’t be done digitally or with cash. Here are some common scenarios where a cheque book comes in handy:

- Paying rent or mortgage

- Settling utility bills

- Making large purchases

- Donating to charities

- Transferring money to family or friends

As you can see, the possibilities are endless. Whether you’re a business owner or just managing personal finances, a Chase cheque book can simplify your life in more ways than one.

Benefits of Using a Chase Cheque Book

There are plenty of reasons why a Chase Bank cheque book is a great addition to your financial toolkit. Here are just a few:

- Convenience: Write cheques anytime, anywhere

- Security: Built-in fraud protection features

- Traceability: Keep track of all your transactions

- Versatility: Use for both personal and business payments

Plus, let’s not forget the nostalgia factor. There’s something satisfying about writing out a cheque and knowing that it’s going to be processed properly. It’s like a little ritual that connects you to the past while keeping you grounded in the present.

Tips for Writing a Chase Cheque

Now that you know the basics, let’s talk about the actual process of writing a cheque. It’s not rocket science, but there are a few best practices to keep in mind:

- Always use a pen to fill out your cheque

- Write clearly and legibly to avoid confusion

- Double-check the amount before signing

- Include a memo note for reference

- Store your cheque book in a secure place

Following these tips will help ensure your cheques are processed smoothly and without any hiccups. And remember, practice makes perfect. The more you write cheques, the more comfortable you’ll become with the process.

Common Mistakes to Avoid

While writing cheques might seem simple, there are a few mistakes people often make. Here are some to watch out for:

- Forgetting to sign the cheque

- Writing the wrong date or amount

- Leaving blank spaces that can be filled in by others

- Using pencil instead of pen

By avoiding these common pitfalls, you’ll save yourself a lot of hassle and potential headaches down the line.

Handling Returned Cheques

Unfortunately, sometimes cheques get returned for various reasons. This could be due to insufficient funds, incorrect information, or even fraud. If this happens, don’t panic. Chase Bank provides resources to help you resolve the issue quickly.

Here’s what you can do:

- Contact Chase customer service for assistance

- Review the cheque details for errors

- Ensure sufficient funds are available in your account

- Follow up with the payee if necessary

Remember, returned cheques can happen to anyone. The key is to address the issue promptly and work with your bank to find a solution.

Preventing Cheque Fraud

With the rise in financial scams, it’s crucial to take steps to protect yourself from cheque fraud. Here are a few tips to keep your Chase cheque book secure:

- Store your cheque book in a locked drawer or safe

- Shred any unused or voided cheques

- Monitor your account regularly for suspicious activity

- Use Chase’s online tools to track your cheques

By staying vigilant and taking these precautions, you can significantly reduce the risk of fraud and keep your finances safe.

Conclusion: Why Chase Bank Cheque Books Are Worth It

And there you have it, folks! A comprehensive guide to Chase Bank cheque books. Whether you’re a seasoned cheque writer or a newcomer to the world of banking, Chase offers a reliable and secure option for all your payment needs.

Remember, a Chase Bank cheque book isn’t just a tool—it’s a solution. It simplifies transactions, enhances security, and gives you peace of mind. So, why not take advantage of everything Chase has to offer?

Now, it’s your turn. Share your thoughts in the comments below, or better yet, try ordering your Chase cheque book today. Who knows? It might just become your new favorite financial tool. Until next time, stay safe and keep those finances in check!

Table of Contents

What Exactly is a Chase Bank Cheque Book?

Why Choose Chase Bank for Your Cheque Book Needs?

How to Order a Chase Bank Cheque Book

Understanding the Components of a Chase Cheque

Common Uses of a Chase Bank Cheque Book

Tips for Writing a Chase Cheque

Conclusion: Why Chase Bank Cheque Books Are Worth It

- Alex Lagina The Mysterious Genius Who Cracked The Worlds Codes

- Understanding The Rank Size Rule A Comprehensive Guide To Urban Growth Patterns

Blank Cheque, Bank Cheque with guilloche template 34762914 Vector Art

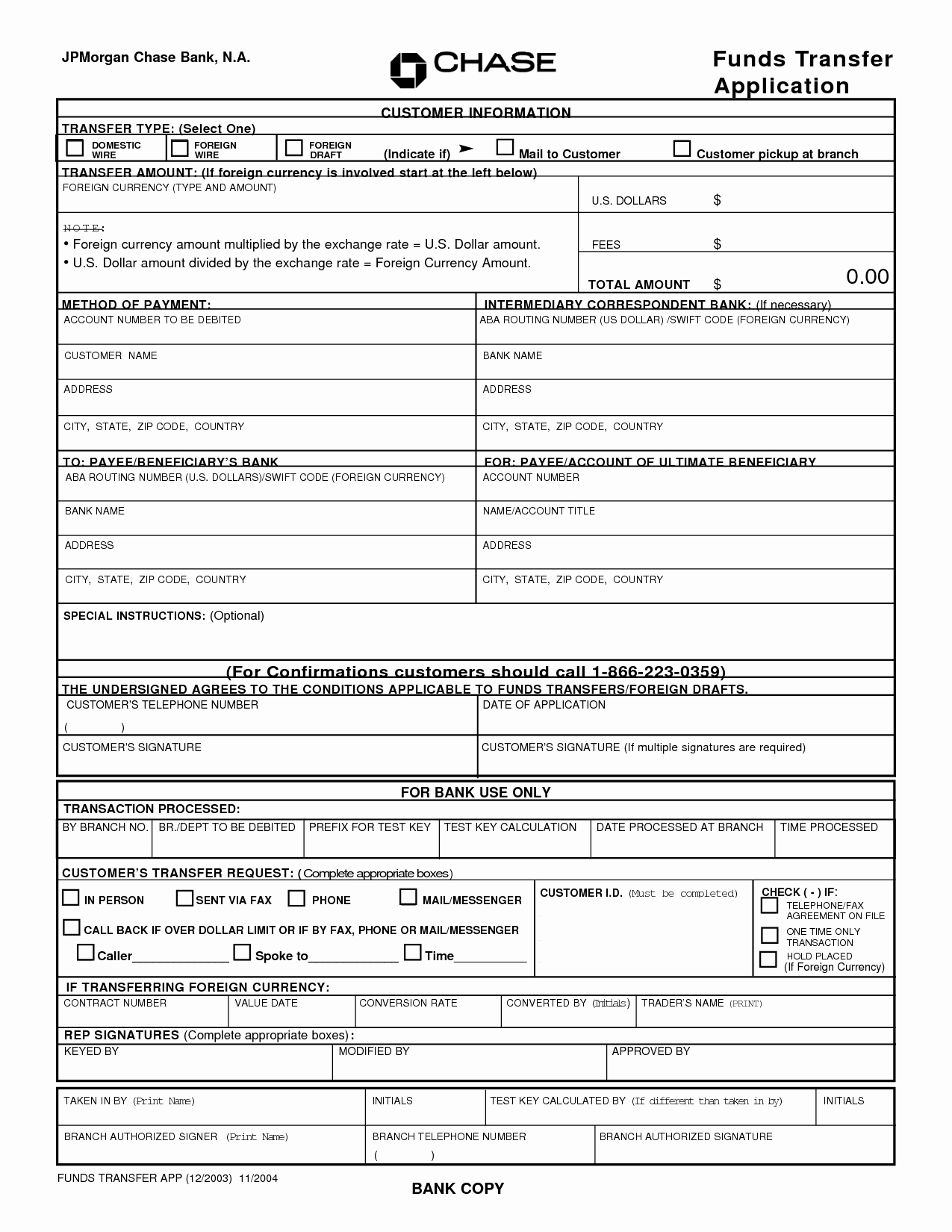

Chase Bank Check Template Peterainsworth

Blank Cheque, Bank Cheque with guilloche template 34762919 Vector Art