What Year Taxes For 24-25 School Year FAFSA? Your Ultimate Guide To Nailing Financial Aid

Alright, folks, let’s get real about FAFSA and those pesky taxes. If you’re stressing over what year taxes to use for the 2024-2025 school year, you’re not alone. Financial aid can be a labyrinth of paperwork, deadlines, and numbers, but don’t sweat it—we’re here to break it down for you in plain English. Whether you’re a student or a parent trying to figure out the financial aid puzzle, we’ve got your back. So, grab a coffee (or maybe a strong drink), and let’s dive in.

FAFSA is more than just an acronym—it’s the gateway to funding your education. For the 2024-2025 school year, knowing which tax year to report is critical. One wrong move, and you could miss out on thousands of dollars in aid. This guide will walk you through everything you need to know about FAFSA taxes, deadlines, and how to avoid common pitfalls.

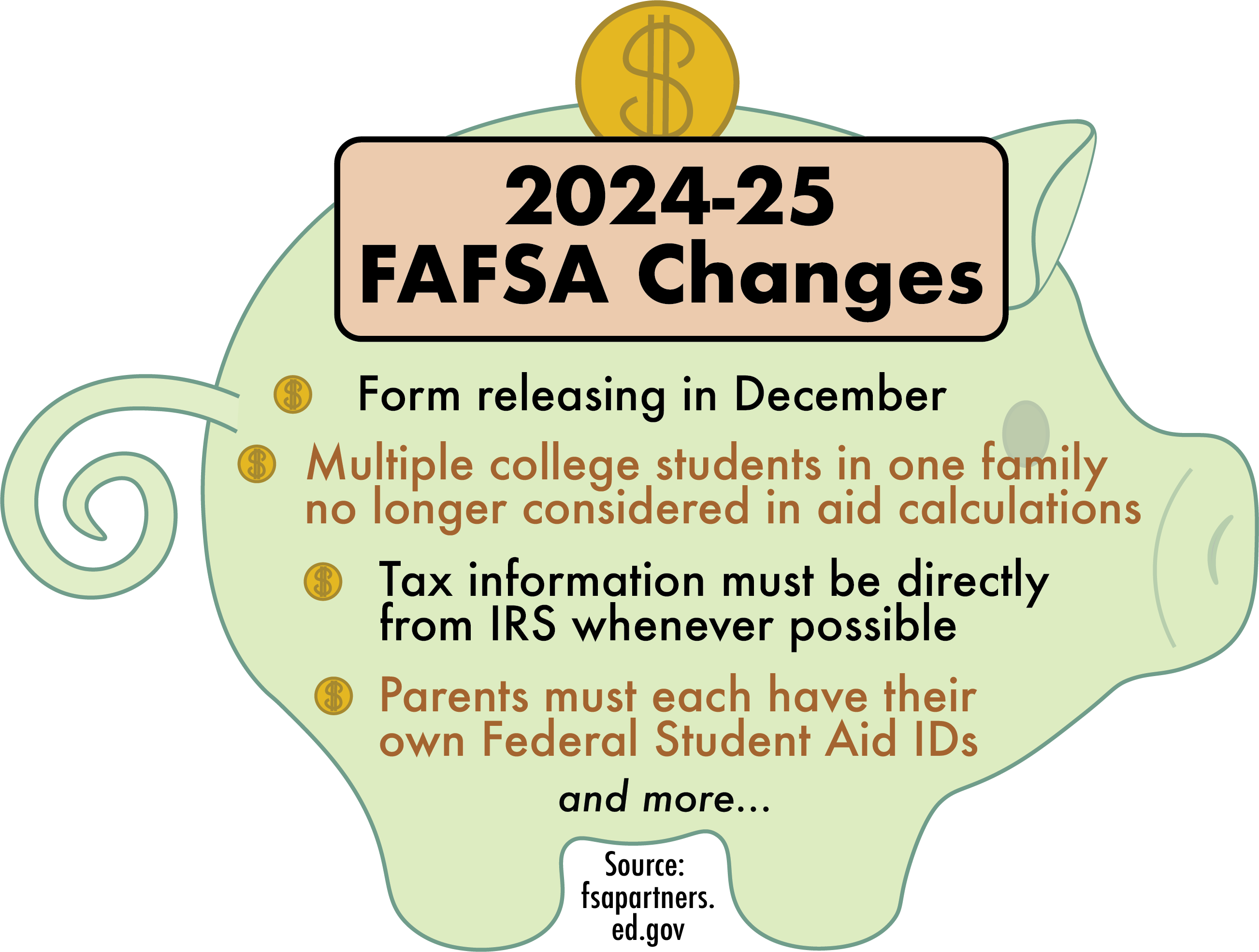

Before we dive deep, let’s clear the air: FAFSA uses prior-prior year (PPY) tax info. That means you won’t be using this year’s taxes but the ones from two years ago. Sounds confusing? Don’t worry; we’ll simplify it so even your grandma could understand. Let’s get started!

- Maureen Mccormack The Iconic Journey Of A Hollywood Legend

- Is Olivia Rodrigo Hispanic Unpacking The Roots And Rising Fame

Table of Contents

- What Year Taxes to Use for 24-25 FAFSA

- FAFSA Deadlines You Can’t Miss

- Why Prior-Prior Year Matters

- How to Report Taxes on FAFSA

- Common Mistakes to Avoid

- Income Verification Process

- Tax Forms You’ll Need

- Special Circumstances and Appeals

- Tips for FAFSA Success

- Wrapping It Up

What Year Taxes to Use for 24-25 FAFSA

Here’s the million-dollar question: what year taxes do you need for the 2024-2025 FAFSA? The short answer is the 2022 tax year. Yes, you heard that right—2022. FAFSA operates on a prior-prior year (PPY) system, meaning it looks at tax info from two years ago. Why? Because it gives a more accurate snapshot of your financial situation without making you scramble for last-minute tax filings.

Let’s break it down further. If you’re applying for the 2024-2025 academic year, FAFSA will pull data from your 2022 tax returns. That includes W-2s, 1040 forms, and any other relevant documents. If you’re a dependent student, your parents’ 2022 taxes will also come into play.

Why PPY Makes Life Easier

Using prior-prior year taxes simplifies the process for everyone involved. Instead of waiting until after the current tax season to file FAFSA, you can submit your application early and use already-filed tax info. This means less stress, quicker processing times, and a better chance at securing aid.

- Eazye Death Age The Untold Story Behind The Iconic Rappers Legacy

- Matthew Rhys The Actor Who Turned Passion Into Stardom

FAFSA Deadlines You Can’t Miss

Deadlines are the name of the game when it comes to FAFSA. Missing them could cost you big time, so mark your calendar and set reminders. The federal FAFSA deadline for the 2024-2025 school year is June 30, 2025. However, some states and schools have earlier deadlines, so double-check those too.

Here’s a quick rundown of key dates:

- Federal Deadline: June 30, 2025

- Early Application Window Opens: October 1, 2023

- State Deadlines: Vary by state (some as early as February 2024)

Pro tip: apply as soon as possible after October 1st. Many states and schools award aid on a first-come, first-served basis, so the earlier you submit, the better your chances of getting more money.

Why Prior-Prior Year Matters

The prior-prior year (PPY) system isn’t just a random rule—it’s designed to make the financial aid process fairer and more manageable. By using older tax data, FAFSA avoids putting undue pressure on families to rush their tax filings just to meet deadlines. Plus, it allows for earlier application submissions, giving students and parents more time to plan financially.

Think about it: if you had to wait until April to file your taxes and then use that info for FAFSA, you’d lose valuable time in the aid application process. PPY eliminates that bottleneck, ensuring everyone has equal access to funding opportunities.

How PPY Affects Your EFC

Your Expected Family Contribution (EFC) is calculated based on the tax data from the PPY. This number determines how much aid you qualify for, so accuracy is key. If your financial situation has changed significantly since 2022, don’t panic—we’ll cover special circumstances later in this guide.

How to Report Taxes on FAFSA

Reporting taxes on FAFSA doesn’t have to be a headache. Thanks to the IRS Data Retrieval Tool (DRT), you can import your tax info directly into your FAFSA form. Here’s how it works:

- Log in to your FAFSA account.

- When prompted, select “Link to IRS” to access the DRT.

- Follow the on-screen instructions to import your 2022 tax data.

Using the DRT not only saves time but also reduces errors. Plus, it speeds up the verification process, meaning you’ll hear back about your aid package faster.

Tips for Using DRT

- Make sure your 2022 taxes are fully processed before using DRT.

- Only use DRT if you filed electronically; paper filings aren’t compatible.

- Don’t forget to update any discrepancies between your tax info and your current financial situation.

Common Mistakes to Avoid

Even the best of us make mistakes when filling out FAFSA. Here are some common pitfalls to watch out for:

- Using the wrong tax year (remember, it’s 2022 for 2024-2025).

- Forgetting to sign and submit the form.

- Misreporting income or asset info.

- Missing state or school deadlines.

Double-check everything before hitting submit. A small error could delay your application or result in a denial of aid.

How to Fix Errors After Submission

Made a mistake? No big deal—you can always correct your FAFSA form online. Just log in to your account, make the necessary changes, and resubmit. Keep in mind that corrections may require additional processing time, so act quickly if you spot an error.

Income Verification Process

Some students and parents may be selected for verification, which means the school will double-check the accuracy of your reported income info. If you’re chosen, don’t freak out—it’s a routine process.

Here’s what you’ll need to do:

- Provide copies of your 2022 tax returns.

- Submit W-2s or other proof of income.

- Complete any additional forms requested by your school.

Verification can take a few weeks, so stay patient and responsive. Once everything checks out, your aid package will be finalized.

What Happens If You Can’t Verify?

If you’re unable to provide the necessary documents, your aid may be reduced or revoked. In extreme cases, you might have to repay any aid already received. Moral of the story: keep all your tax records organized and accessible.

Tax Forms You’ll Need

To complete your FAFSA accurately, gather these essential tax forms:

- IRS Form 1040 (2022)

- W-2s from all employers

- 1099 forms (if applicable)

- Business or farm tax returns (if applicable)

Dependent students will also need their parents’ tax info, so make sure everyone involved is on the same page.

Special Circumstances and Appeals

Life happens, and sometimes your financial situation changes after the tax year used for FAFSA. If you’ve experienced a job loss, divorce, or other significant event, you can appeal for a revised aid package.

Here’s how to request a special circumstances review:

- Contact your school’s financial aid office.

- Explain your situation in detail and provide supporting documentation.

- Wait for the school’s decision—this process can take several weeks.

Appeals aren’t guaranteed to result in more aid, but they’re worth pursuing if your situation warrants it.

Tips for FAFSA Success

Now that you know the ins and outs of FAFSA taxes, here are some final tips to help you succeed:

- Start early—don’t wait until the last minute to apply.

- Use the IRS Data Retrieval Tool to ensure accuracy.

- Keep detailed records of all documents and communications related to FAFSA.

- Stay organized and informed about deadlines and requirements.

Remember, FAFSA is your ticket to funding your education. Take the time to do it right, and you’ll reap the rewards for years to come.

Wrapping It Up

There you have it, folks—a comprehensive guide to what year taxes to use for the 2024-2025 FAFSA. By now, you should feel confident about navigating the financial aid process and avoiding common pitfalls. Remember, the key is preparation, accuracy, and staying on top of deadlines.

So, what’s next? Take action! Gather your 2022 tax info, create your FAFSA account, and get started on your application. And when you’re done, don’t forget to share this guide with friends and family who might benefit from it. Together, we can make higher education more accessible for everyone.

Got questions or feedback? Drop a comment below—we’d love to hear from you. Happy filing, and good luck with your future studies!

- How To Decode Your Ez Pass Transponder Number Like A Pro

- Unveiling The Mysteries Of Zodiac Sign August 26th Your Cosmic Guide

Fafsa Deadline 202525 School Year End Sherry T Bass

What Taxes Do I Need For Fafsa 202524 Susan Estrella

Fafsa 202525 Application Parent Harold J. Burch