How To Order Checkbook Chase: A Comprehensive Guide For Your Banking Needs

Ordering a checkbook from Chase Bank has never been easier, but navigating the process can still feel overwhelming if you're unfamiliar with the steps. Whether you're a new customer or just haven't ordered checks in a while, this guide will walk you through everything you need to know. From understanding the basics to exploring your options, we’ve got you covered.

Let’s face it—life gets busy, and sometimes we forget how simple tasks like ordering a checkbook can actually be. Chase offers multiple ways to request a checkbook, whether you prefer doing things online, over the phone, or even stopping by a branch. But before you dive into the process, let’s break down why having a checkbook is still relevant in today’s digital world. Checks might not seem as trendy as Venmo or Zelle, but they’re still a reliable way to pay for certain expenses, especially when dealing with businesses or individuals who don’t accept electronic payments.

Now that you’re here, it’s time to learn all about how to order checkbook chase without breaking a sweat. Stick around because we’ll cover everything from the basics to advanced tips so you can make an informed decision. Let’s get started!

- Unbeatable Black Friday Tools Deals 2024 Your Ultimate Shopping Guide

- Did Serita Jakes Really Leave Td Jakes The Untold Story

Understanding the Importance of a Checkbook

Before we jump into the nitty-gritty of ordering a checkbook from Chase, let’s take a moment to appreciate why checks are still valuable. Sure, digital payment methods have taken over in many areas, but there are situations where checks shine. For example, if you’re buying a house, paying rent, or sending money to someone who doesn’t use apps, checks come in handy. Plus, they offer a paper trail that can be super useful for record-keeping.

Why You Should Still Use Checks

Here are a few reasons why checks remain relevant:

- They provide a secure and traceable payment method.

- You can customize them to fit your personal style.

- They’re accepted by most businesses and individuals.

- They’re perfect for large transactions where cash isn’t practical.

So, whether you’re a college student learning to manage your finances or a seasoned professional looking to streamline your payments, having a checkbook can simplify your life.

- What Star Sign Is Jan 16 Unlock Your Zodiac Power

- Exploring Food Dishes That Start With N A Flavorful Journey

How to Order Checkbook Chase Online

Ordering your checkbook online is quick and convenient. Chase makes it easy for customers to do everything digitally, which is great for those who prefer minimal effort. All you need is access to your Chase account and a few minutes of your time.

Step-by-Step Guide to Ordering Online

Step 1: Log in to your Chase account on their official website or mobile app. Make sure you’re using a secure connection to protect your information.

Step 2: Navigate to the “Order Checks” section. You can usually find this under the “Settings” or “Account Services” tab.

Step 3: Choose the type of checks you want. Chase offers standard checks, duplicate checks, and even personalized designs.

Step 4: Select the quantity and review your order. Double-check everything to avoid mistakes.

Step 5: Confirm your order and wait for your checkbook to arrive in the mail. It typically takes 7-10 business days.

And that’s it! Ordering online is straightforward and saves you the hassle of visiting a branch.

Ordering Checkbook Chase Over the Phone

Some people prefer the personal touch of speaking to a representative. If you’re one of them, ordering your checkbook over the phone might be the way to go. Chase’s customer service team is available to assist you with any questions or issues you may have.

How to Place Your Order via Phone

Step 1: Call Chase’s customer service number, which you can find on their official website or on the back of your debit card.

Step 2: Follow the automated prompts until you reach a live representative.

Step 3: Provide your account information for verification purposes.

Step 4: Specify the type and quantity of checks you need.

Step 5: Confirm your order and wait for your checkbook to arrive.

While ordering over the phone may take slightly longer than doing it online, it’s a great option if you need additional assistance or have specific requests.

Visiting a Chase Branch to Order Your Checkbook

If you’re more of a hands-on person, visiting a Chase branch might be the best approach for you. This method allows you to speak directly with a bank representative and get answers to any questions you might have.

What to Expect at the Branch

When you visit a Chase branch, here’s what you can expect:

- A friendly representative will greet you and guide you through the process.

- You’ll need to bring a valid ID and your account information.

- You can choose from a variety of check designs and options.

- Your order will be processed on the spot, and you’ll receive a confirmation.

Visiting a branch is ideal if you prefer face-to-face interaction or if you have complex requests that require more attention.

Customizing Your Checkbook

One of the coolest things about ordering a checkbook from Chase is the ability to customize it. Whether you want to add your name, address, or even a fun design, Chase has got options for everyone.

Popular Customization Options

Here are some ways you can personalize your checkbook:

- Choose from a variety of colors and patterns.

- Add your name and address for convenience.

- Select duplicate checks for record-keeping purposes.

- Include security features to protect against fraud.

Customizing your checkbook not only makes it unique but also helps you stay organized and secure.

Tips for Managing Your Checkbook

Once you’ve ordered your checkbook, it’s important to know how to manage it effectively. Here are some tips to help you get the most out of your checks:

Best Practices for Using Checks

Tip 1: Always keep your checkbook in a safe place to prevent theft or loss.

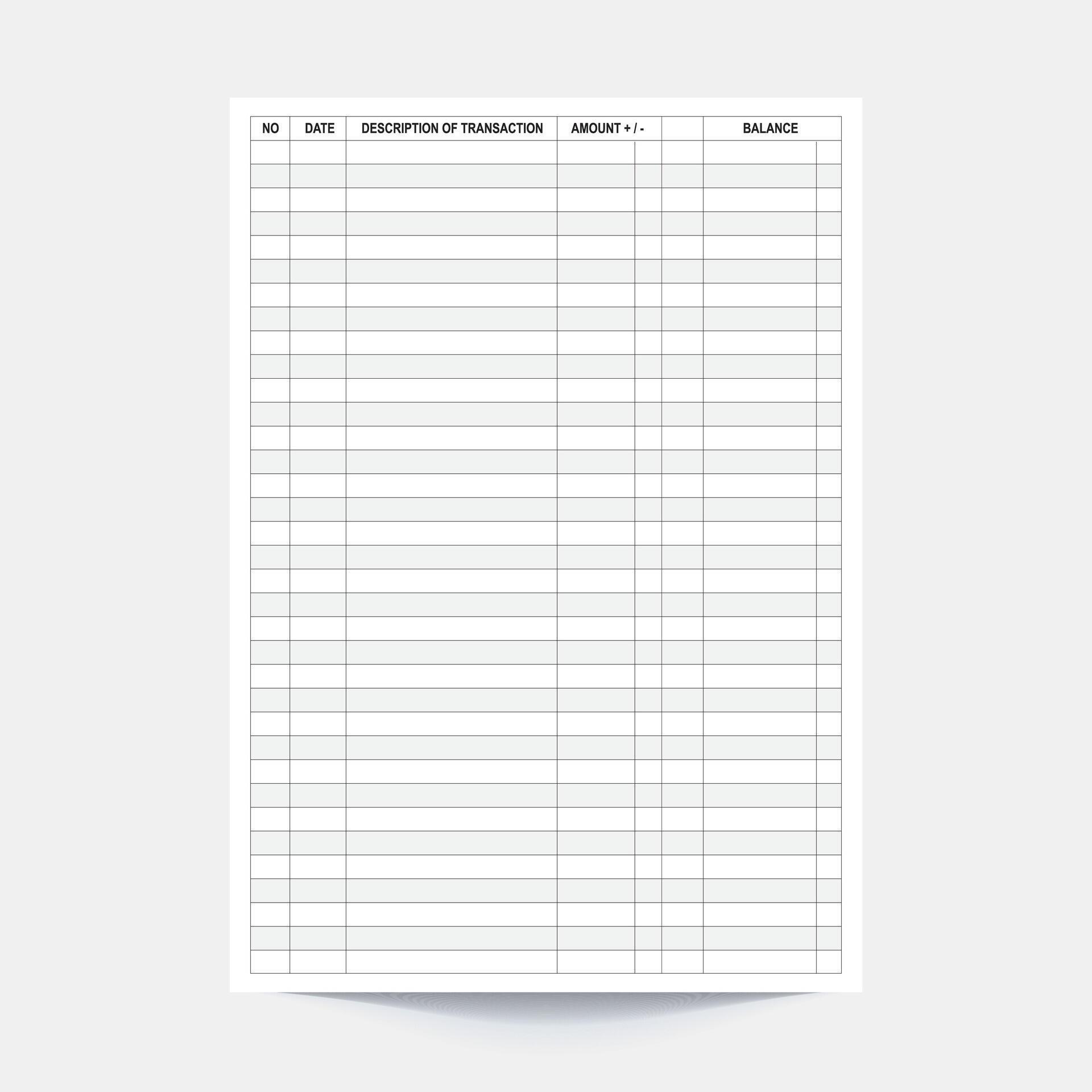

Tip 2: Record every check you write in your check register to avoid overdrafts.

Tip 3: Reconcile your checkbook with your bank statement regularly.

Tip 4: Be cautious when writing checks to unknown parties to protect yourself from fraud.

By following these tips, you can ensure that your checkbook remains a reliable tool for managing your finances.

Common Issues and Solutions

Even with the best intentions, things can sometimes go wrong when ordering a checkbook. Here are some common issues and how to resolve them:

Problem: My Checkbook Hasn’t Arrived

If your checkbook hasn’t arrived within the expected timeframe, don’t panic. Contact Chase customer service and provide them with your order details. They’ll track your order and let you know if there are any delays.

Problem: I Made a Mistake on My Order

Mistakes happen, and Chase is usually understanding about them. If you made an error on your order, reach out to customer service as soon as possible. They may be able to cancel or modify your order depending on the situation.

Understanding Chase’s Fees

While Chase offers many convenient services, it’s important to be aware of any associated fees. Ordering a checkbook typically comes with a cost, so it’s good to know what to expect.

What to Expect in Terms of Fees

Chase charges different fees based on the type and quantity of checks you order. Here’s a breakdown:

- Standard checks: $15-$20 per book

- Duplicate checks: $25-$30 per book

- Custom designs: Additional fees may apply

While these fees might seem steep, remember that checks are a valuable tool for managing your finances. Plus, Chase often offers promotions or discounts for loyal customers.

Conclusion

Ordering a checkbook from Chase doesn’t have to be a daunting task. Whether you choose to do it online, over the phone, or in person, Chase provides multiple options to suit your preferences. By understanding the process and following our tips, you can ensure a smooth and hassle-free experience.

We encourage you to share your thoughts in the comments below. Have you ordered a checkbook from Chase before? What was your experience like? And don’t forget to check out our other articles for more helpful tips and tricks on managing your finances.

Table of Contents

- Understanding the Importance of a Checkbook

- How to Order Checkbook Chase Online

- Ordering Checkbook Chase Over the Phone

- Visiting a Chase Branch to Order Your Checkbook

- Customizing Your Checkbook

- Tips for Managing Your Checkbook

- Common Issues and Solutions

- Understanding Chase’s Fees

- Conclusion

- What Happened To The Original Hosts Of Wipeout A Wild Ride Down Memory Lane

- Amtrak Station Dc Your Gateway To Seamless Travel

Checkbook order chase bihety

Checkbook order drivevvti

checkbook register,transaction register for checkbook,checkbook