Conns Payment Options: Your Ultimate Guide To Hassle-Free Financing

Let me tell you something, folks—life gets complicated when you're trying to figure out how to pay for big purchases. But don’t worry, because Conns Payment Options is here to simplify things for you. Whether you're looking to buy furniture, appliances, or electronics, Conns offers flexible payment plans that fit your budget. This isn’t just about buying stuff; it’s about making smart financial decisions without breaking the bank. So, let’s dive into what makes Conns Payment Options so special and how it can work for you.

Nowadays, people are always searching for ways to manage their finances better. And let’s be honest, traditional loans or credit cards aren’t always the best solution. That’s where Conns comes in. They’ve designed a system that gives customers more control over how they pay for their purchases. With options like deferred interest, installment plans, and even no-money-down deals, Conns makes shopping easier than ever.

But hold up—before we get too deep into the details, I want to make sure you understand why this matters. If you’re reading this, chances are you’ve been in a situation where you needed something big but didn’t have the cash upfront. Maybe it was a new fridge, a comfy sofa, or a shiny TV. Whatever it was, Conns Payment Options could’ve been your answer. So stick around, and I’ll break it all down for you.

- Dealing With Itchy Bumps On Inner Thigh A Comprehensive Guide

- 1952 In Chinese Zodiac Discover Your Year Of The Dragon

What Are Conns Payment Options?

Alright, let’s start with the basics. Conns Payment Options is essentially a financing program designed to help customers afford high-ticket items. It’s not just a one-size-fits-all deal; there are multiple ways to structure payments based on your needs. Think of it like a toolbox for your wallet—there’s something in there for everyone.

Here’s the deal: when you shop at Conns, you can choose from different payment methods depending on the item and your financial situation. Some plans let you pay off the balance over time, while others offer special promotions like “no payments for 12 months” or “0% APR.” These perks make it easier to budget and avoid unexpected fees.

Why Choose Conns Payment Options?

So why should you care about Conns Payment Options? Let me count the ways. First off, they’re super flexible. Unlike traditional lenders, Conns understands that not everyone has perfect credit or tons of disposable income. Their plans are tailored to meet real-world needs, not some ideal scenario.

- Fox News Female Contributors Breaking Barriers And Shaping News

- How Do You Delete Uber Trip History A Stepbystep Guide For Clean Slate

Secondly, Conns offers transparency. You won’t find hidden fees or complicated terms buried in the fine print. Everything is laid out clearly so you know exactly what you’re signing up for. And hey, who doesn’t love a little honesty in their financial dealings?

Understanding the Types of Conns Payment Plans

Now that we’ve covered the basics, let’s take a closer look at the types of payment plans available through Conns. There’s no one-size-fits-all approach here, which is great news for shoppers. Instead, you’ll find several options designed to suit different budgets and preferences. Here’s a quick rundown:

- Deferred Interest Plans: Pay nothing for a set period (usually 6–12 months). If you pay off the balance within that time, you avoid paying interest altogether.

- Installment Loans: Spread the cost of your purchase over a fixed number of months with regular payments.

- No Money Down: Walk away with your purchase without putting any money down upfront.

- 0% APR Offers: Enjoy zero interest rates on certain items for a limited time.

Each plan has its own benefits, so it’s important to choose the one that aligns with your financial goals. For example, if you’re disciplined and can pay off the balance quickly, a deferred interest plan might be perfect. But if you prefer smaller, predictable payments, an installment loan could be the way to go.

How Do Deferred Interest Plans Work?

Let’s zoom in on deferred interest plans for a moment. These babies are like a breath of fresh air if you need time to pay off your purchase. Here’s how it works:

You pick out the item you want, apply for financing, and Conns gives you a grace period—say, 12 months—during which you don’t have to make any payments. As long as you pay off the full balance before the grace period ends, you won’t owe a cent in interest. But—and this is a big but—if you miss the deadline, you’ll be charged interest retroactively from the purchase date. Yikes!

So, the key is to stay on top of those payments. Set reminders, create a budget, and stick to it. With a little discipline, deferred interest plans can save you a bundle.

Eligibility Criteria for Conns Payment Options

Okay, so you’re sold on the idea of Conns Payment Options. But wait—do you qualify? The good news is that Conns doesn’t have super strict requirements compared to other lenders. However, there are still some criteria you need to meet:

- You must be at least 18 years old.

- You’ll need to provide proof of income or employment.

- Conns will check your credit history, but having less-than-perfect credit won’t necessarily disqualify you.

- You may need to show a valid ID and proof of residency.

Now, here’s the cool part: Conns isn’t just looking at your credit score. They consider factors like your payment history, length of employment, and even your relationship with Conns if you’ve shopped with them before. This holistic approach means more people can access affordable financing.

Tips for Maximizing Your Chances of Approval

If you’re applying for Conns Payment Options, there are a few things you can do to boost your chances:

- Make sure your credit report is up-to-date and accurate.

- Provide detailed documentation of your income and expenses.

- Be honest about your financial situation during the application process.

- Consider adding a co-signer if your credit isn’t strong enough on its own.

By taking these steps, you’ll give yourself the best shot at getting approved—and securing the financing you need.

Applying for Conns Payment Options

Ready to take the plunge? Applying for Conns Payment Options is easier than you might think. You can apply online, over the phone, or in-store. Each method has its own advantages, so choose the one that works best for you.

If you go the online route, you’ll need to create an account on the Conns website. From there, you can fill out the application form, upload required documents, and submit everything electronically. It’s fast, convenient, and paperless.

On the other hand, if you prefer face-to-face interaction, visiting a Conns store is a great option. A knowledgeable associate will walk you through the process and answer any questions you might have. Plus, you’ll get instant feedback on your application status.

What to Expect During the Application Process

Once you’ve submitted your application, what happens next? Here’s a quick breakdown:

Conns will review your information and run a credit check. Depending on the complexity of your application, this could take anywhere from a few minutes to a couple of days. If everything checks out, you’ll receive an approval decision along with the details of your financing plan.

If for some reason you’re denied, don’t panic. Conns will provide a reason for the denial and may offer alternative solutions. Remember, rejection isn’t the end of the road—it’s just a bump in the journey.

Managing Your Conns Payments

Alright, you’ve been approved for Conns Payment Options. Congrats! But now comes the important part: managing your payments. Here’s how to stay on track:

- Set up automatic payments to avoid late fees.

- Monitor your account regularly to ensure accuracy.

- Reach out to Conns customer service if you encounter any issues.

One of the coolest features of Conns Payment Options is their online portal. It lets you view your account balance, payment history, and due dates—all in one place. Plus, you can make extra payments anytime to pay off your balance faster and save on interest.

What Happens If You Miss a Payment?

We all make mistakes sometimes, and missing a payment is definitely something that can happen. If it does, don’t freak out. Conns has processes in place to help you get back on track.

First, you’ll likely receive a reminder notice via email or phone call. This gives you a chance to catch up on your payments before things escalate. If you continue to miss payments, Conns may charge late fees or report the delinquency to credit bureaus.

To avoid this headache, it’s crucial to communicate with Conns if you’re having trouble making payments. They may be able to adjust your payment plan or offer temporary relief.

Common Questions About Conns Payment Options

Before we wrap things up, let’s tackle some frequently asked questions about Conns Payment Options:

Can I Use Conns Financing for Any Purchase?

Not exactly. Conns Payment Options are typically available for purchases made at Conns stores or on their website. However, the program covers a wide range of products, including furniture, appliances, electronics, and more.

Is There a Minimum Purchase Amount?

In most cases, no. You can use Conns financing for purchases big and small, though some promotions may require a minimum spend. Be sure to check the terms and conditions of each offer.

What Happens If I Can’t Pay Off My Balance Within the Grace Period?

If you don’t pay off your balance within the deferred interest period, you’ll be charged interest retroactively from the purchase date. To avoid this, create a repayment plan and stick to it.

Conclusion

Well, folks, that’s the scoop on Conns Payment Options. Whether you’re furnishing your dream home or upgrading your tech setup, Conns has got your back with flexible financing plans that fit your lifestyle. From deferred interest to installment loans, there’s a solution for every budget.

So what are you waiting for? Head over to Conns and explore your options. And don’t forget to share this article with friends and family who might benefit from the info. Together, we can all make smarter financial decisions—one purchase at a time.

Table of Contents

- What Are Conns Payment Options?

- Why Choose Conns Payment Options?

- Understanding the Types of Conns Payment Plans

- How Do Deferred Interest Plans Work?

- Eligibility Criteria for Conns Payment Options

- Tips for Maximizing Your Chances of Approval

- Applying for Conns Payment Options

- What to Expect During the Application Process

- Managing Your Conns Payments

- What Happens If You Miss a Payment?

- How To Connect Iot Remotely To Wifi Like A Pro

- Mark Twain Winners Celebrating The Legends Of American Literature

Easy Payment Solutions for Conns Furniture Shopping

Easy Payment Solutions for Conns Furniture Shopping

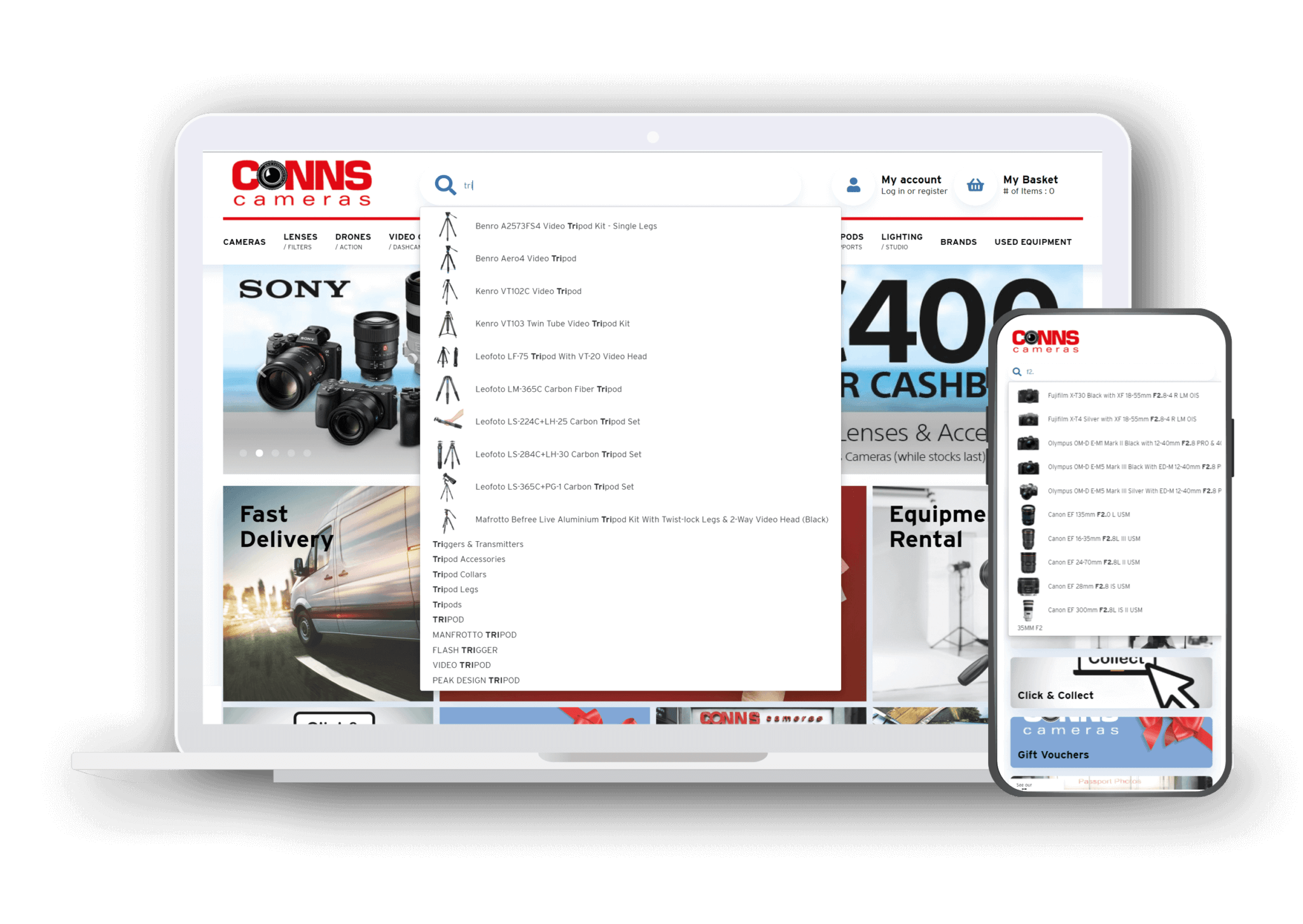

Conns Cameras Makes Finding Complicated Product Names Simple With