What Tax Return Do I Need For FAFSA 2025-26? A Comprehensive Guide For Students

Filling out the FAFSA can feel like navigating a maze, but don’t sweat it! Understanding what tax return you need for FAFSA 2025-26 is key to unlocking financial aid opportunities. Whether you're a first-timer or a seasoned pro, this guide has got your back. Let’s dive in and break it down step by step!

FAFSA (Free Application for Federal Student Aid) is one of the most important forms you'll ever fill out as a student. It determines how much financial aid you’re eligible for, including grants, scholarships, and loans. But here’s the deal—your tax return plays a crucial role in this process. So, knowing exactly which tax return you need is essential to avoid any hiccups.

Don’t worry if you’re feeling overwhelmed. By the end of this article, you’ll have all the info you need to confidently complete your FAFSA application. Let’s make sure you’re ready to rock the 2025-26 academic year without breaking a sweat!

- How Do You Delete Uber Trip History A Stepbystep Guide For Clean Slate

- How Many Twice Members Are There The Ultimate Guide To The Kpop Sensation

Here's a quick roadmap of what we'll cover:

- What Tax Return Do I Need for FAFSA 2025-26?

- FAFSA Basics: What You Need to Know

- Key Tax Documents for FAFSA

- Independent vs. Dependent Students

- Understanding Filing Status for FAFSA

- Using IRS Data Retrieval Tool

- Common Mistakes to Avoid

- Tips for a Successful FAFSA Submission

- Special Circumstances and Exceptions

- Wrapping It Up

What Tax Return Do I Need for FAFSA 2025-26?

Alright, let’s cut to the chase. For the FAFSA 2025-26 application, you’ll need to use your 2023 tax return. That’s right—FAFSA uses your tax info from two years prior to the academic year you’re applying for. This means if you’re applying for aid in the 2025-26 school year, your 2023 tax info is what they’re looking for.

But wait, there’s more! If you’re a dependent student, your parents’ tax info is also on the table. Yep, both your and your parents’ 2023 tax returns will be required. If you’re flying solo as an independent student, it’s all about your own tax documents.

- Unveiling The Secrets Of April 15 Zodiac Aries Or Taurus Dive In

- 191xt How To Use The Ultimate Guide For Unlocking Maximum Potential

Why the 2023 Tax Return?

The FAFSA folks like to play it safe by using older tax data. This gives them a clear picture of your financial situation without waiting for the latest tax returns to be filed. Plus, it makes things easier for you since your 2023 taxes should already be squared away by the time you’re filling out the FAFSA.

FAFSA Basics: What You Need to Know

Before we dive deeper, let’s cover some FAFSA basics. The FAFSA is your golden ticket to federal financial aid. It’s like a report card for your finances that colleges use to determine how much aid you qualify for. Here’s what you need to keep in mind:

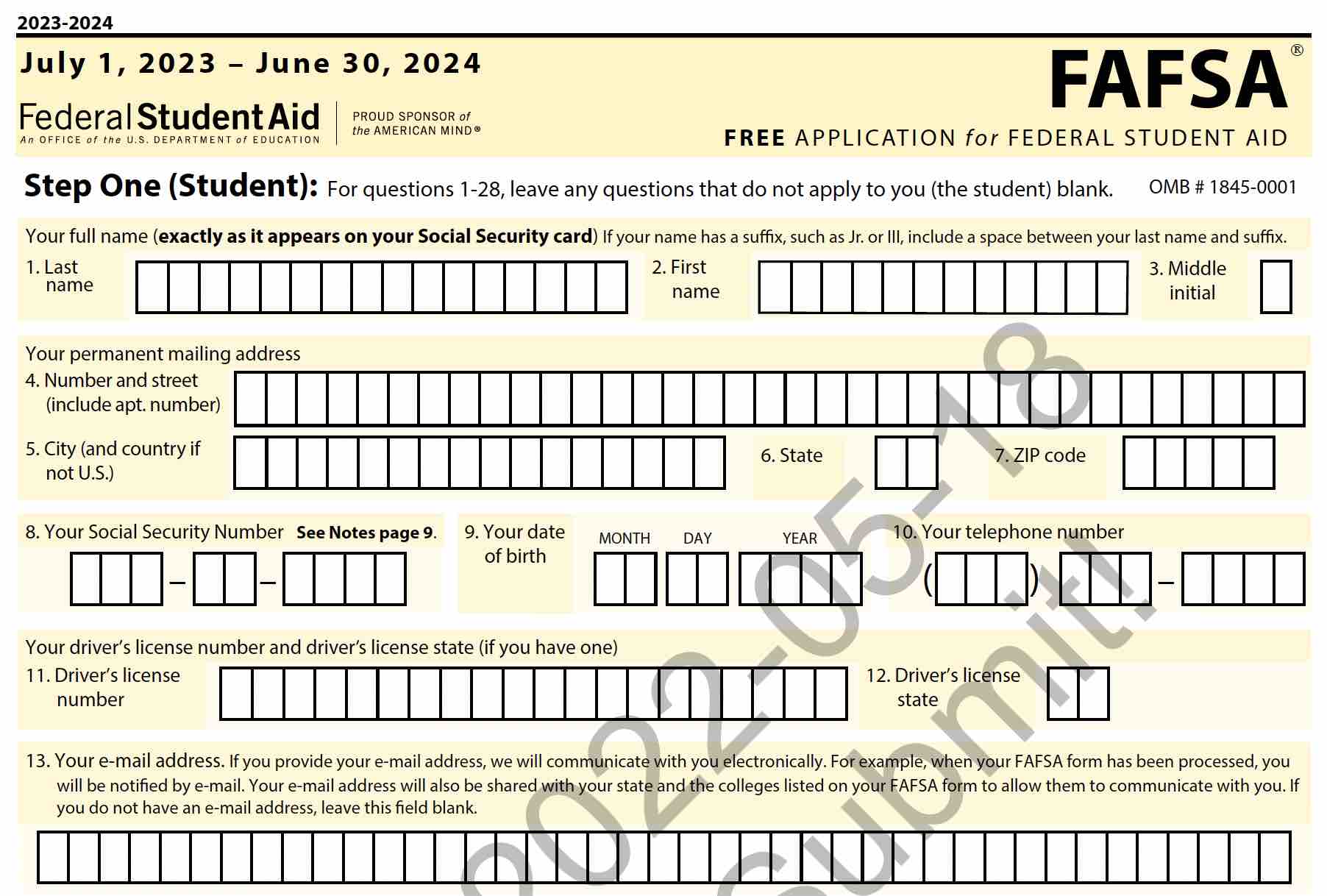

- FAFSA is free—don’t fall for any scams charging you to fill it out.

- It’s available starting October 1st each year for the upcoming academic year.

- You’ll need your Social Security Number (SSN) and other important documents.

Now, let’s focus on the tax side of things. Your tax return is one of the most critical pieces of the puzzle. It helps determine your Expected Family Contribution (EFC), which colleges use to figure out your aid package.

Key Tax Documents for FAFSA

When it comes to FAFSA, having the right tax documents ready is a must. Here’s a quick rundown of what you’ll need:

- 1040 Federal Tax Return: This is the main tax form you’ll use. Make sure it’s for the 2023 tax year.

- W-2 Forms: These show your income from employers and are crucial for verifying your earnings.

- Other Tax Forms: Depending on your situation, you might need forms like 1099s for investments or self-employment income.

If you’re a dependent student, your parents will need to provide their 2023 tax documents as well. Don’t forget to gather all the necessary info before you start filling out the FAFSA.

Independent vs. Dependent Students

One of the biggest factors affecting which tax return you need is your dependency status. Here’s the lowdown:

Dependent Students

Most undergrads are considered dependent students. This means your parents’ financial info is required on the FAFSA. So, you’ll need to provide both your and your parents’ 2023 tax returns. If your parents are divorced or separated, you’ll typically use the info from the parent you lived with more during the year.

Independent Students

On the flip side, if you’re an independent student, it’s all about your own finances. You won’t need to include your parents’ tax info. However, if you’re married, your spouse’s tax info will come into play.

Understanding Filing Status for FAFSA

Your tax filing status can impact how you complete the FAFSA. Here’s a quick breakdown:

- Single: If you filed as single on your 2023 tax return, you’ll use your individual tax info.

- Married Filing Jointly: If you’re married and filed jointly, you’ll need to include your spouse’s tax info.

- Head of Household: If you filed as head of household, you’ll use your own tax info, but there might be additional considerations depending on your situation.

It’s important to match your FAFSA filing status with your tax return to ensure everything lines up correctly.

Using IRS Data Retrieval Tool

Here’s a game-changer: the IRS Data Retrieval Tool (DRT). This tool lets you automatically import your tax info directly from the IRS into your FAFSA. It’s fast, accurate, and saves you a ton of time. Plus, it reduces the chances of making mistakes while entering your tax data manually.

To use the DRT, you’ll need to sign into the FAFSA website with your FSA ID. From there, you can link to the IRS website and pull in your 2023 tax info with just a few clicks. Easy peasy!

Common Mistakes to Avoid

Even the best of us make mistakes, but when it comes to FAFSA, accuracy is key. Here are some common errors to steer clear of:

- Using the wrong tax year—double-check that you’re using your 2023 tax return.

- Forgetting to include all required documents—make sure you have everything ready before starting.

- Not using the IRS Data Retrieval Tool—this tool can save you from typos and other input errors.

Take your time and review your application carefully before submitting. A little extra effort now can save you a lot of headaches later.

Tips for a Successful FAFSA Submission

Now that you know the ins and outs of FAFSA tax requirements, here are some tips to help you ace the application process:

- Start Early: The earlier you submit your FAFSA, the better your chances of getting more aid.

- Use Online Resources: The FAFSA website has tons of helpful info and FAQs to guide you through the process.

- Stay Organized: Keep all your tax documents and other info in one place to make filling out the FAFSA a breeze.

Remember, the goal is to get the most financial aid possible. By following these tips, you’ll be well on your way to achieving that goal.

Special Circumstances and Exceptions

Life isn’t always straightforward, and sometimes special circumstances can affect your FAFSA application. If you’ve experienced a significant change in your financial situation since filing your 2023 taxes, you might be able to request a review. This could include things like job loss, medical expenses, or other unexpected expenses.

To request a review, you’ll need to contact the financial aid office at the schools you’re applying to. They might ask for additional documentation to verify your situation. It’s worth reaching out if you think it could impact your aid eligibility.

Wrapping It Up

So there you have it—a comprehensive guide to what tax return you need for FAFSA 2025-26. Remember, your 2023 tax return is the star of the show. Whether you’re a dependent or independent student, having your tax documents ready will make the process smoother.

Don’t forget to use the IRS Data Retrieval Tool to avoid errors and make your life easier. And if you run into any issues or have special circumstances, don’t hesitate to reach out to the financial aid offices at your schools.

Now it’s your turn! Take action by gathering your tax info and starting your FAFSA application. The sooner you submit, the better your chances of securing the financial aid you need for the 2025-26 academic year. Good luck, and let us know how it goes in the comments below!

- Mylaheychart Your Ultimate Guide To Revolutionizing Healthcare Access

- Ben Shapiro Nationality The Story Behind The Popular Commentators Roots

FAFSA 2025 Your Ultimate Guide to Free College Money!

Tax Form For Fafsa 202526 Max E. Winfrey

Fafsa Application For 2025 2025 Emma Foran B.