What Taxes Are Needed For FAFSA 2025-26: A Comprehensive Guide

Hey there, future college student or parent of one! If you’re diving into the world of financial aid for the 2025-26 academic year, you’re probably wondering what taxes are needed for FAFSA. Don’t stress—we’ve got you covered. Navigating the FAFSA process can feel like decoding an ancient language, but with the right info, it’s totally doable. Let’s break it down so you can focus on the fun stuff, like picking your dream major or deciding which dorm to call home.

FAFSA (Free Application for Federal Student Aid) is your golden ticket to accessing federal financial aid, scholarships, grants, and more. But here’s the deal: to qualify, you need to provide some tax-related details. Whether you’re a first-timer or a seasoned pro at filling out forms, understanding the tax requirements is key to avoiding headaches and ensuring you don’t miss out on potential funding.

Before we dive deep, let’s get one thing straight: FAFSA isn’t just about the numbers. It’s about empowering you to make college affordable. So buckle up, grab a snack, and let’s unravel the mystery of FAFSA taxes together. You’ve got this!

- Wade Wilson Teeth Broken The Untold Story Behind The Iconic Smile

- Why Sim Failure Happens And What You Can Do About It

Understanding the Basics of FAFSA Taxes

What Taxes Are Needed for FAFSA 2025-26?

Alright, let’s start with the basics. When you’re filling out the FAFSA form for the 2025-26 academic year, you’ll need to provide tax information from the previous tax year. For this cycle, that means using your 2023 tax returns. Why 2023? Because FAFSA uses the IRS Data Retrieval Tool (DRT) to pull in your tax info, and it needs a complete and finalized tax year to work its magic.

Here’s the lowdown on the types of taxes you’ll need:

- Income Tax: This includes federal and state income taxes.

- Wages: If you’ve been working, your W-2 forms will come into play.

- Self-Employment Taxes: If you’re a freelancer or small business owner, don’t forget to include Schedule SE.

- Investment Income: This covers dividends, interest, and capital gains.

Remember, if you’re a dependent student, your parents’ tax info will also be required. But don’t panic—we’ll walk you through it step by step.

- Tyson Career Record A Knockout Journey Through Boxing History

- Foodtown Davie Florida Your Ultimate Foodie Destination You Never Knew You Needed

Who Needs to Provide Tax Info?

Dependent vs. Independent Students

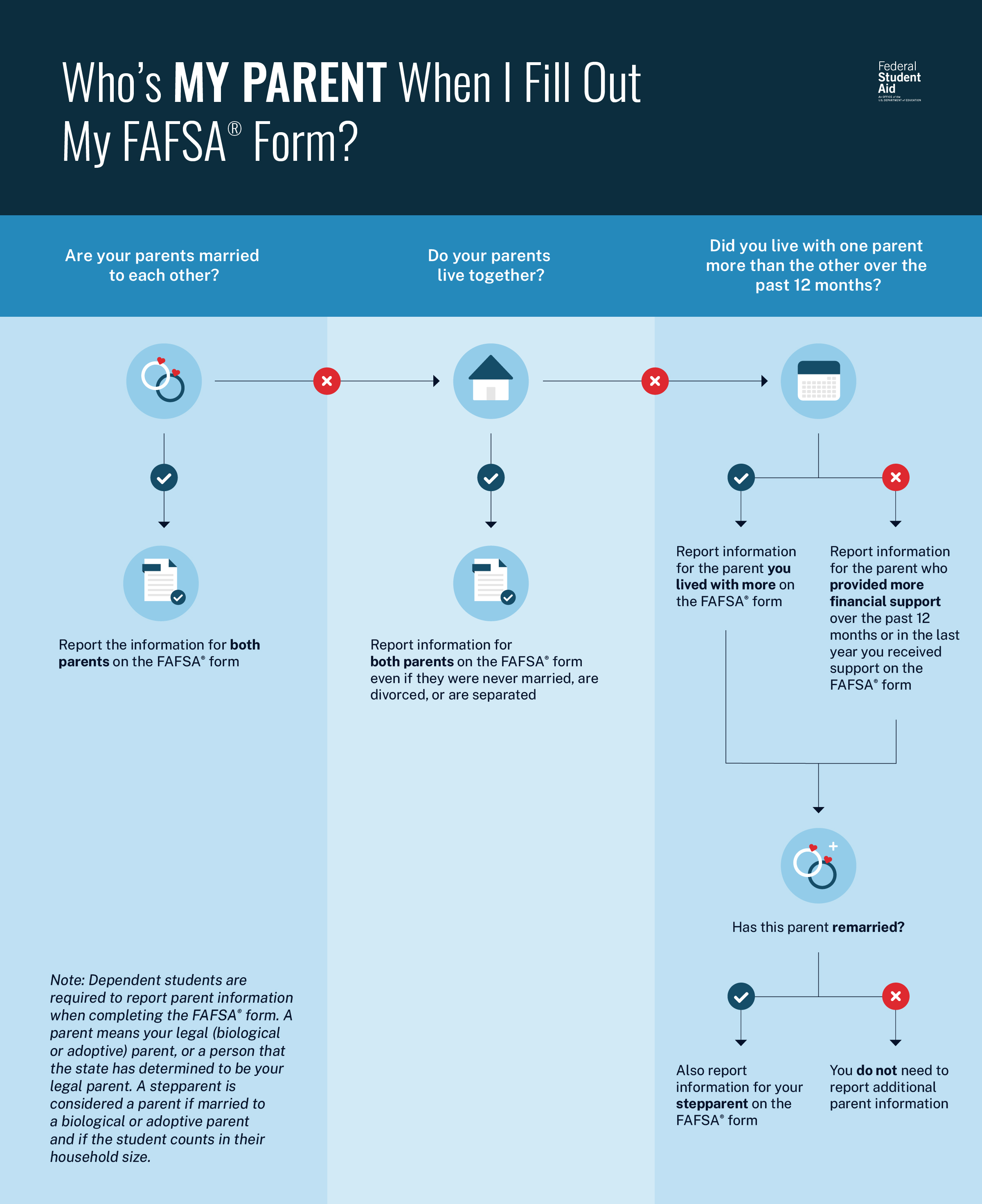

Here’s where things get interesting. Your tax requirements depend on whether you’re considered a dependent or independent student. If you’re a dependent, your parents’ tax info is crucial. But if you’re flying solo (independent), it’s all about your own financials.

Let’s break it down:

- Dependent Students: You’ll need your parents’ 2023 federal income tax returns, W-2 forms, and other records of income.

- Independent Students: You’ll provide your own 2023 tax info, plus your spouse’s if you’re married.

Not sure which category you fall under? Don’t sweat it. The FAFSA form will guide you through the questions to determine your dependency status.

How to Gather Your Tax Documents

Tax Forms You’ll Need

Now that you know who needs to provide tax info, let’s talk about the specific forms you’ll need to gather. Here’s a quick checklist:

- IRS Form 1040 (U.S. Individual Income Tax Return)

- W-2 Forms (Wage and Tax Statements)

- 1099 Forms (various types, depending on your income sources)

- Schedule C (Profit or Loss from Business)

- Schedule SE (Self-Employment Tax)

Pro tip: If you’re using the IRS DRT, make sure your tax return is fully processed before you start the FAFSA. This ensures the info pulls in correctly and saves you a ton of time.

Using the IRS Data Retrieval Tool

Why the IRS DRT Matters

Let’s face it: typing in all your tax info manually is a recipe for errors. That’s where the IRS Data Retrieval Tool comes in. This nifty feature allows you to securely transfer your tax info directly from the IRS to your FAFSA form. It’s fast, accurate, and eliminates the risk of typos.

Here’s how it works:

- Complete your 2023 federal tax return.

- Start the FAFSA form and reach the financial info section.

- Select the option to use the IRS DRT.

- Follow the prompts to connect your tax info.

Voila! Your tax data will populate automatically, saving you time and hassle.

Common Mistakes to Avoid

Tax Mistakes That Could Cost You

Let’s be real—no one’s perfect, and mistakes happen. But when it comes to FAFSA taxes, even small errors can delay your application or reduce your aid eligibility. Here are some common blunders to steer clear of:

- Using the wrong tax year (e.g., 2022 instead of 2023).

- Forgetting to include all sources of income.

- Not using the IRS DRT when possible.

- Mixing up dependent and independent status.

Double-check everything before hitting submit. Trust us, your future self will thank you.

Financial Aid Implications of Tax Info

How Taxes Affect Your Aid Package

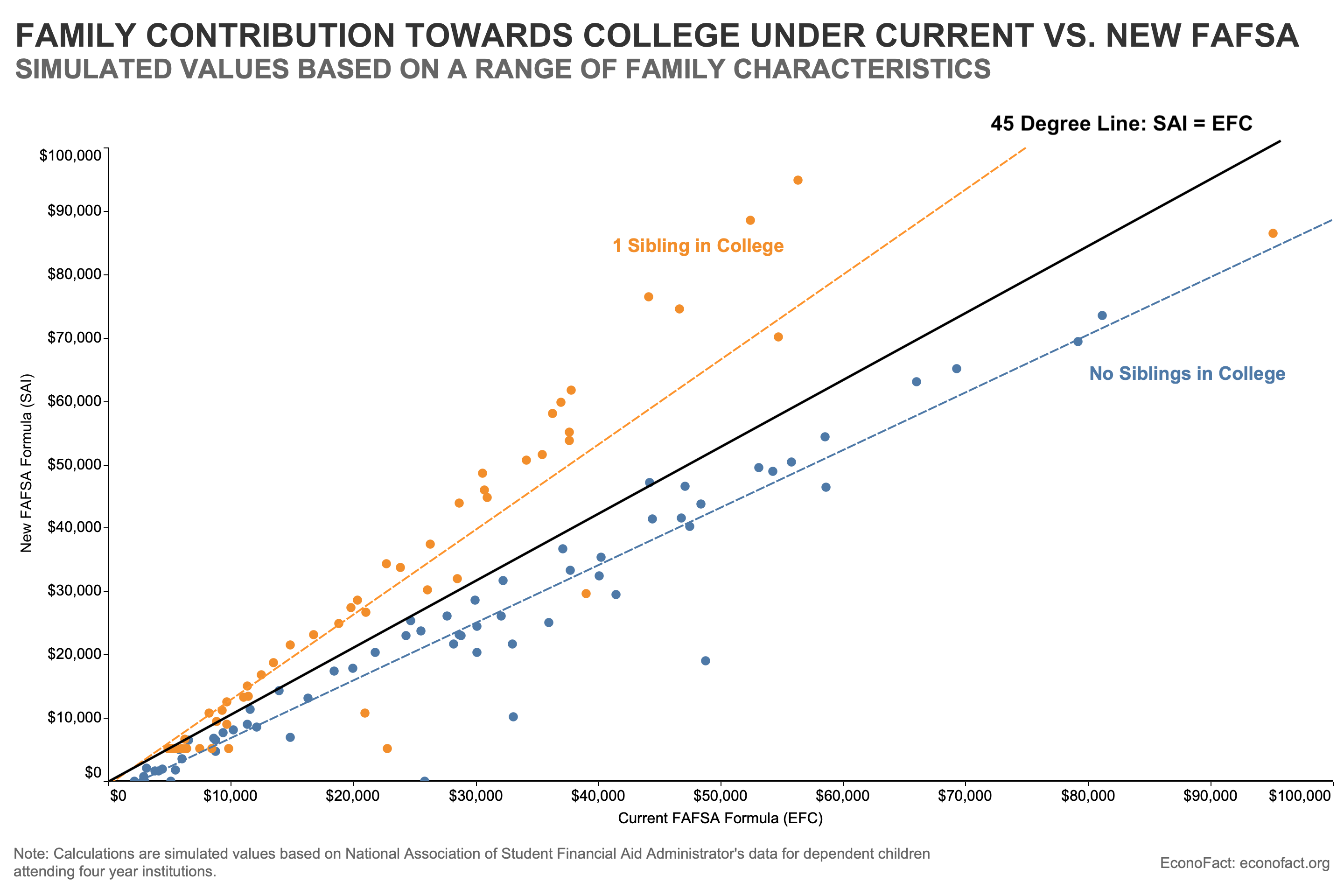

Your tax info plays a big role in determining your Expected Family Contribution (EFC). The EFC is a number that colleges use to calculate how much financial aid you’re eligible for. The more taxable income you or your parents report, the higher your EFC may be—and that could mean less aid.

But here’s the silver lining: certain tax deductions and credits can lower your reported income, potentially boosting your aid eligibility. So, it pays to strategize when filing your taxes.

Tips for Maximizing Financial Aid

Strategies to Optimize Your FAFSA Taxes

Want to make the most of your financial aid opportunities? Here are some smart moves to consider:

- File your taxes early to ensure timely FAFSA submission.

- Take advantage of education-related tax credits, like the American Opportunity Credit or Lifetime Learning Credit.

- Minimize reportable assets by paying down debt or contributing to retirement accounts.

Every little bit helps when it comes to funding your education. And remember, financial aid isn’t just about loans—there are grants and scholarships out there waiting for you.

Understanding Special Circumstances

What If Your Tax Situation Is Unique?

Life isn’t always black and white, and neither are tax situations. If you’ve experienced a major change in your financial circumstances—like a job loss, divorce, or medical emergency—you can request a FAFSA appeal. Colleges may adjust your aid package based on your unique situation.

Here’s what to do:

- Contact the financial aid office at your school.

- Provide documentation of your special circumstances.

- Work with the aid counselor to explore your options.

Don’t be afraid to advocate for yourself. Colleges want to help you succeed, and they’re often willing to work with students in tough situations.

Deadlines and Timing

Don’t Miss the FAFSA Deadline!

Mark your calendar, because missing the FAFSA deadline could cost you big time. For the 2025-26 academic year, the federal deadline is June 30, 2026. However, many states and colleges have earlier deadlines, so be sure to check those as well.

Here’s a quick timeline to keep you on track:

- January 2024: File your 2023 taxes.

- October 2024: Submit your FAFSA as soon as possible after October 1st.

- Spring 2025: Review your aid offers and make decisions.

Procrastination is not your friend when it comes to FAFSA. Get organized early and stay on top of deadlines.

Final Thoughts and Next Steps

So, there you have it—a comprehensive guide to what taxes are needed for FAFSA 2025-26. By now, you should feel confident about gathering your tax info, using the IRS DRT, and avoiding common mistakes. Remember, the goal is to make college affordable and accessible for everyone.

Here’s a quick recap of the key takeaways:

- Use 2023 tax info for the 2025-26 FAFSA.

- Dependent students need parents’ tax info; independent students use their own.

- Utilize the IRS DRT to streamline the process.

- Avoid common errors and submit your FAFSA early.

Now it’s your turn to take action. Start gathering your tax documents, file your FAFSA, and explore all the financial aid opportunities available to you. And if you have questions or need further guidance, don’t hesitate to reach out to your school’s financial aid office or a trusted advisor.

Good luck on your college journey, and remember—you’re not alone in this. We’ve got your back!

Table of Contents

- Understanding the Basics of FAFSA Taxes

- Who Needs to Provide Tax Info?

- How to Gather Your Tax Documents

- Using the IRS Data Retrieval Tool

- Common Mistakes to Avoid

- Financial Aid Implications of Tax Info

- Tips for Maximizing Financial Aid

- Understanding Special Circumstances

- Deadlines and Timing

- Final Thoughts and Next Steps

- Who Is K Dot The King Of West Coast Hiphop

- Who Is The Lead Singer Of Journey Discover The Voice Behind The Iconic Rock Anthems

When Fafsa 202526 Application Opens Melba J. Gonzales

FAFSA 2025 Your Ultimate Guide to Free College Money!

Better FAFSA Updates The Office of Financial Aid