Riverside County CA Property Tax Rate: A Deep Dive Into What You Need To Know

Property taxes can be a tricky subject, especially when you're trying to figure out how much you'll owe in Riverside County, California. If you're a homeowner or planning to buy property in this beautiful area, understanding the Riverside County CA property tax rate is crucial. It's not just about numbers; it's about knowing how these taxes affect your wallet and your future financial plans.

Let’s face it, nobody loves paying taxes, but they're a necessary part of life. In Riverside County, property taxes help fund essential services like schools, public safety, and infrastructure. But how exactly does the system work, and what should you expect? We'll break it down for you in a way that's easy to understand and packed with valuable insights.

So, whether you're a first-time homeowner or a seasoned property investor, this guide will help you navigate the world of Riverside County property taxes. Stick around, and let's unravel the mysteries of property tax rates together!

- Procter Csi Miami The Ultimate Guide To Uncovering The Truth

- 18th June Horoscope What The Stars Predict For Your Zodiac Today

Understanding Riverside County CA Property Tax Rate

First things first, let’s talk about the basics. The Riverside County CA property tax rate is generally around 1% of your property's assessed value. But hold up, there's more to it than just that simple percentage. Local assessments, additional fees, and special districts can bump up your total tax bill. So, while the base rate might seem manageable, there are other factors at play that could increase your overall tax burden.

Here’s the deal: the property tax rate in Riverside County is determined by the state of California, which mandates that the base rate can't exceed 1%. However, local governments can add on additional assessments for things like school bonds, transportation projects, and other public services. These add-ons can vary depending on where your property is located within the county.

How Is Property Tax Assessed?

Now, let’s dive into how your property gets assessed. The county assessor determines the value of your property based on its market value at the time of purchase. From there, the value can only increase by a maximum of 2% per year, thanks to Proposition 13, a law passed in 1978 to protect homeowners from skyrocketing tax bills.

- Billionaires Baby Chinese Drama A Behindthescenes Look You Wont Want To Miss

- Ammonium Bicarbonate Food A Comprehensive Guide You Need To Read

Here are some key points about property assessments:

- Market value at the time of purchase sets the baseline.

- Annual increases are capped at 2%.

- Reassessments occur only when there's a change in ownership or significant improvements to the property.

This system ensures that property taxes don’t fluctuate wildly from year to year, giving homeowners some stability and predictability in their tax bills.

Factors Influencing Riverside County Property Tax

While the base tax rate is straightforward, several factors can influence how much you end up paying. Location, property type, and additional assessments all play a role in determining your final tax bill. Let’s break it down further:

Location, Location, Location

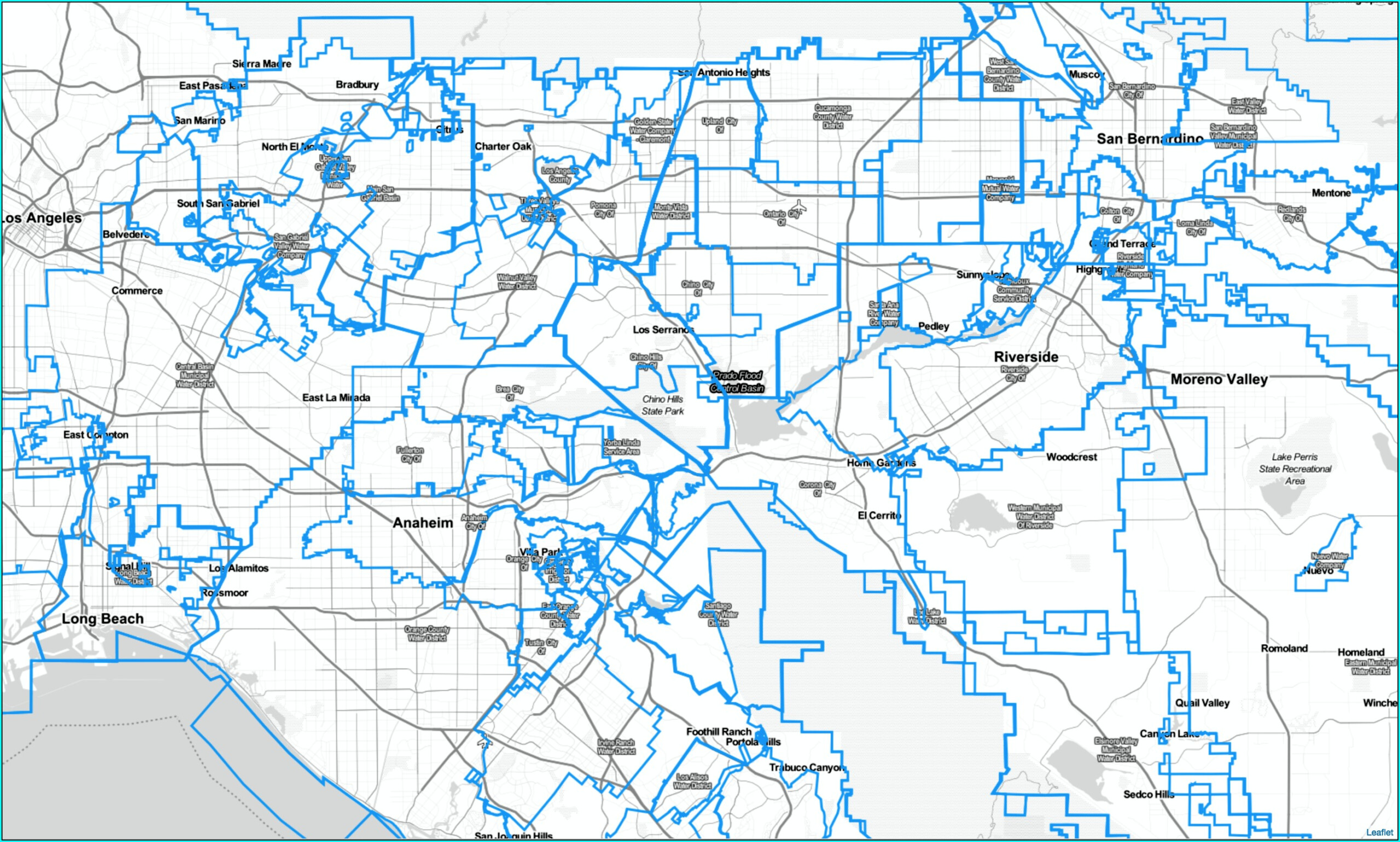

Where your property is located within Riverside County can make a big difference. Some areas have higher additional assessments due to special districts or bond measures that fund local projects. For example, if your property is in a school district that recently passed a bond measure, you might see an increase in your tax bill to cover those costs.

Here’s a quick rundown of how location impacts your taxes:

- Certain neighborhoods may have higher fees for improved infrastructure.

- Special districts for water, fire, or parks can add extra costs.

- Proximity to urban centers might result in higher assessments.

Property Type

Residential, commercial, and agricultural properties are assessed differently. Residential properties typically enjoy the benefits of Proposition 13, while commercial and agricultural properties may be subject to different rules and rates. It’s essential to understand how your specific type of property is classified to get an accurate estimate of your tax liability.

Here’s a quick comparison:

- Residential: Base rate + local assessments.

- Commercial: Market value assessments without Proposition 13 protections.

- Agricultural: Special rules for farmland and open space.

Key Statistics and Data

According to the latest data from the Riverside County Assessor's Office, the average property tax bill for homeowners in the county is around $3,000 per year. However, this number can vary widely depending on the factors we discussed earlier. For instance, properties in more affluent areas or those with additional assessments might see bills closer to $5,000 or more.

Here are some interesting stats to consider:

- Approximately 500,000 properties are assessed annually in Riverside County.

- Property tax revenue accounts for a significant portion of the county’s budget, funding vital services like education and public safety.

- Recent trends show a steady increase in property values, which can lead to higher tax bills over time.

How to Calculate Your Property Tax

Calculating your property tax isn’t as complicated as it might seem. Here’s a simple formula to help you estimate your bill:

Property Tax = Assessed Value x Tax Rate + Additional Assessments

Let’s say your property’s assessed value is $500,000, and the base tax rate is 1%. Without any additional assessments, your tax bill would be $5,000. However, if your area has an additional assessment of $1,000 for a school bond, your total tax bill would be $6,000.

Tips for Estimating Your Tax Bill

Here are some tips to help you estimate your property tax more accurately:

- Check the county assessor’s website for your property’s assessed value.

- Look up any additional assessments that apply to your area.

- Use online calculators provided by the county or third-party websites for a quick estimate.

Challenges and Controversies

Like any tax system, Riverside County’s property tax structure has its share of challenges and controversies. Some homeowners feel that the additional assessments are unfair, while others argue that they’re necessary to fund essential services. The debate over how to balance taxpayer burdens with public needs continues to be a hot topic in local politics.

Here are some of the main issues:

- Unfair distribution of additional assessments across different areas.

- Limited transparency in how tax revenue is spent.

- Concerns about rising property values leading to higher tax bills.

Ways to Reduce Your Property Tax

While you can’t completely avoid property taxes, there are steps you can take to reduce your bill. Here are a few strategies:

File for Property Tax Exemptions

California offers several exemptions that can lower your property tax bill. For example, the Homeowners' Exemption can save you up to $7,000 in assessed value, effectively reducing your tax bill. Other exemptions are available for seniors, disabled individuals, and veterans.

Appeal Your Assessment

If you believe your property’s assessed value is too high, you can file an appeal with the county assessor’s office. This process involves presenting evidence that your property’s market value is lower than the assessed amount. While it can be time-consuming, a successful appeal can result in significant tax savings.

Future Trends in Riverside County Property Taxes

Looking ahead, there are a few trends to watch in Riverside County’s property tax landscape. With property values continuing to rise, homeowners can expect their tax bills to increase accordingly. Additionally, local governments may propose new bond measures or assessments to fund infrastructure projects and public services.

Here’s what to expect in the coming years:

- Potential increases in additional assessments to fund new projects.

- Continued growth in property values driving higher tax bills.

- Ongoing debates over tax fairness and revenue allocation.

Conclusion

In conclusion, understanding the Riverside County CA property tax rate is essential for anyone who owns or plans to buy property in the area. While the base rate is relatively low, additional assessments and rising property values can impact your overall tax bill. By staying informed and taking advantage of available exemptions and appeals, you can minimize your tax burden and plan for the future.

So, what’s next? Take action by checking your property’s assessed value, exploring available exemptions, and staying up-to-date on local tax developments. Share this article with friends and family who might benefit from the information, and don’t forget to leave a comment below with your thoughts or questions. Together, we can make sense of the sometimes confusing world of property taxes!

Table of Contents

- Riverside County CA Property Tax Rate: A Deep Dive into What You Need to Know

- Understanding Riverside County CA Property Tax Rate

- How Is Property Tax Assessed?

- Factors Influencing Riverside County Property Tax

- Location, Location, Location

- Property Type

- Key Statistics and Data

- How to Calculate Your Property Tax

- Tips for Estimating Your Tax Bill

- Challenges and Controversies

- Ways to Reduce Your Property Tax

- File for Property Tax Exemptions

- Appeal Your Assessment

- Future Trends in Riverside County Property Taxes

- Conclusion

- Alfalfa The Character The Beloved Icon In Popular Culture

- Matthew Rhys The Actor Who Turned Passion Into Stardom

Riverside County, CA Cities for Financial Empowerment Fund

Riverside County Assessor Map Gis Map Resume Examples

Annual Secured Property Tax Bill Placer County, CA