Unlocking The Power Of Balance Gift Card Vanilla: Your Ultimate Guide

Hey there, gift card enthusiasts! If you're diving into the world of balance gift cards, specifically the Vanilla version, you're in the right place. Balance gift cards have become a go-to option for people looking to give or receive flexible, cash-like value. Vanilla prepaid cards, in particular, have carved out a special niche in this space. So, what makes them so appealing? Let's dive in and find out!

You might be wondering, "What’s all the fuss about?" Well, the Vanilla gift card is more than just a piece of plastic. It’s a tool that offers freedom, flexibility, and convenience. Whether you're treating yourself, gifting it to someone special, or using it for personal finance management, these cards have got your back. So, let’s break down why they’ve become such a big deal.

In this guide, we’ll cover everything you need to know about Vanilla prepaid cards. From how they work to the benefits they offer, we’ll make sure you’re well-informed and ready to make the most out of this financial tool. So, grab a cup of coffee, and let’s get started on this journey together!

- How Many Seasons Are There Of Heartland A Deep Dive Into The Heartwarming Series

- A1c To Average Blood Sugar Calculator Your Ultimate Guide To Understanding Blood Sugar Levels

What Exactly is a Balance Gift Card Vanilla?

Alright, let’s get down to the nitty-gritty. A balance gift card Vanilla is a prepaid card that acts like cash but with a few added perks. Unlike traditional gift cards tied to specific stores, these babies are versatile. You can use them almost anywhere credit or debit cards are accepted. Plus, they’re reloadable, which gives you even more control over your spending.

Here’s the kicker: Vanilla prepaid cards are unbranded, meaning they don’t carry the logo of any specific retailer. This anonymity is a big draw for many users who prefer privacy in their transactions. Think of it as a blank slate for your spending needs.

Let’s break it down with some quick facts:

- Is The 2016 Gmc Acadia Reliable Everything You Need To Know

- Harry Potters Severus Snape Actor A Deep Dive Into His Life And Legacy

- Prepaid and reloadable

- Accepted almost everywhere

- No bank account required

- Flexible and anonymous

Why Should You Choose a Vanilla Prepaid Card?

Now that we’ve covered the basics, let’s talk about why you should consider a Vanilla prepaid card. First off, they’re incredibly convenient. You don’t need a bank account to use one, which makes them accessible to a wider audience. Whether you’re looking to budget better or just want a safer way to shop online, these cards have got you covered.

Here’s another cool thing: they’re a great way to manage finances without the worry of overspending. Since they’re prepaid, you can only spend what’s on the card. No unexpected overdraft fees or surprises here. Plus, they’re a fantastic option for people who want to avoid carrying cash but don’t want the hassle of traditional credit cards.

Key Benefits of Using Vanilla Cards

Let’s zoom in on the benefits, shall we? Here’s a quick rundown of what makes Vanilla prepaid cards stand out:

- Privacy: No retailer branding means your transactions stay private.

- Flexibility: Use them online, in-store, or even to pay bills.

- No Credit Checks: Unlike credit cards, you don’t need a credit history to get one.

- Control: Reloadable options give you full control over your spending.

How Do Vanilla Prepaid Cards Work?

So, how exactly do these cards function? It’s pretty straightforward. You load money onto the card, and then you use it wherever credit or debit cards are accepted. Simple, right? But there’s a bit more to it than that.

First, you’ll need to purchase a Vanilla card. These can be found at many retailers, both online and in-store. Once you have your card, you can load it with funds. Some cards allow you to reload them, while others are single-use. It’s important to check the terms before you buy.

Once your card is loaded, you can use it just like any other debit or credit card. Swipe it at checkout, enter it online, or even use it for recurring payments. Just remember to keep track of your balance to avoid any unpleasant surprises.

Steps to Using Your Vanilla Card

Here’s a quick guide to using your Vanilla prepaid card:

- Purchase the card from a retailer or online platform.

- Load it with funds via cash, bank transfer, or other methods.

- Use it wherever credit or debit cards are accepted.

- Monitor your balance regularly to stay on top of your spending.

Who Uses Vanilla Prepaid Cards?

Vanilla prepaid cards have a wide range of users. From students managing their first budgets to parents looking for a safer way to give their kids spending money, these cards cater to a diverse audience. They’re also popular among people who want to avoid the fees and complexities of traditional banking.

Here’s a snapshot of some typical users:

- Young adults learning to manage finances

- Parents providing spending money for kids

- People without bank accounts

- Travelers looking for a secure way to carry funds

Testimonials from Real Users

Let’s hear from some real users about their experiences with Vanilla prepaid cards:

"I love the flexibility of my Vanilla card. It’s perfect for online shopping without the worry of my personal info being out there." – Sarah, 25

"As a traveler, having a prepaid card that’s accepted almost everywhere is a game-changer. No more carrying cash!" – Mark, 34

Where Can You Use Your Vanilla Card?

One of the coolest things about Vanilla prepaid cards is their versatility. You can use them virtually anywhere that accepts credit or debit cards. That includes online retailers, physical stores, and even bill payment platforms. They’re also accepted internationally, making them a great option for travelers.

Here’s a list of some places where you can use your Vanilla card:

- Online shopping platforms

- Physical retail stores

- Bill payment services

- International transactions

Tips for Maximizing Your Card Usage

Want to get the most out of your Vanilla card? Here are a few tips:

- Keep track of your balance to avoid overspending.

- Use it for recurring payments to simplify your finances.

- Consider reloading for long-term use.

- Always check for fees associated with card usage.

What Are the Fees Associated with Vanilla Cards?

Now, let’s talk about fees. While Vanilla prepaid cards are generally affordable, it’s important to be aware of any potential costs. Some cards may charge for activation, reloading, or even monthly maintenance. However, many retailers offer cards with no fees at all, so it’s worth shopping around.

Here’s a breakdown of common fees:

- Activation fees (if applicable)

- Reload fees (if applicable)

- Monthly maintenance fees (if applicable)

- ATM withdrawal fees (if applicable)

How to Avoid Unnecessary Fees

Want to keep your costs low? Here’s how:

- Look for cards with no activation or reload fees.

- Use the card regularly to avoid dormancy charges.

- Withdraw cash from in-network ATMs to avoid fees.

Are Vanilla Prepaid Cards Safe?

Safety is a top concern for many users, and Vanilla prepaid cards have several features to keep your money secure. For starters, they’re PIN-protected, which means only you can access the funds. Plus, since they’re not linked to a bank account, your personal financial information stays private.

Here’s how Vanilla cards keep you safe:

- PIN protection for added security

- No link to bank accounts

- Zero liability protection in case of fraud

Best Practices for Staying Secure

Here are a few tips to keep your card safe:

- Always keep your PIN confidential.

- Monitor your transactions regularly.

- Report any suspicious activity immediately.

Conclusion: Is a Balance Gift Card Vanilla Right for You?

So, there you have it – everything you need to know about balance gift cards Vanilla. They’re versatile, convenient, and offer a level of privacy that’s hard to beat. Whether you’re looking to manage your finances better or just want a safer way to shop, these cards are definitely worth considering.

Now, it’s your turn. Have you used a Vanilla prepaid card before? What’s your favorite feature? Let us know in the comments below. And if you found this guide helpful, don’t forget to share it with your friends and family. Until next time, stay savvy and keep those finances in check!

Table of Contents

- What Exactly is a Balance Gift Card Vanilla?

- Why Should You Choose a Vanilla Prepaid Card?

- How Do Vanilla Prepaid Cards Work?

- Who Uses Vanilla Prepaid Cards?

- Where Can You Use Your Vanilla Card?

- What Are the Fees Associated with Vanilla Cards?

- Are Vanilla Prepaid Cards Safe?

- Conclusion: Is a Balance Gift Card Vanilla Right for You?

- Who Played In Christmas Vacation A Festive Cast Dive

- Gatwick Code Unlocking The Secrets Of Londons Secondbusiest Airport

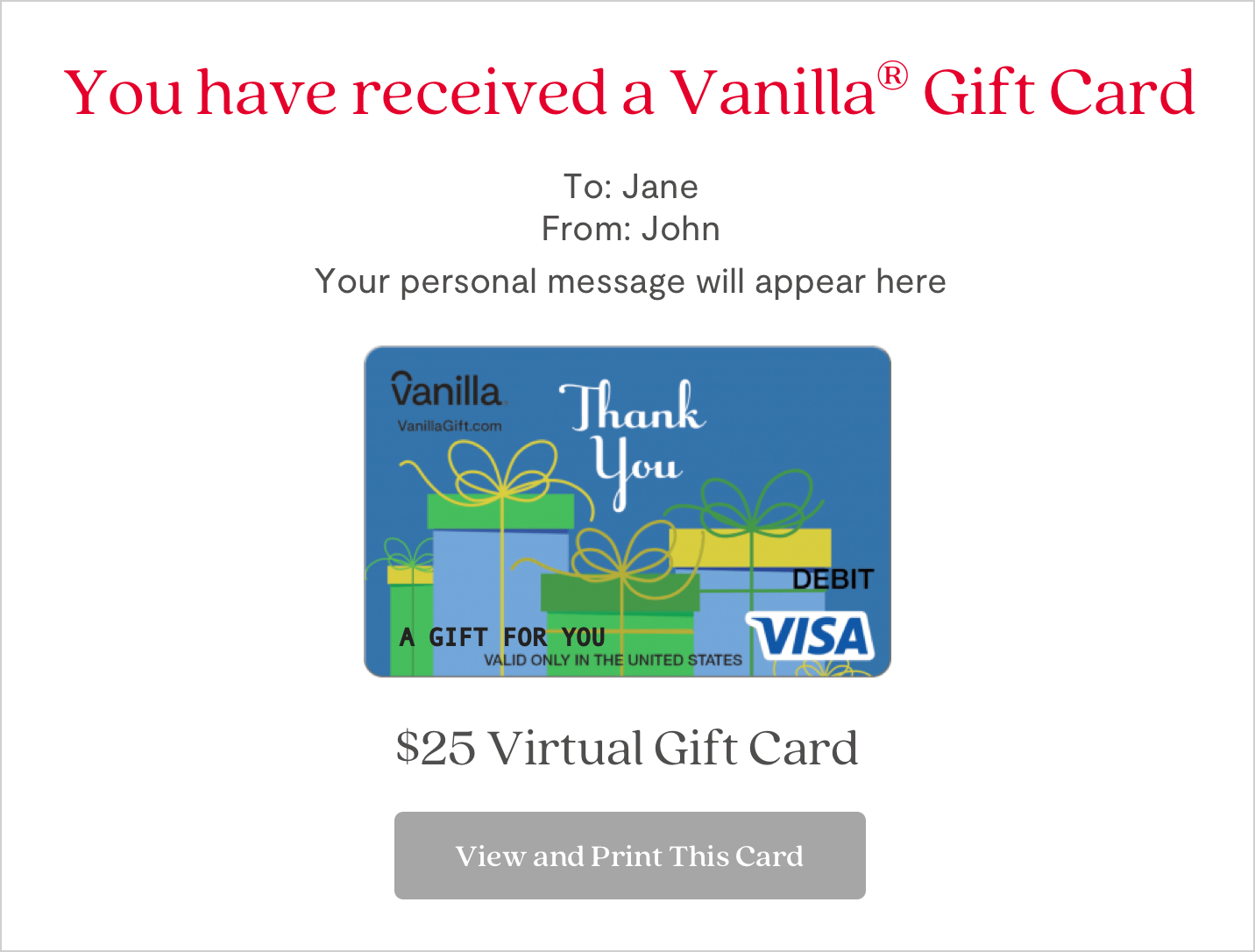

Vanilla Gift Card Balance

Vanilla Gift Card Balance

Vanilla Digital Custom Card