Riverside County CA Property Tax: A Comprehensive Guide

Hey there, friend! If you're diving into the world of Riverside County CA property tax, you're in the right place. Property taxes can be a tricky beast, but don't sweat it—we’ve got your back. Whether you're a homeowner, investor, or just someone curious about how it all works, this guide is here to break it down for you. So grab a coffee, sit back, and let’s unravel the mysteries of Riverside County's property tax system together!

Property taxes are one of those things that everyone talks about but not everyone fully understands. And let’s be real—taxes can get pretty complicated, especially when you throw in the specifics of Riverside County, California. But don’t worry, we’re here to make it as simple and painless as possible. This isn’t just about numbers; it’s about understanding how these taxes affect your wallet and your property.

From the basics of how property taxes are calculated to the latest trends and tips for saving money, this article is your go-to resource. We’ll cover everything you need to know so you can make informed decisions about your property. Ready? Let’s jump in!

- Jamie Pressly And Margot Robbie Two Stars One Fascinating Story

- How To Master Conversion De F A Centigrados A Simple Guide For Everyday Life

Understanding Riverside County CA Property Tax

First things first, what exactly is Riverside County CA property tax? Simply put, it’s a tax levied on real estate properties within the boundaries of Riverside County. This tax is based on the assessed value of your property, which means the government looks at how much your house or land is worth before they slap a tax amount on it. It’s not just about owning property—it’s about maintaining it and contributing to the community.

How Is Riverside County Property Tax Calculated?

Alright, let’s get into the nitty-gritty. Riverside County property tax is calculated using the property’s assessed value. The assessed value is usually a percentage of the market value, which is determined by the county assessor. In California, thanks to Proposition 13, property taxes are generally capped at 1% of the property’s assessed value, plus any additional voter-approved assessments.

Here’s a quick breakdown:

- Scream Car The Ultimate Thrill Of Speed And Fury

- 7 Swordsmen Of The Mist Weapons Unveiling The Razorsharp Legacy

- Assessed Value: This is the value assigned to your property by the county assessor.

- Base Year Value: The initial value of your property when you bought it.

- Annual Increases: Your property’s assessed value can increase by up to 2% each year due to inflation.

So, if your property’s assessed value is $500,000, your base tax would be around $5,000 (1% of $500,000). But remember, there might be additional fees depending on local bonds or special assessments.

Key Factors Affecting Riverside County CA Property Tax

Now, let’s talk about the factors that can influence your property tax bill. These aren’t just random numbers; they’re based on real-world conditions and regulations. Here are some of the main factors:

Property Location

Where your property is located plays a huge role in determining your tax rate. Different areas within Riverside County may have different tax rates based on local services, schools, and infrastructure. For example, properties in more developed areas might have higher taxes because of better amenities and services.

Property Type

Whether you own a single-family home, a commercial building, or agricultural land, the type of property affects your tax bill. Residential properties are taxed differently than commercial or industrial properties. Agricultural land, for instance, might qualify for special tax breaks if it’s used for farming.

Market Conditions

The real estate market can also impact property taxes. If property values in Riverside County rise due to high demand, your assessed value might increase, leading to higher taxes. Conversely, if the market slows down, you might see a decrease in your tax bill.

Proposition 13: A Game-Changer for Property Taxes

Let’s not forget about Proposition 13, a game-changer for California property taxes. Passed in 1978, this law limits how much property taxes can increase annually. It also caps the tax rate at 1% of the property’s assessed value. This has been a huge relief for many homeowners, especially in areas like Riverside County where property values have skyrocketed over the years.

Benefits of Proposition 13

Here are some of the key benefits:

- Stability: Property owners know exactly how much their taxes will increase each year.

- Predictability: With a cap on the tax rate, homeowners can budget more effectively.

- Protection: Long-term residents are protected from sudden spikes in property taxes.

However, it’s worth noting that Proposition 13 also means new buyers might pay significantly higher taxes than long-term residents, even for similar properties. This can create some disparity in the system, but overall, it’s been a boon for many Californians.

How to Lower Your Riverside County CA Property Tax

Let’s face it—nobody loves paying taxes. But did you know there are ways to potentially lower your Riverside County CA property tax? Here are a few strategies:

File for Reassessment

If you believe your property’s assessed value is too high, you can file for reassessment. This involves challenging the county’s valuation and providing evidence that your property is worth less than they claim. It’s not always easy, but it can save you money in the long run.

Look for Tax Exemptions

There are several exemptions available that could reduce your tax bill. For example:

- Homeowner’s Exemption: If you live in your property, you might qualify for a reduction of up to $7,000 in assessed value.

- Senior Citizen Exemption: Seniors on a fixed income might be eligible for additional tax breaks.

- Disaster Relief: If your property was damaged by a natural disaster, you might qualify for reduced taxes.

Be sure to check with the Riverside County Assessor’s Office for more details on available exemptions.

Riverside County CA Property Tax Deadlines

Knowing the deadlines for paying your property taxes is crucial. In Riverside County, property taxes are typically due in two installments:

First Installment

The first installment is due by November 1st and must be paid by December 10th to avoid penalties. This payment covers half of your annual tax bill.

Second Installment

The second installment is due by February 1st and must be paid by April 10th. Again, late payments will result in penalties, so mark these dates on your calendar!

Pro tip: Set up automatic payments or reminders to ensure you never miss a deadline. It’s an easy way to avoid unnecessary fees.

Understanding Your Property Tax Bill

When you receive your property tax bill, it might look like a bunch of numbers and codes. But don’t panic—once you know what to look for, it’s pretty straightforward. Here’s a quick guide to understanding your bill:

Assessed Value

This is the value your property was assessed at. Remember, it’s usually a percentage of the market value, so it might not reflect the exact price you could sell your property for.

Tax Rate

This is the percentage applied to your assessed value to calculate your taxes. In Riverside County, the base rate is 1%, but additional assessments might increase this.

Special Assessments

These are extra fees that might be added to your bill. They could include things like school bonds, water districts, or other local improvements.

Common Myths About Riverside County CA Property Tax

There’s a lot of misinformation floating around about property taxes. Let’s bust some common myths:

Myth #1: Property Taxes Are the Same Everywhere

Wrong! Property taxes vary widely depending on location, property type, and local regulations. Just because your neighbor pays a certain amount doesn’t mean you will too.

Myth #2: Property Taxes Always Increase

Not necessarily. While property values often rise, there are times when they decrease. If your property’s value drops significantly, your taxes might go down too.

Myth #3: You Can’t Challenge Your Tax Bill

Absolutely false! As we discussed earlier, you can and should challenge your tax bill if you believe it’s unfair. Just be prepared to back up your claims with solid evidence.

Resources for Riverside County CA Property Tax

Finally, here are some resources to help you navigate the world of Riverside County CA property tax:

- Riverside County Assessor’s Office: The official website for all things related to property assessment and taxes.

- Riverside County Treasurer-Tax Collector: Where you can pay your taxes and find payment deadlines.

- State of California: For more information on statewide tax laws and regulations.

Conclusion

Well, there you have it—a comprehensive guide to Riverside County CA property tax. From understanding how it’s calculated to strategies for lowering your bill, we’ve covered it all. Property taxes might not be the most exciting topic, but they’re an important part of owning property. By staying informed and proactive, you can ensure you’re paying the right amount and taking advantage of any available exemptions.

So, what’s next? If you found this article helpful, feel free to share it with others who might benefit. And don’t forget to check out our other articles for more tips and insights on real estate and finance. Remember, knowledge is power—and when it comes to property taxes, being informed can save you a ton of money!

Got questions or comments? Drop them below, and let’s keep the conversation going!

Table of Contents

- Understanding Riverside County CA Property Tax

- Key Factors Affecting Riverside County CA Property Tax

- Proposition 13: A Game-Changer for Property Taxes

- How to Lower Your Riverside County CA Property Tax

- Riverside County CA Property Tax Deadlines

- Understanding Your Property Tax Bill

- Common Myths About Riverside County CA Property Tax

- Resources for Riverside County CA Property Tax

- Conclusion

- Where Is Yasmine Bleeth Now Unveiling The Life Of A Beloved Star

- Stratagems Helldivers 2 Codes The Ultimate Guide To Mastering The Chaos

Riverside County, CA Cities for Financial Empowerment Fund

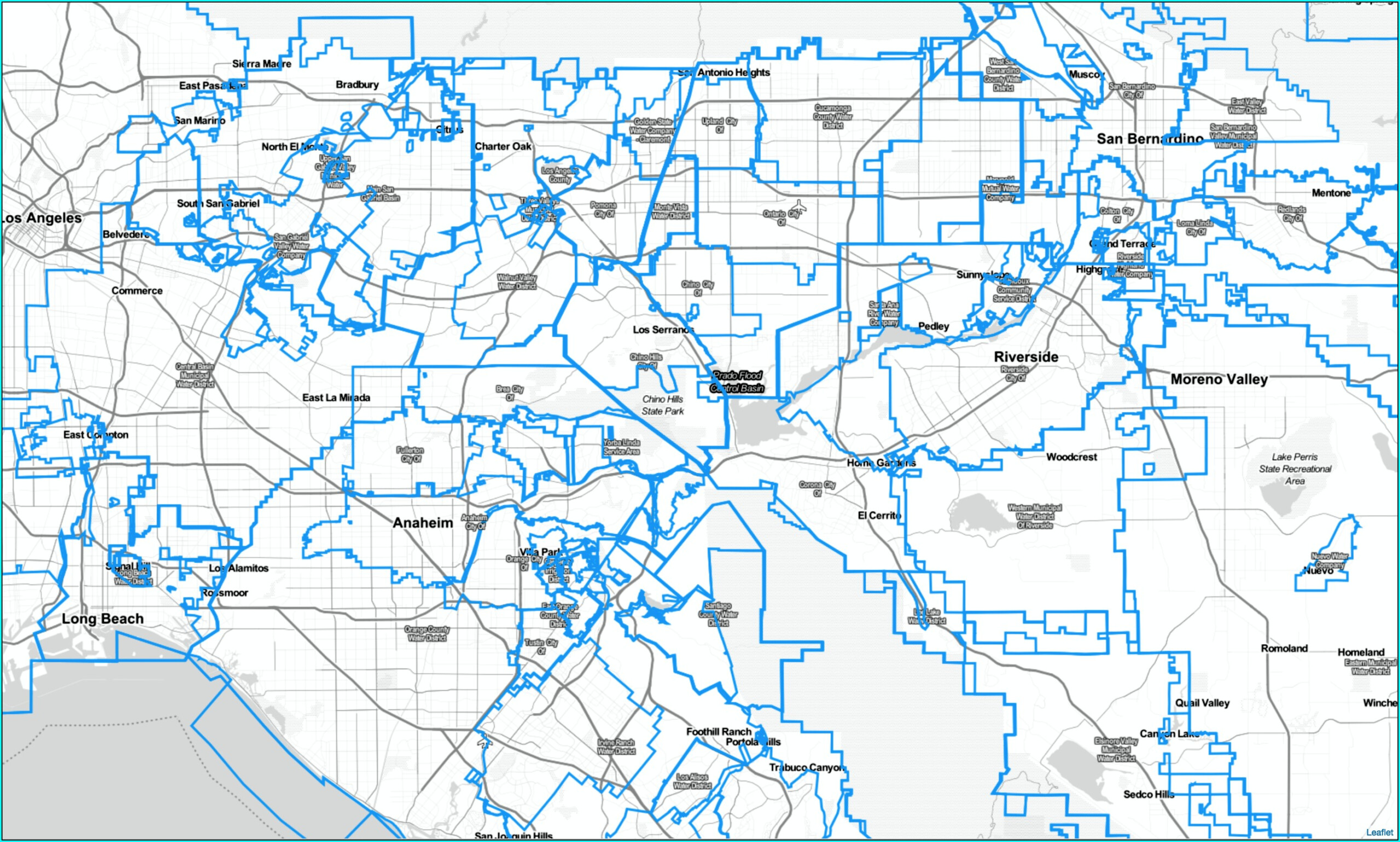

Riverside County Assessor Map Gis Map Resume Examples

Annual Secured Property Tax Bill Placer County, CA