What Tax Information Is Needed For FAFSA 2025-26? A Comprehensive Guide

So, you're diving into the world of FAFSA for the 2025-26 academic year, huh? If you're like most students or parents, the process can feel overwhelming, especially when it comes to tax info. Don't sweat it! Understanding what tax information is needed for FAFSA 2025-26 is crucial, but it doesn't have to be complicated. Let's break it down step by step, so you can breeze through this application like a pro.

FAFSA, or the Free Application for Federal Student Aid, is your golden ticket to accessing financial aid for college. Whether you're aiming for grants, scholarships, work-study programs, or federal loans, filling out the FAFSA accurately is key. And guess what? Tax info plays a huge role in determining your eligibility and aid amount.

But here's the thing—tax forms can be confusing, and knowing exactly what to include can make or break your application. In this guide, we'll walk you through everything you need to know about tax information for FAFSA 2025-26. We’ll cover the essentials, tips, and tricks to help you submit a flawless application. Ready? Let's get started!

- Eazye Death Age The Untold Story Behind The Iconic Rappers Legacy

- Comprehensive Guide To Jewish Last Name List Discover Your Heritage

Here's a quick overview of what we'll cover:

- Tax Documents You Need for FAFSA

- Dependent vs. Independent Students

- Using the IRS Data Retrieval Tool

- Common Mistakes to Avoid

- FAQs About FAFSA Tax Info

- Additional Resources

Tax Documents You Need for FAFSA

Alright, let's talk about the nitty-gritty. To complete your FAFSA for the 2025-26 academic year, you'll need some specific tax documents. These docs will help verify your financial situation and determine how much aid you qualify for. Here's a rundown of what you should gather:

Tax Returns

Your federal tax returns are the foundation of your FAFSA application. For the 2025-26 FAFSA, you'll need your 2023 tax returns. Why 2023? Because FAFSA uses prior-prior year (PPY) income info to calculate your Expected Family Contribution (EFC). If you're a dependent student, you'll also need your parents' 2023 tax returns.

- Alex Lagina The Mysterious Genius Who Cracked The Worlds Codes

- 19th Nov Zodiac Sign Discover The Mystical Scorpio Energy

- Form 1040 (U.S. Individual Income Tax Return)

- Form 1040-SR (U.S. Tax Return for Seniors)

- Form 1040-NR (U.S. Non-Resident Alien Income Tax Return)

Don't forget any related schedules, like Schedule 1, 2, or 3, if applicable.

W-2 Forms

Your W-2 forms are another essential piece of the puzzle. These documents show your earned income for the year and are used to verify your wages. If you have multiple jobs, make sure you gather all W-2s from each employer.

Other Financial Records

Besides tax returns and W-2s, there are a few other financial records you might need:

- 1099 forms for interest, dividends, or other income

- Records of untaxed income, such as child support received or veterans' benefits

- Bank statements and investment records

Having all these documents ready will save you time and headaches when filling out the FAFSA.

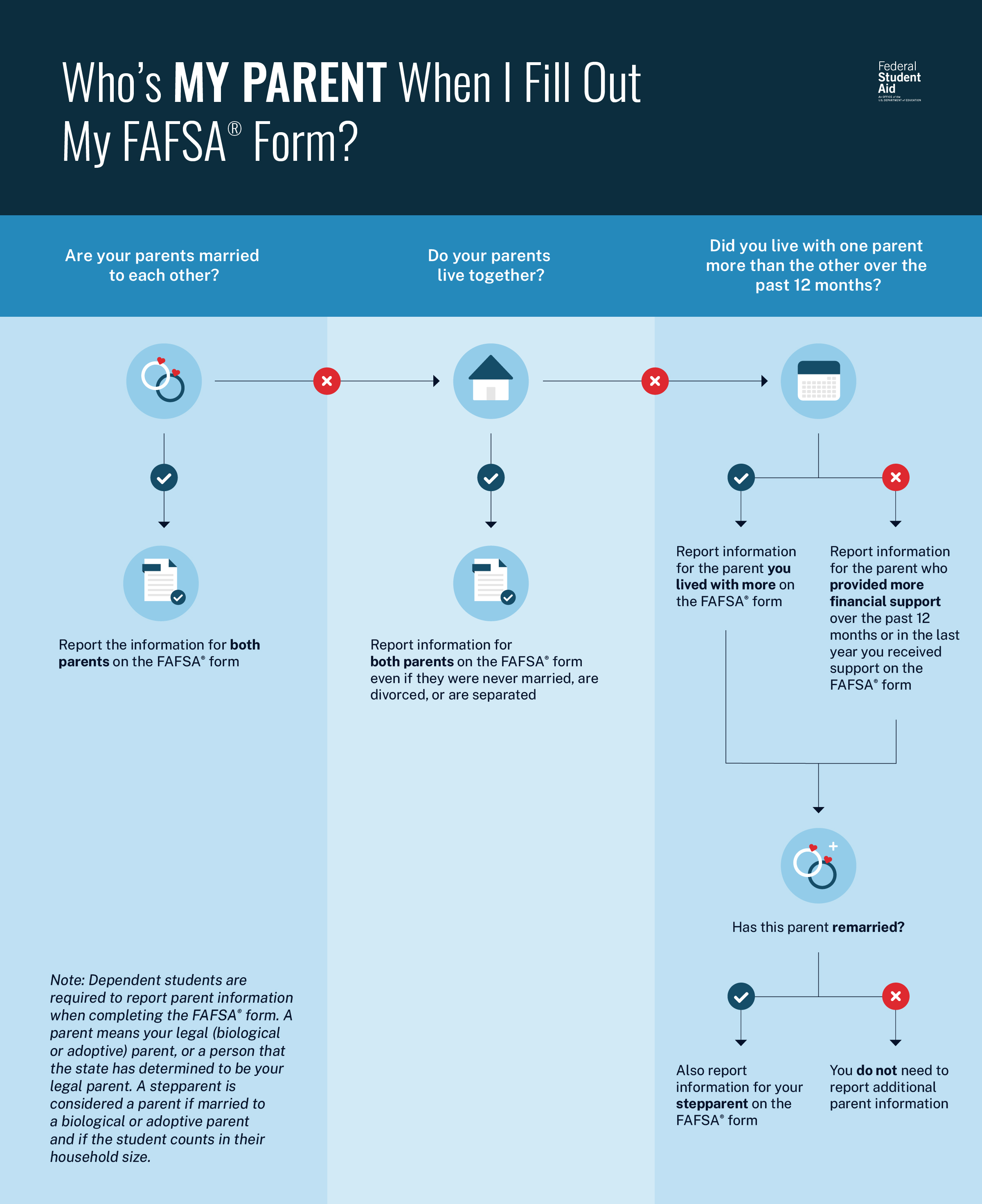

Dependent vs. Independent Students

One of the biggest factors affecting your FAFSA tax info is whether you're considered a dependent or independent student. This distinction impacts whose tax information you need to report.

Dependent Students

If you're a dependent student, you'll need to include your parents' tax information on your FAFSA. This includes their 2023 federal tax returns, W-2s, and any other relevant financial records. Even if you don't live with your parents or they don't claim you as a dependent on their taxes, their info is still required.

Independent Students

As an independent student, you only need to report your own tax information. If you're married, you'll also need to include your spouse's tax info. Being independent doesn't necessarily mean you're financially self-sufficient—it's based on specific criteria like age, marital status, or having dependents of your own.

Make sure to check the FAFSA dependency guidelines to determine your status. It could affect how much aid you're eligible for.

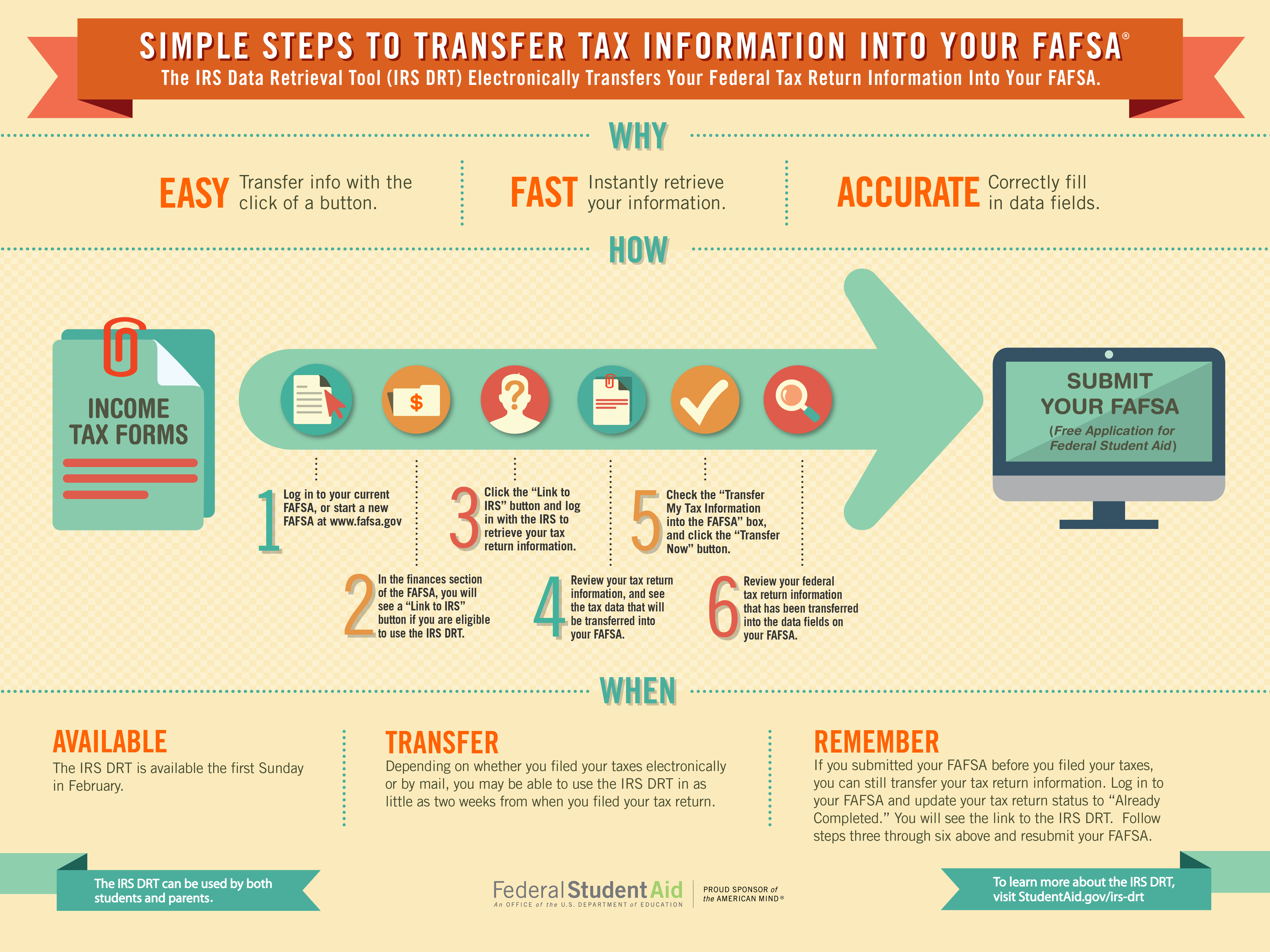

Using the IRS Data Retrieval Tool

Now, here's a game-changer: the IRS Data Retrieval Tool (DRT). This tool lets you automatically import your tax info directly from the IRS into your FAFSA. It's fast, accurate, and eliminates the hassle of manually entering data.

To use the DRT, follow these steps:

- Complete the FAFSA up to the financial info section.

- Select the option to link to the IRS website.

- Sign in to your IRS account and authorize the data transfer.

- Wait a few moments for the info to populate in your FAFSA.

Pro tip: Make sure you've already filed your 2023 tax returns before using the DRT. If you haven't filed yet, you can still complete the FAFSA with estimated numbers and update it later.

Common Mistakes to Avoid

Even the most prepared students can make mistakes on their FAFSA. Here are a few common errors to watch out for when entering tax information:

- Forgetting to include all required tax documents

- Misreporting income or assets

- Not updating estimated info with actual numbers after filing taxes

- Using the wrong tax year (remember, it's 2023 for FAFSA 2025-26)

Double-check your work before submitting your FAFSA. A small error could delay your aid or even lead to a denial.

FAQs About FAFSA Tax Info

Do I Need to Submit Physical Copies of My Tax Returns?

Nope! The FAFSA doesn't require physical copies of your tax documents. Just enter the required info online or use the IRS Data Retrieval Tool.

What If I Haven't Filed My Taxes Yet?

You can still complete the FAFSA with estimated numbers. Just be sure to update your application once you've filed your taxes.

Can I Use State Tax Returns Instead of Federal?

No, the FAFSA specifically requires federal tax returns. State returns won't cut it.

Additional Resources

Still feeling unsure about what tax information is needed for FAFSA 2025-26? Here are some helpful resources to guide you:

These sites offer detailed info and support to help you navigate the FAFSA process.

Conclusion

There you have it—everything you need to know about what tax information is needed for FAFSA 2025-26. By gathering the right documents, understanding your dependency status, and using tools like the IRS Data Retrieval Tool, you can make the process smoother and more efficient.

Remember, the key to a successful FAFSA application is accuracy and thoroughness. Take your time, double-check your info, and don't hesitate to reach out for help if you need it. Your future self will thank you when that financial aid package comes rolling in!

So, what are you waiting for? Get those tax docs ready and start your FAFSA journey today. And hey, if you found this guide helpful, drop a comment below or share it with a friend who might need it. Let's make college dreams a reality, one FAFSA at a time!

- How Many Twice Members Are There The Ultimate Guide To The Kpop Sensation

- Yeezy Colorways 350 A Sneakerheads Dream Collection

Tax Form For Fafsa 202526 Max E. Winfrey

How to transfer your tax information into the FAFSA

Better FAFSA Updates The Office of Financial Aid