Unveiling The Truth About Property Tax Rate In Riverside County, CA

Hey there, property owners and aspiring homeowners! If you've ever found yourself scratching your head over the property tax rate in Riverside County, CA, you're not alone. Property taxes are one of those topics that can make even the most seasoned homeowners feel a bit overwhelmed. But don’t sweat it—we’re here to break it down for you in a way that’s easy to digest and packed with useful info. So, let’s dive right in and unravel the mystery behind Riverside County’s property tax rates.

Let’s face it, taxes aren’t exactly the most thrilling topic, but they’re definitely something you need to wrap your head around if you’re buying or owning property in Riverside County. Whether you’re a long-time resident or a newbie to the area, understanding how property taxes work can save you a lot of headaches and maybe even some cash in the long run.

Now, before we get too deep into the nitty-gritty, let’s set the stage. Riverside County is known for its diverse neighborhoods, stunning landscapes, and a growing population. But along with all the charm comes the responsibility of paying property taxes. So, buckle up, because we’re about to demystify the world of property tax rates in Riverside County, CA.

- What Horoscope Is August 26 Discover Your Zodiac Sign And Unleash Its Mysteries

- Whats Eminems Real Name Unveiling The Man Behind The Mask

Understanding Property Tax Rate in Riverside County

Alright, first things first—what exactly is the property tax rate in Riverside County, CA? Simply put, it’s the percentage of your property’s assessed value that you’re required to pay to the local government each year. This money goes toward funding essential services like schools, public safety, infrastructure, and more. Think of it as your contribution to keeping the community running smoothly.

In Riverside County, the base property tax rate is typically around 1.0% of your property’s assessed value. However, there’s a catch—this isn’t the only fee you’ll see on your tax bill. Additional assessments, such as bond measures and special district fees, can bump up the total rate to around 1.2% to 1.5%. So, when you hear someone talking about the "property tax rate," they’re usually referring to the combined total of all these charges.

How Property Taxes Are Calculated

Now that we’ve got the basics down, let’s talk about how property taxes are actually calculated. The process starts with the assessed value of your property. This is determined by the county assessor, who evaluates your property based on factors like location, size, age, and improvements. Once the assessed value is set, the tax rate is applied to calculate your annual tax bill.

- Whats In Body Armor Unveiling The Layers Of Protection

- King County Recorder Your Ultimate Guide To Records Services And More

Here’s a quick breakdown of the formula:

- Assessed Value × Tax Rate = Property Tax

For example, if your property is assessed at $500,000 and the tax rate is 1.2%, your annual property tax would be $6,000. Easy peasy, right? Well, not quite. There are a few more factors to consider, like Proposition 13 and potential reassessments, which we’ll get into later.

Key Factors Influencing Property Tax Rates

Property tax rates in Riverside County aren’t set in stone—they can fluctuate based on several factors. Let’s take a closer look at what influences these rates:

1. Proposition 13

Proposition 13, passed in 1978, is a game-changer for property taxes in California. It limits the annual increase in assessed value to no more than 2% and caps the tax rate at 1% of assessed value. This means that even if property values skyrocket, your tax bill won’t skyrocket with them—at least not right away.

2. Bond Measures

Bond measures are voter-approved initiatives that fund specific projects, like building schools or improving infrastructure. These measures often come with additional assessments that get added to your property tax bill. It’s important to stay informed about any bond measures in your area, as they can impact your taxes.

3. Special District Fees

Special district fees are charges levied by local agencies to fund specific services, such as water, sewer, or fire protection. These fees can vary depending on where you live within Riverside County and can add to your overall tax burden.

Comparing Riverside County to Other Counties in California

So, how does Riverside County stack up against other counties in California when it comes to property tax rates? The truth is, it’s pretty competitive. While the base rate of 1.0% is standard across the state, additional assessments can vary widely depending on the county and even the specific neighborhood.

For example, counties like San Diego and Los Angeles might have slightly higher total tax rates due to more extensive bond measures and special district fees. On the other hand, rural counties like Inyo and Modoc tend to have lower overall rates. It’s all about location, location, location!

Breaking Down the Numbers

Let’s take a look at some average property tax rates for a few counties in California:

- Riverside County: 1.2% to 1.5%

- Los Angeles County: 1.3% to 1.6%

- San Diego County: 1.1% to 1.4%

- San Francisco County: 1.15% to 1.45%

As you can see, Riverside County falls right in the middle of the pack. It’s not the cheapest, but it’s certainly not the most expensive either.

How to Reduce Your Property Tax Bill

Now, here’s the part you’ve been waiting for—ways to potentially reduce your property tax bill. Who doesn’t love saving money, right? Here are a few strategies to consider:

1. File for Reassessment

If you believe your property’s assessed value is too high, you can file for a reassessment with the county assessor’s office. This is especially relevant if property values in your area have dropped or if your property has suffered significant damage.

2. Take Advantage of Exemptions

California offers several property tax exemptions that you might qualify for, such as the Homeowner’s Exemption, which reduces your assessed value by $7,000. Other exemptions include those for seniors, disabled veterans, and low-income homeowners.

3. Challenge Unjust Assessments

If you feel your assessment is unfair or inaccurate, you can file an appeal with the county’s assessment appeals board. Be sure to gather all relevant evidence, such as recent sales data for similar properties in your area.

Understanding the Importance of Property Taxes

Before we wrap things up, let’s take a moment to appreciate the importance of property taxes. Sure, they might feel like a burden, but they play a vital role in funding essential services that benefit the entire community. From public schools to emergency services, property taxes help keep Riverside County a great place to live.

Plus, paying your property taxes on time can actually work in your favor. It builds a positive credit history and demonstrates financial responsibility, which can come in handy if you ever need to apply for a loan or mortgage in the future.

What Happens If You Don’t Pay?

On the flip side, failing to pay your property taxes can lead to some serious consequences. Not only will you face penalties and interest charges, but your property could even be subject to foreclosure. So, it’s always best to stay on top of your tax obligations.

Future Trends in Property Tax Rates

As Riverside County continues to grow and develop, we can expect some changes in property tax rates. With more people moving to the area and new construction projects underway, the demand for public services is likely to increase. This could result in higher bond measures and special district fees in the future.

However, Proposition 13 will continue to provide a safety net for property owners, limiting the annual increase in assessed values. So, while rates may rise, they’ll do so at a controlled pace.

Staying Informed

The key to navigating property taxes in Riverside County is staying informed. Keep an eye on local elections, especially those involving bond measures, and make your voice heard. Understanding how these decisions impact your tax bill can help you plan for the future.

Final Thoughts and Call to Action

And there you have it—a comprehensive guide to property tax rates in Riverside County, CA. Whether you’re a seasoned homeowner or just starting your property journey, understanding how property taxes work is essential. By staying informed and taking advantage of available exemptions, you can keep your tax bill in check and make the most of your investment.

Now, it’s your turn! If you found this article helpful, don’t hesitate to share it with your friends and family. And if you have any questions or insights to add, drop them in the comments below. Let’s keep the conversation going and help each other navigate the world of property taxes in Riverside County.

Oh, and one last thing—be sure to bookmark this page for future reference. You never know when you’ll need a quick refresher on property tax rates in Riverside County, CA. Until next time, stay savvy and keep those taxes under control!

Table of Contents

- Understanding Property Tax Rate in Riverside County

- Key Factors Influencing Property Tax Rates

- Comparing Riverside County to Other Counties in California

- How to Reduce Your Property Tax Bill

- Understanding the Importance of Property Taxes

- Future Trends in Property Tax Rates

- How Property Taxes Are Calculated

- Proposition 13

- Breaking Down the Numbers

- Staying Informed

- A1c To Average Blood Sugar Calculator Your Ultimate Guide To Understanding Blood Sugar Levels

- Blippi Real Voice Discovering The Voice Behind The Mask

Riverside County, CA Cities for Financial Empowerment Fund

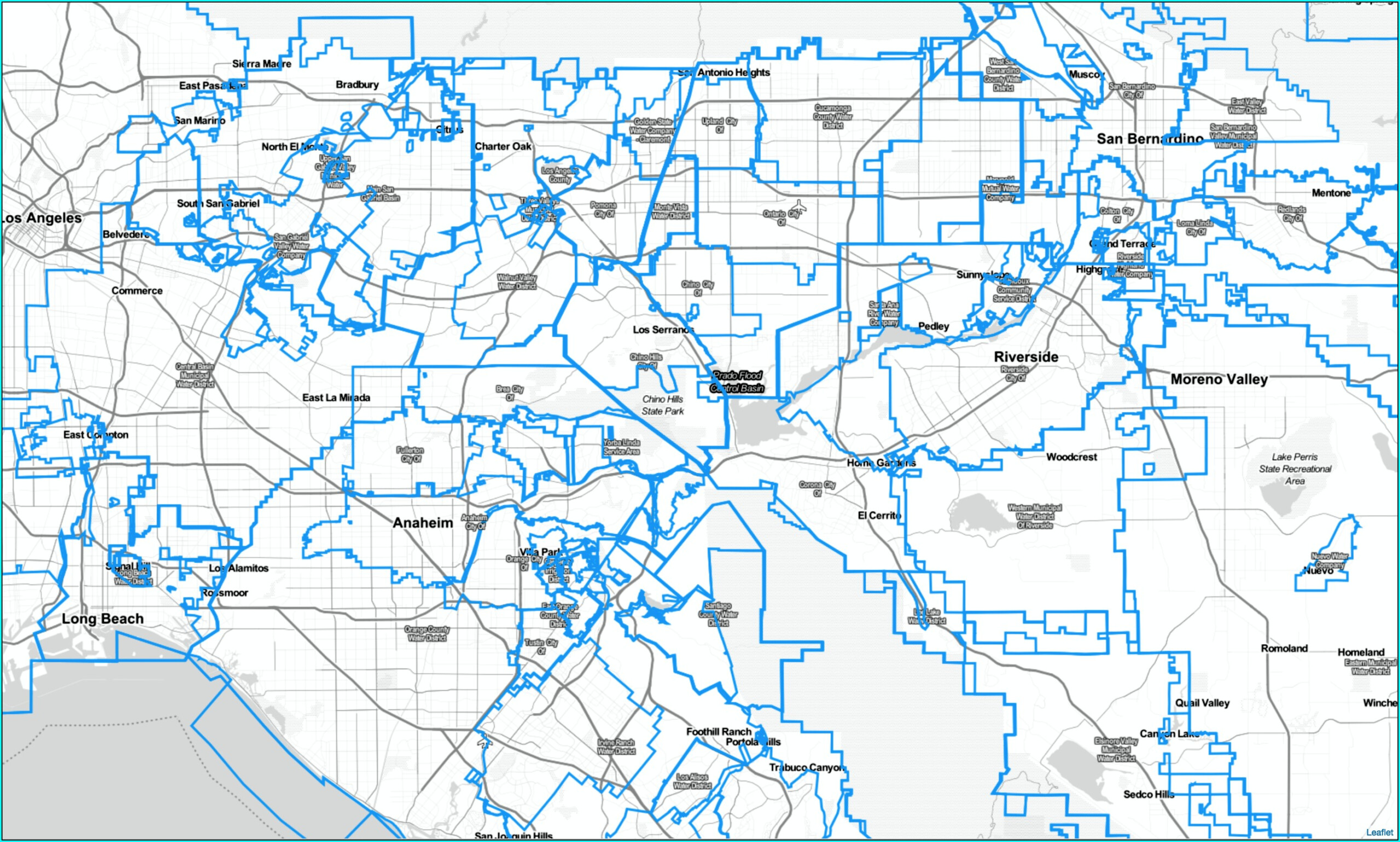

Riverside County Assessor Map Gis Map Resume Examples

Riverside County, CA Population 2023 Stats & Trends Neilsberg