Economic Relief For 2024 Eligibility: Your Ultimate Guide To Securing Financial Aid

Listen up, folks! If you've been scratching your head trying to figure out what the deal is with economic relief for 2024 eligibility, you're in the right place. In these uncertain times, financial help can be a lifesaver. Governments and organizations around the world are rolling out programs to support individuals and businesses affected by economic challenges. But here’s the thing—just because help is available doesn’t mean everyone qualifies. So, let’s dive into the nitty-gritty of who gets what and why.

Let’s face it, life can throw some pretty heavy curveballs at us. Whether it’s unexpected job loss, rising living costs, or medical emergencies, financial strain is no joke. That’s where economic relief programs come in. These programs are designed to ease the burden on those who need it most. But hey, there’s a catch—eligibility requirements can be tricky to navigate. Stick with me, and we’ll break it all down for you.

Before we jump into the details, let’s address the elephant in the room. Economic relief isn’t just a handout; it’s a lifeline for people who are genuinely struggling. The goal of these programs is to stabilize the economy and help individuals get back on their feet. By the end of this guide, you’ll have a solid understanding of what you need to qualify for 2024 economic relief and how to apply. Ready? Let’s go!

- Exploring The Mystical Beauty Of Tree Gondor A Journey Through Natures Wonders

- 73 Fahrenheit To Celsius The Ultimate Guide To Temperature Conversion

Table of Contents

What Is Economic Relief for 2024 Eligibility?

Eligibility Requirements for Economic Relief

Types of Economic Relief Available in 2024

- How Many Twice Members Are There The Ultimate Guide To The Kpop Sensation

- Drake Meat Pics The Hype The Story And The Juicy Details You Didnrsquot Know

How to Apply for Economic Relief

Common Mistakes to Avoid When Applying

Private Initiatives for Economic Relief

Tax Implications of Economic Relief

The Future Outlook for Economic Relief

What Is Economic Relief for 2024 Eligibility?

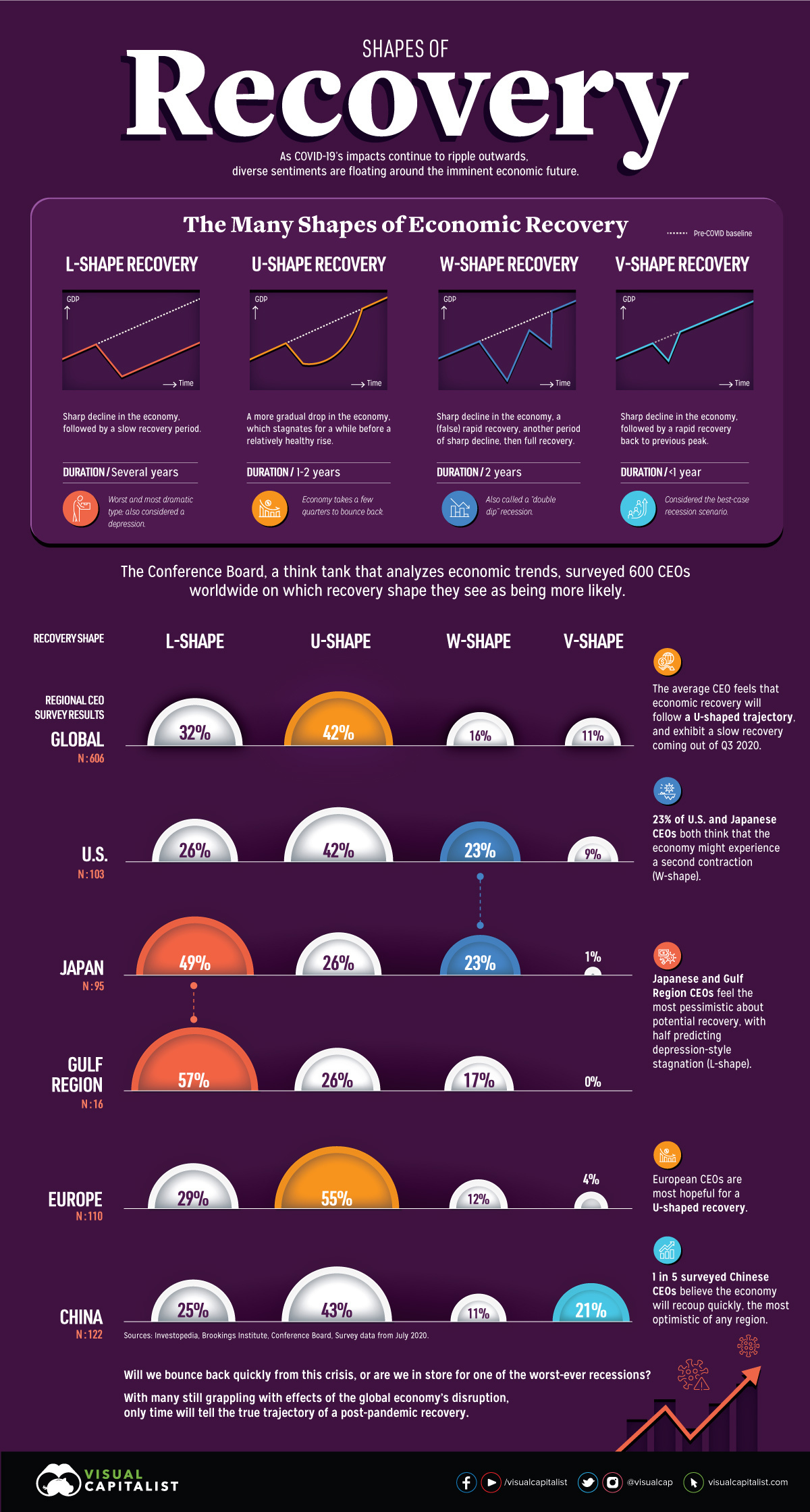

Alright, let’s start with the basics. Economic relief refers to financial assistance provided by governments or organizations to help individuals, families, and businesses during tough economic times. In 2024, these programs are expected to focus on addressing inflation, rising unemployment rates, and the lingering effects of global economic shifts. Think of it as a safety net designed to keep people from falling into financial despair.

Here’s the kicker: economic relief isn’t one-size-fits-all. Programs vary depending on factors like location, income level, and specific needs. For example, some programs might offer direct cash payments, while others provide assistance with housing, healthcare, or education expenses. It’s all about tailoring the help to fit the situation.

Key Features of Economic Relief Programs

- Direct cash assistance for low-income households

- Subsidies for essential services like utilities and rent

- Grants for small businesses struggling to stay afloat

- Tax breaks for middle-class families

Eligibility Requirements for Economic Relief

Now, let’s talk about the big question—am I eligible? Eligibility requirements for economic relief programs can vary widely depending on the program. However, there are some common factors that most programs consider. These include income level, household size, employment status, and citizenship or residency status.

For instance, if you’re applying for a federal program, you’ll likely need to provide proof of income, such as tax returns or pay stubs. Some programs also require documentation of expenses, like rent receipts or medical bills. It’s all about proving that you genuinely need the help.

Factors That Determine Eligibility

- Annual household income

- Number of dependents

- Employment status (e.g., unemployed, part-time, self-employed)

- Citizenship or residency status

Types of Economic Relief Available in 2024

Let’s break down the different types of economic relief you might qualify for in 2024. There’s no one-size-fits-all solution here; the type of relief you receive will depend on your specific circumstances. Here are some of the most common options:

Direct Cash Payments

These are exactly what they sound like—money straight into your pocket. Direct cash payments are often provided to low-income individuals and families to help cover basic living expenses. The amount you receive will depend on factors like your income and household size.

Rent and Utility Assistance

Struggling to pay your rent or utilities? Many programs offer assistance with these essential expenses. This can be a huge relief for those facing eviction or utility shutoffs. Just be prepared to provide proof of your financial hardship.

Small Business Grants

If you’re a small business owner, you might qualify for grants to help keep your business afloat. These grants can cover things like payroll, rent, and operational expenses. It’s all about giving businesses the support they need to survive and thrive.

Income Limits and Thresholds

Income limits play a huge role in determining eligibility for economic relief programs. Each program has its own set of thresholds, so it’s important to check the specifics. Generally speaking, lower-income individuals and families have a better chance of qualifying. But don’t lose hope if you’re middle-class—there are programs designed to help you too.

For example, the federal poverty level (FPL) is often used as a benchmark for determining eligibility. In 2024, the FPL for a family of four is expected to be around $28,000. Programs might set income limits at 100%, 150%, or even 200% of the FPL, depending on the level of assistance being provided.

Income Limits for Common Programs

- Supplemental Nutrition Assistance Program (SNAP): Up to 130% of FPL

- Section 8 Housing Assistance: Up to 50% of median income for your area

- Child Tax Credit: Phases out at higher income levels

How to Apply for Economic Relief

Alright, you’ve figured out which programs you might qualify for—now what? The application process can seem overwhelming, but it’s actually pretty straightforward if you know what to expect. Here’s a step-by-step guide to help you navigate the process:

Step 1: Gather Your Documents

Before you start the application, make sure you have all the necessary documents. This might include:

- Tax returns from the past two years

- Pay stubs or proof of income

- Bank statements

- Proof of expenses (e.g., rent receipts, utility bills)

Step 2: Find the Right Program

Not all programs are created equal. Do some research to find the ones that best fit your needs. Check out government websites, nonprofit organizations, and community resources for information.

Step 3: Submit Your Application

Once you’ve gathered your documents and identified the right program, it’s time to submit your application. Most programs offer online applications, but some might require you to mail in paperwork. Be sure to follow all instructions carefully to avoid delays.

Common Mistakes to Avoid When Applying

Applying for economic relief can be a stressful process, but there are a few common mistakes you’ll want to avoid. Here are some tips to keep you on track:

Mistake #1: Missing Deadlines

Programs often have strict deadlines for applications. Don’t let yours slip by—set reminders and stay organized.

Mistake #2: Failing to Provide Required Documentation

Make sure you have all the necessary documents before you start the application. Missing paperwork can delay the process or even result in your application being denied.

Mistake #3: Not Reading the Fine Print

It’s tempting to skim through application instructions, but don’t do it. Pay attention to details like income limits, residency requirements, and any additional criteria that might affect your eligibility.

Government Support Programs

The government is one of the biggest players in the economic relief game. Federal, state, and local programs offer a wide range of assistance to help individuals and businesses weather tough times. Here are a few examples:

Federal Programs

- Supplemental Nutrition Assistance Program (SNAP)

- Temporary Assistance for Needy Families (TANF)

- Section 8 Housing Assistance

State and Local Programs

Many states and local governments offer their own economic relief programs. These might include rental assistance, utility payment programs, and job training initiatives. Check with your local government website or community organizations for more information.

Private Initiatives for Economic Relief

Don’t forget about private organizations and charities that offer economic relief. These groups often fill the gaps left by government programs, providing assistance to those who might not qualify elsewhere. Here are a few examples:

Nonprofit Organizations

- Feeding America: Provides food assistance to those in need

- United Way: Offers a variety of programs, including financial counseling and emergency assistance

- Local food banks and shelters

Corporate Initiatives

Some companies offer their own economic relief programs for employees or customers. For example, banks might offer loan deferments, and utility companies might provide bill payment assistance.

Tax Implications of Economic Relief

Here’s something you might not have thought about—tax implications. Some forms of economic relief are considered taxable income, while others are not. It’s important to understand how receiving assistance might affect your tax situation.

For example, direct cash payments from the government are generally not taxable. However, grants or subsidies for businesses might be considered taxable income. Be sure to consult with a tax professional if you’re unsure about how economic relief will impact your taxes.

The Future Outlook for Economic Relief

So, what does the future hold for economic relief programs? Experts predict that demand for these programs will continue to grow as economic challenges persist. Governments and organizations are likely to expand existing programs and introduce new ones to meet the needs of those affected.

But here’s the thing—there’s no guarantee that programs will remain the same. Eligibility requirements, funding levels, and program structures could all change over time. Stay informed by keeping an eye on government announcements and news from trusted sources.

Kesimpulan

And there you have it, folks—a comprehensive guide to economic relief for 2024 eligibility. Whether you’re struggling to make ends meet or just want to be prepared for the future, understanding these programs can make a huge difference. Remember, the key to success is knowing your options and taking action.

So, what’s next? If you think you might qualify for economic relief, don’t wait—start gathering your documents and exploring your options today. And don’t forget to share this guide with friends and family who might benefit from it. Together, we can make a difference in our communities.

Got questions or comments? Drop them below—I’d love to hear from you. And if you found this article helpful, be sure to check out more content on our site. Let’s keep the conversation going!

- Bongkrek Acid The Ultimate Guide To Understanding Its Power And Potential

- Murder Drones Sentinels The Future Of Warfare And Security

Economic Relief Program 2024 Eligibility Criteria Deonne Amaleta

Economic Relief For 2024 Eligibility Carmen Kristel

Economic Relief 2024 Program Eligibility Helga Beverlie