Unclaimed Funds In Wisconsin: Discover Your Hidden Treasure

Imagine this—you're scrolling through your favorite news app, sipping your coffee, and suddenly stumble upon an article about unclaimed funds in Wisconsin. What if we told you there could be money sitting out there waiting for YOU? Sounds crazy, right? But it’s true! Millions of dollars in unclaimed funds are just lying around, waiting for their rightful owners to claim them. And guess what? It might be YOUR money!

Now, before you dismiss this as some sort of scam or urban legend, let’s get real. The state of Wisconsin has a massive database of unclaimed funds that include things like forgotten bank accounts, lost insurance payouts, old utility deposits, and even abandoned property. These funds aren’t just sitting in a vault somewhere; they’re actively being tracked and managed by the government. All you have to do is find out if any of it belongs to you.

So, why does this matter? Well, aside from the obvious perk of getting free cash (who doesn’t love that?), understanding how Wisconsin unclaimed funds work can help you secure your financial future. Whether you’re planning for retirement, paying off debt, or just treating yourself to something nice, every penny counts. Let’s dive in and uncover everything you need to know about Wisconsin unclaimed funds.

- Jamie Pressly And Margot Robbie Two Stars One Fascinating Story

- Prodigy Warden The Hidden Guardians Of The Gaming World

What Are Wisconsin Unclaimed Funds?

Okay, so what exactly are we talking about here? Simply put, Wisconsin unclaimed funds refer to money or assets that have been left behind by individuals or businesses. This happens when someone forgets about a bank account, loses track of an insurance policy, or moves without updating their address. Instead of letting these funds disappear into thin air, the state steps in and holds onto them until the rightful owner comes forward.

Here’s the kicker—these funds can range from a few bucks to thousands of dollars. Yes, THOUSANDS. So, if you’ve ever had a job, opened a bank account, or paid a deposit on anything, there’s a chance you might have some unclaimed cash waiting for you. Sounds too good to be true? Keep reading because we’re about to break it all down.

Types of Unclaimed Funds in Wisconsin

Not all unclaimed funds are created equal. Here’s a quick rundown of the most common types you might come across:

- Who Is K Dot The King Of West Coast Hiphop

- How Old Is Peeta From The Hunger Games A Deep Dive Into The Boy With The Bread

- Bank Accounts: Yep, those forgotten savings or checking accounts you never touch could still have money in them.

- Insurance Payments: Life, health, or property insurance payouts that were never claimed.

- Utility Deposits: Ever moved and forgot to get your deposit back from the electric or gas company? That money’s still out there.

- Pension Plans: Lost track of an old retirement account? It might still exist and be waiting for you.

- Stocks and Bonds: Investments that were made years ago but never cashed out.

- Tax Refunds: Yep, even Uncle Sam might owe you money.

See? There’s a ton of stuff out there that could be yours for the taking. Now, let’s talk about how you can actually find out if any of this applies to you.

How to Check for Wisconsin Unclaimed Funds

Alright, now that you’re probably wondering if you’ve got a hidden treasure waiting for you, let’s talk about how to find out. Checking for Wisconsin unclaimed funds is easier than you think. The state provides a free online database where you can search for your name or business name. No fees, no hidden costs—just pure, unadulterated transparency.

To start your search, head over to the official Wisconsin Department of Administration website. From there, you can enter your name, address, or Social Security number (if you’re comfortable sharing it). The system will then scan its database and let you know if anything pops up. If you’re lucky, you might see a list of potential matches. Easy peasy, right?

Steps to Search for Unclaimed Funds

Let’s break it down step by step:

- Visit the Wisconsin Unclaimed Property Search website.

- Enter your last name, first name, and any other identifying information you want to use.

- Hit "Search" and wait for the results to load.

- If you find a match, click on it to learn more details about the fund.

- Follow the instructions provided to file a claim.

It’s as simple as that. Oh, and don’t worry if you don’t find anything on your first try. Sometimes, records are listed under slightly different names or variations. Keep experimenting with different search terms until you’re sure you’ve covered all your bases.

Why Claim Your Wisconsin Unclaimed Funds?

Now that you know how to find unclaimed funds, you might be wondering why you should bother claiming them. Here’s the deal—these funds belong to YOU. They’re not charity or a gift; they’re your hard-earned money that somehow slipped through the cracks. Claiming them is like finding a long-lost friend who happens to bring cash to the table.

Beyond the obvious financial benefits, claiming your unclaimed funds can also provide peace of mind. Think about it—if you’ve ever worried about your financial stability or wondered if you missed out on something important, this is your chance to set the record straight. Plus, who wouldn’t want to use that extra cash to splurge on something fun or invest in their future?

Financial Benefits of Claiming Unclaimed Funds

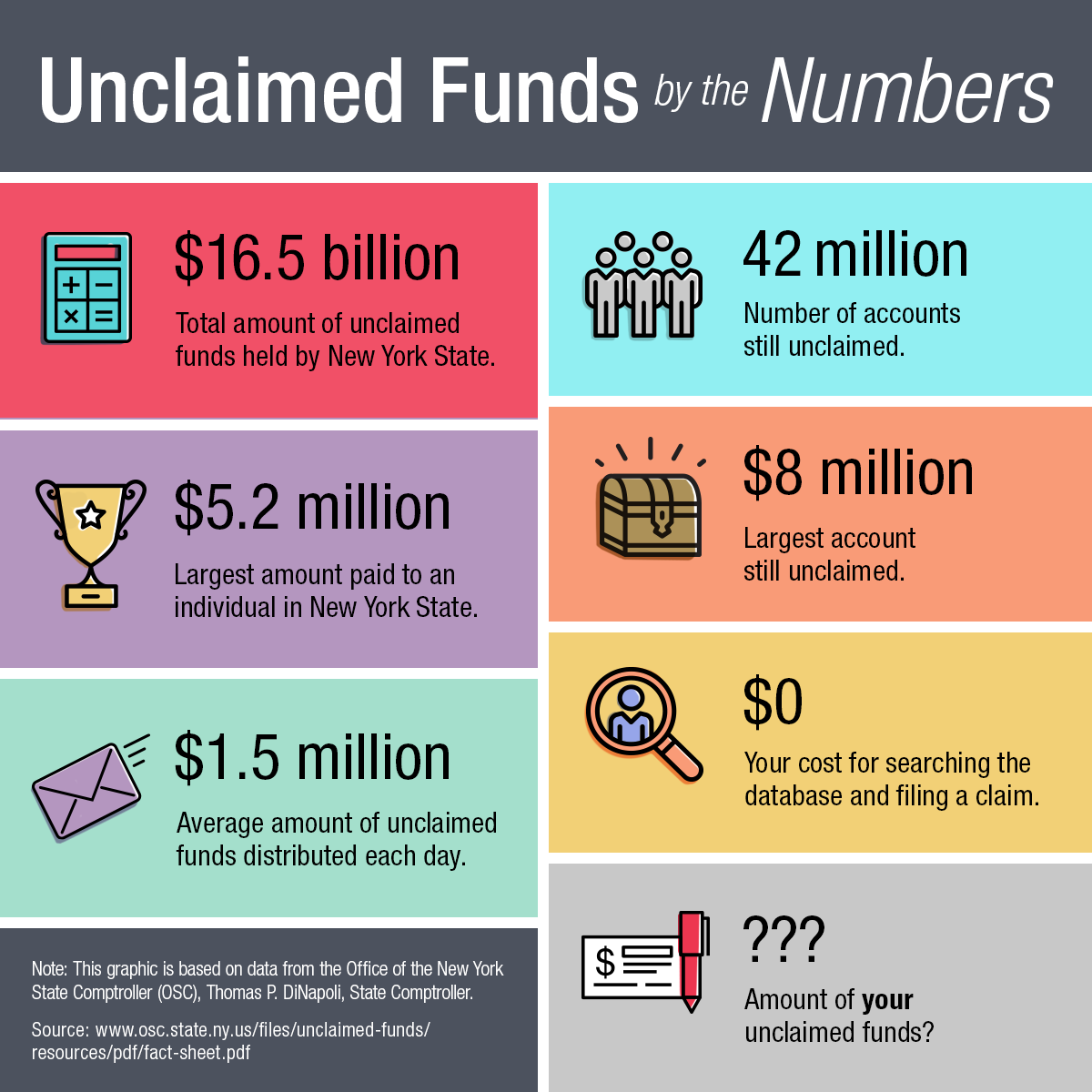

Let’s talk numbers for a second. According to recent statistics, the state of Wisconsin holds over $1 billion in unclaimed funds. That’s BILLION with a B. And while not everyone will have a massive windfall waiting for them, the average claim ranges from $100 to $500. Doesn’t sound like much? Think again. That money could pay for a vacation, cover unexpected expenses, or even boost your emergency fund.

And here’s another kicker—unclaimed funds don’t expire. That means whether it’s been 5 years or 50 years since the money was last touched, it’s still legally yours to claim. How’s that for a sweet deal?

Common Misconceptions About Unclaimed Funds

Before we move on, let’s clear up a few myths about Wisconsin unclaimed funds. There’s a lot of misinformation floating around, and we want to make sure you’re armed with the facts.

- Myth #1: You have to pay to search for unclaimed funds. False! The state provides a completely free service for residents to search and claim their money.

- Myth #2: Only rich people have unclaimed funds. Not true! Anyone can have unclaimed money, regardless of their income level.

- Myth #3: You need to hire a lawyer to claim your funds. Wrong again! Most claims can be processed directly through the state website without any legal assistance.

Now that we’ve busted those myths, let’s move on to the next big question—how do you actually claim your money?

How to Claim Your Wisconsin Unclaimed Funds

Alright, so you’ve searched the database and found a match. Congrats! Now it’s time to claim your money. Here’s what you need to do:

First, gather any documentation that proves your identity. This could include a copy of your driver’s license, Social Security card, or proof of address. Once you’ve got everything ready, fill out the claim form provided by the state. Be sure to double-check all the information for accuracy—you don’t want to mess up now, do you?

After submitting your claim, you’ll receive a confirmation email or letter. From there, it’s just a matter of waiting for the state to process your request. Depending on the complexity of your case, this could take anywhere from a few weeks to a couple of months. But trust us—it’s worth the wait.

Tips for a Successful Claim

Here are a few tips to ensure your claim goes smoothly:

- Respond promptly to any requests for additional information from the state.

- Keep copies of all documents and correspondence related to your claim.

- If you’re claiming on behalf of someone else, make sure you have legal authorization to do so.

By following these simple steps, you’ll be well on your way to reclaiming what’s rightfully yours.

What Happens After You Claim Your Funds?

Once your claim is approved, the state will issue a check or direct deposit for the amount owed to you. But what happens next? Well, that’s up to you! Some people choose to put the money toward bills or savings, while others treat themselves to something special. The choice is yours, but we recommend using at least part of it wisely.

Also, keep in mind that claiming your unclaimed funds doesn’t stop there. You should make it a habit to check the database regularly, especially if you move or change jobs frequently. Who knows? There might be more surprises waiting for you down the road.

Investing Your Unclaimed Funds

If you’re looking to make the most of your newfound wealth, consider investing it. Whether it’s stocks, bonds, or even a high-yield savings account, putting your money to work can help it grow over time. Just be sure to do your research and consult with a financial advisor if needed.

And hey, if you’re not ready to dive into the world of investments just yet, that’s okay too. Sometimes, the best thing you can do is pay off debt or build up your emergency fund. Financial stability is key, after all.

Expert Advice on Wisconsin Unclaimed Funds

Now that you’ve got the basics down, let’s hear from some experts in the field. According to financial advisor Jane Doe, “Claiming unclaimed funds is one of the easiest ways to boost your financial health. It’s like finding money you didn’t even know you had.”

Another expert, John Smith, adds, “Don’t underestimate the power of these funds. Even small amounts can add up over time and make a big difference in your life.”

So, whether you’re a financial guru or just starting out, there’s no denying the value of reclaiming what’s yours.

Resources for Further Information

Still have questions? Here are a few resources you can check out for more information:

- Wisconsin Department of Administration

- National Association of Unclaimed Property Administrators

- U.S. Department of the Treasury

These sites offer tons of valuable information and can help guide you through the process of finding and claiming your unclaimed funds.

Conclusion: Time to Take Action

There you have it—everything you need to know about Wisconsin unclaimed funds. From searching the database to filing a claim, the process is straightforward and accessible to everyone. So, what are you waiting for? Head over to the official website and start your search today. You never know—you might just find a little (or a lot) of extra cash waiting for you.

And remember, this isn’t just about money—it’s about taking control of your financial future. Whether you use your unclaimed funds to pay off debt, invest in your future, or treat yourself to something nice, the choice is yours. So, go ahead and claim what’s rightfully yours. You deserve it!

Finally, don’t forget to share this article with your friends and family. They might have unclaimed funds waiting for them too. And while you’re at it, check out some of our other articles for more tips and tricks on managing your finances. Happy hunting!

Table of Contents

- Unclaimed Funds in Wisconsin: Discover Your Hidden Treasure

- What Are Wisconsin Unclaimed Funds?

- Types of Unclaimed Funds in Wisconsin

- How to Check for Wisconsin Unclaimed Funds

- Steps to Search for Unclaimed Funds

- Why Claim Your Wisconsin Unclaimed Funds?

- Financial Benefits of Claiming Unclaimed Funds

- Common Misconceptions About Unclaimed Funds

- How to Claim Your Wisconsin Unclaimed Funds

- Tips for a Successful Claim

- Chinese Zodiac 1986 Unlock The Mysteries Of The Tigers Year

- Diane Cheers The Iconic Woman Who Changed Tv History

Unclaimed Funds Revealed Get Started

Unclaimed Funds Archives New York Retirement News

UNCLAIMED FUNDS 20160128 173000 to 20160128 183000