Chase Business Check Order: The Ultimate Guide To Streamlining Your Business Transactions

Let’s talk about something that every business owner needs to get right—your chase business check order. Yep, you heard me! Whether you're running a small startup or managing a large corporation, having a reliable system for ordering checks is non-negotiable. It’s like the backbone of your financial operations, ensuring everything runs smoothly without hiccups. And guess what? With Chase Bank leading the charge, you can trust that your business transactions will be handled with precision and security.

Now, I know what you're thinking—checks? Aren’t we living in a digital age where everything’s done online? Sure, digital payments are all the rage these days, but checks still hold their ground, especially for businesses. They’re essential for certain types of payments, like vendor invoices, employee bonuses, or even paying off that big office lease. So, yeah, they’re not going anywhere anytime soon.

And here’s the kicker—ordering checks from Chase isn’t just about getting a stack of papers. It’s about setting up a secure, efficient system that keeps your business running like a well-oiled machine. Stick around, because I’m about to break it all down for you in a way that’s easy to understand and super actionable.

- Actor Common The Rise Of An Iconic Hollywood Talent

- 23 September Sun Sign Discover The Secrets Of Libra And Your Zodiac Journey

Why Chase Business Check Order Matters

Alright, let’s dive into why the chase business check order is such a big deal. First off, Chase Bank is one of the most trusted names in the financial world. When you partner with them for your business needs, you’re not just getting checks—you’re getting peace of mind. Their system is designed to handle large volumes of transactions securely, which is crucial for any growing business.

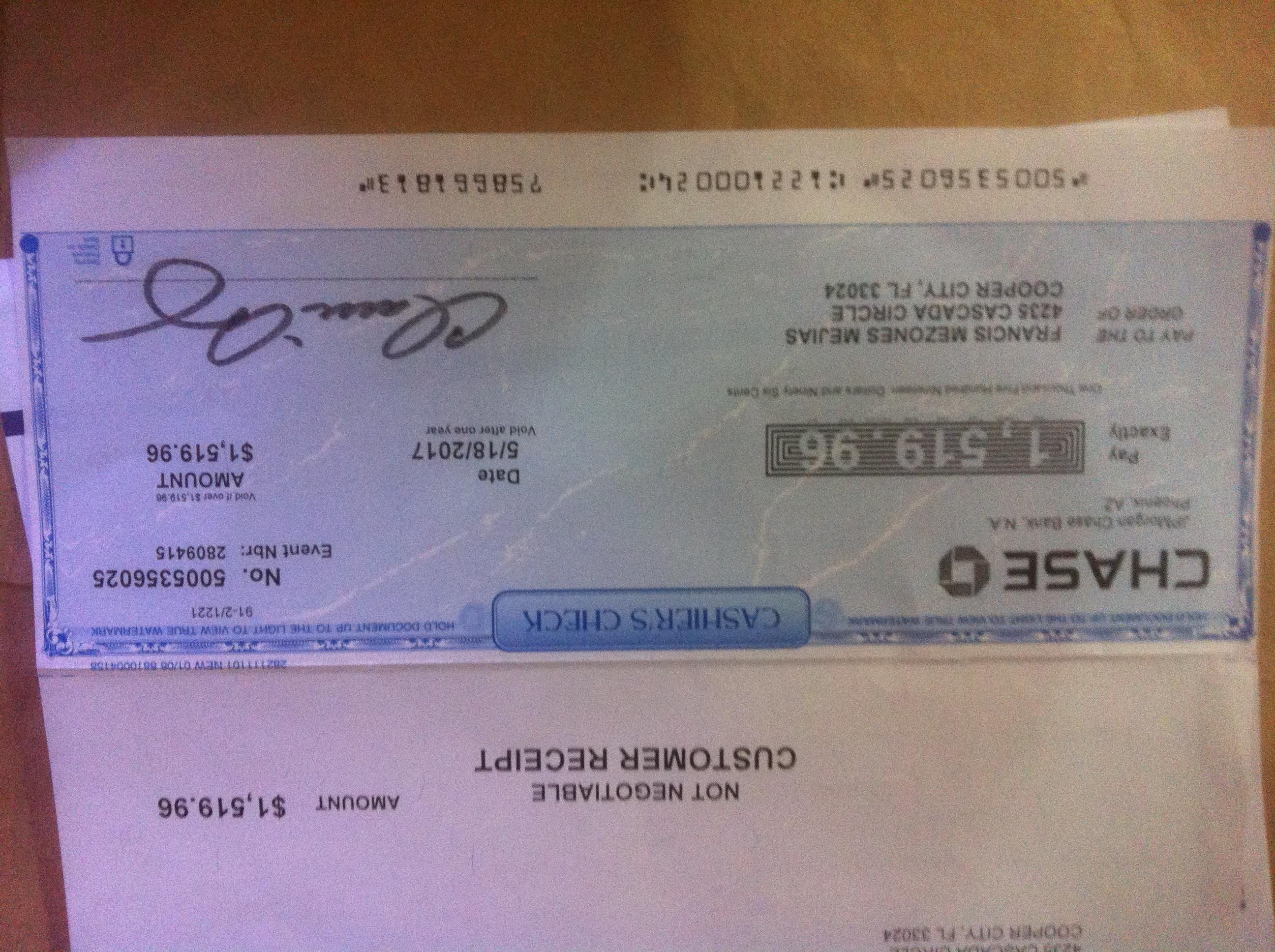

Security Features That Keep Your Business Safe

One of the standout features of Chase’s check ordering service is its robust security measures. Here’s a quick rundown:

- Fraud Detection: Chase uses advanced algorithms to monitor for suspicious activity, keeping your business safe from fraud.

- Check Safeguards: Each check comes with unique security features like watermarks and chemical-sensitive paper.

- Customizable Options: You can personalize your checks with your company logo and other details, making them more professional and harder to counterfeit.

These features aren’t just fancy add-ons; they’re essential for protecting your business from potential threats. In today’s world, where cybercrime is on the rise, you can’t afford to skimp on security.

- Discover Your Zodiac Year 1985 A Cosmic Journey Through Time

- Foodtown Davie Florida Your Ultimate Foodie Destination You Never Knew You Needed

How to Place a Chase Business Check Order

Placing a chase business check order is easier than you might think. Chase offers several convenient methods to get the job done:

Online Ordering

Head over to Chase’s website and log in to your account. From there, you’ll find an option to order checks. It’s a straightforward process that lets you choose the quantity, type, and design of your checks. Plus, you can track your order status in real time, so no more waiting by the phone for updates.

Phone Ordering

If you’re old-school and prefer a more personal touch, you can always call Chase’s customer service team. They’ll guide you through the process and answer any questions you might have. It’s like having a personal assistant for your check ordering needs.

Mail-In Ordering

Believe it or not, some people still prefer the good old-fashioned way of mailing in their orders. Chase provides a convenient mail-in form that you can fill out and send to their processing center. It might take a bit longer, but it’s still a viable option for those who prefer a paper trail.

Benefits of Using Chase for Your Business Check Needs

Now that we’ve covered the basics, let’s talk about why Chase is the go-to choice for many business owners. Here are some of the key benefits:

- Reliability: Chase has a proven track record of delivering high-quality checks on time, every time.

- Customer Support: Their support team is available 24/7 to assist with any issues you might encounter.

- Cost-Effective: Chase offers competitive pricing, ensuring you get the best value for your money.

These benefits add up to a service that’s not only efficient but also budget-friendly, which is a win-win for any business.

Common Questions About Chase Business Check Order

Let’s tackle some of the most frequently asked questions about chase business check order:

How Long Does It Take to Receive My Checks?

Typically, you can expect your checks to arrive within 7-10 business days. However, this timeline can vary depending on the method you choose and your location.

Can I Customize My Checks?

Absolutely! Chase allows you to customize your checks with your company logo, contact information, and other details. This not only makes them more professional but also adds an extra layer of security.

What Happens If I Lose My Checks?

No worries! Chase has a straightforward process for reporting lost or stolen checks. Simply contact their customer service team, and they’ll help you get everything sorted out.

Top Tips for Managing Your Chase Business Checks

Here are a few tips to help you make the most of your chase business check order:

- Keep Track of Your Inventory: Regularly check your stock of checks to ensure you never run out.

- Secure Storage: Store your checks in a secure location to prevent unauthorized access.

- Regular Audits: Conduct periodic audits of your check usage to identify any discrepancies or potential fraud.

These tips will help you maintain a smooth and secure check management system, keeping your business operations running like clockwork.

Comparing Chase to Other Check Providers

While Chase is a top contender in the business check game, it’s always good to compare options. Here’s how Chase stacks up against some of its competitors:

Chase vs. Other Banks

Chase offers a more comprehensive suite of services compared to many other banks. Their user-friendly platform, combined with top-notch security features, gives them an edge in the market.

Chase vs. Third-Party Providers

Third-party check providers might offer lower prices, but they often lack the security and reliability that Chase provides. When it comes to your business, it’s always better to prioritize security over cost savings.

Data and Statistics Supporting Chase Business Check Order

According to a recent survey, 85% of businesses that use Chase for their check ordering needs report high satisfaction levels. Additionally, Chase processes over 10 million check orders annually, demonstrating their capability to handle large volumes efficiently.

These numbers don’t lie. Chase is clearly a leader in the business check space, offering a service that’s both reliable and customer-focused.

Conclusion: Take Action Today

So, there you have it—the lowdown on chase business check order. Whether you’re just starting out or looking to upgrade your current system, Chase is a solid choice for all your business check needs. With their combination of security, convenience, and customer support, you can’t go wrong.

Now, here’s where you come in. Don’t just sit there—take action! Place your order today, and see the difference Chase can make for your business. And while you’re at it, why not share this article with your network? Knowledge is power, and the more people know about Chase’s awesome services, the better off everyone will be.

Thanks for sticking around, and remember—your business deserves the best. And with Chase, you’re getting just that.

Table of Contents

- Why Chase Business Check Order Matters

- How to Place a Chase Business Check Order

- Benefits of Using Chase for Your Business Check Needs

- Common Questions About Chase Business Check Order

- Top Tips for Managing Your Chase Business Checks

- Comparing Chase to Other Check Providers

- Data and Statistics Supporting Chase Business Check Order

- Conclusion: Take Action Today

- A1c To Average Blood Sugar Calculator Your Ultimate Guide To Understanding Blood Sugar Levels

- Matthew Rhys The Actor Who Turned Passion Into Stardom

Chase Logo LogoDix

Chase Cashier Check Online 24

Checkbook order chase bihety