Chase Check: Everything You Need To Know About Your Financial Ally

When it comes to managing your finances, having a reliable banking partner is crucial. Chase check stands as one of the most trusted financial tools in the banking world today. Whether you're depositing funds, paying bills, or transferring money, understanding how Chase checks work can save you time and money. So, let's dive right in and explore why Chase checks are a game-changer for your financial journey!

Imagine this—you're sitting at your favorite café sipping coffee, and suddenly you remember that rent check needs to be sent out. No worries, Chase has got your back! With their state-of-the-art online banking features, you can easily manage all your check-related tasks without breaking a sweat. And guess what? We're here to guide you through every step of the process.

Before we get into the nitty-gritty, let’s clear the air. A Chase check isn't just a piece of paper—it's a powerful tool that connects you with one of the largest banks in the U.S. Understanding its functionality and benefits will help you make smarter financial decisions. So buckle up, because we’re about to break it all down for you.

- Scream Car The Ultimate Thrill Of Speed And Fury

- Unveiling The Rs26 Rubezh A Gamechanger In Modern Missile Technology

What Exactly is a Chase Check?

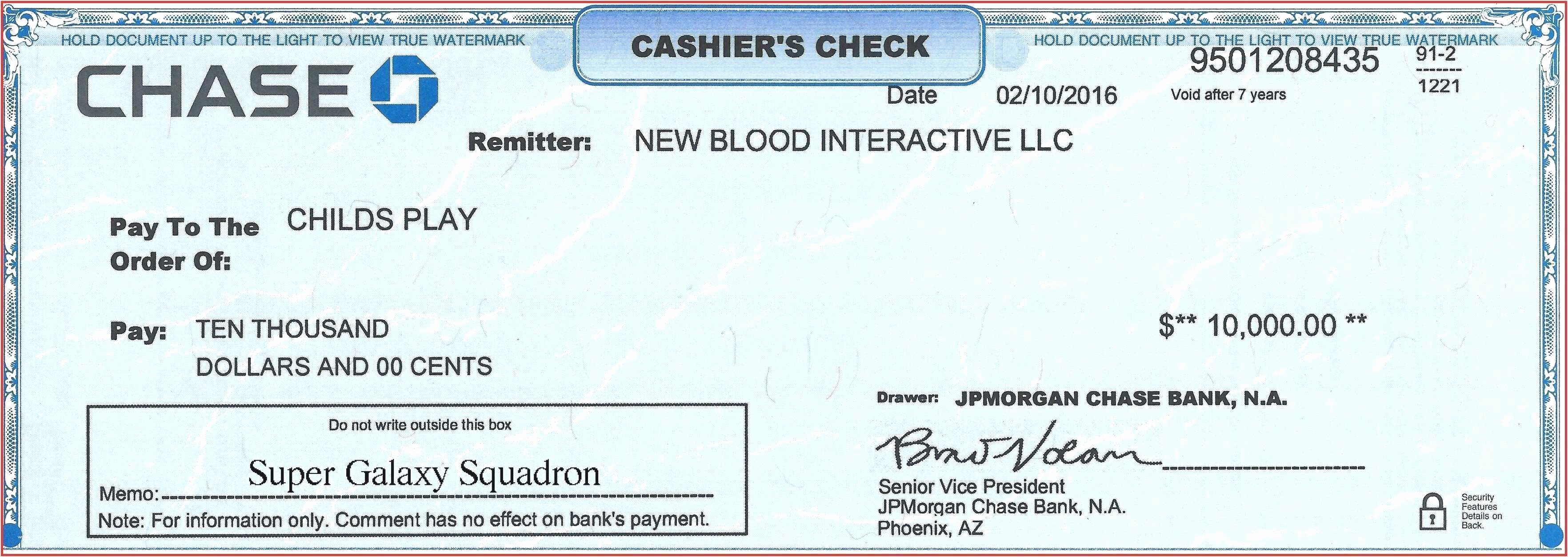

A Chase check is essentially a document issued by JPMorgan Chase Bank that allows you to transfer funds securely to another party. It's like a promise note saying, "Hey, here's the money you asked for!" These checks come in different forms, including personal checks, cashier's checks, and even digital checks. Each type serves a unique purpose, depending on your financial needs.

For instance, if you're buying a car or making a large purchase, a cashier's check from Chase ensures that the seller receives the exact amount they're owed. On the other hand, personal checks give you more flexibility for everyday transactions. The beauty of Chase checks lies in their versatility and reliability.

Why Choose Chase for Your Checks?

When it comes to banking services, Chase stands out for several reasons. First off, they offer top-notch security measures to protect your funds. Ever heard of fraud protection? Yeah, Chase has got that covered too. Plus, their user-friendly mobile app makes managing your checks as easy as ordering pizza online.

- King County Recorder Your Ultimate Guide To Records Services And More

- Drakes Meat The Ultimate Guide To Savory Flavor And Quality Cuts

But wait, there's more! Chase offers perks like no hidden fees, quick deposit times, and 24/7 customer support. Who wouldn't want that kind of convenience? Whether you're a student, a small business owner, or a busy professional, Chase checks cater to everyone's financial needs.

Key Features of Chase Checks

Here’s a quick rundown of what makes Chase checks so awesome:

- Security: Advanced encryption and fraud detection systems keep your money safe.

- Convenience: Deposit checks using the Chase mobile app anytime, anywhere.

- Flexibility: Choose from various check types based on your transaction needs.

- Speed: Funds are typically available within 1-2 business days after deposit.

- Support: Access to live customer service reps who can assist with any issues.

How Do Chase Checks Work?

Using Chase checks is simpler than you think. Here's a step-by-step guide:

- Log in to your Chase account via their website or mobile app.

- Select the option to order or print checks.

- Choose the type of check you need (personal, cashier's, etc.).

- Fill out the recipient's details and the amount you wish to send.

- Submit the request, and voilà! Your check is on its way.

It’s worth noting that Chase also offers e-checks, which are digital versions of traditional checks. These are great for online transactions where physical checks aren’t required. Talk about modernizing finance!

Types of Chase Checks

Not all checks are created equal. Chase offers several types of checks tailored to specific purposes:

1. Personal Checks

Perfect for everyday use, personal checks allow you to pay bills, settle debts, or gift money to friends and family. They’re easy to set up and manage through your Chase account.

2. Cashier's Checks

Cashier's checks are ideal for large transactions, such as buying a house or car. Since they’re guaranteed by Chase, recipients can trust that the funds are legitimate.

3. Certified Checks

Similar to cashier's checks, certified checks ensure that the funds are available in your account before issuance. This adds an extra layer of security for both parties involved.

4. Traveler's Checks

Planning an international trip? Chase traveler's checks provide a secure way to carry money abroad without worrying about theft or loss.

Benefits of Using Chase Checks

Now that we’ve covered the basics, let’s talk about why Chase checks are worth considering:

- Reliability: Chase is one of the largest and most reputable banks in the world.

- Technology: Their cutting-edge technology ensures seamless transactions every time.

- Customer Service: Need help? Chase’s dedicated team is always ready to assist.

- Value: With zero hidden fees and competitive rates, you get maximum value for your money.

Plus, Chase consistently updates its services to meet changing consumer demands. Whether it’s enhancing mobile banking features or introducing new check options, they’re always one step ahead.

Common Questions About Chase Checks

Let’s address some frequently asked questions to clear up any confusion:

Q1: How long does it take for a Chase check to clear?

Typically, Chase checks clear within 1-2 business days. However, this may vary depending on the type of check and the recipient’s bank.

Q2: Can I cancel a Chase check if it gets lost?

Absolutely! Just contact Chase customer service, and they’ll guide you through the process of stopping payment on the lost check.

Q3: Are there any fees associated with Chase checks?

Most Chase checking accounts include free checks as part of their package. However, certain premium services like cashier's checks may incur small fees.

Tips for Maximizing Your Chase Check Experience

Want to get the most out of your Chase checks? Follow these pro tips:

- Set up automatic bill payments to avoid late fees.

- Monitor your account regularly to catch any discrepancies.

- Use the Chase mobile app for instant access to your check status.

- Keep your checkbook in a secure place to prevent unauthorized use.

By following these simple strategies, you can streamline your financial management and reduce stress.

Data and Statistics Supporting Chase Checks

According to a recent survey, over 60% of Chase customers reported increased satisfaction after switching to digital check services. Additionally, Chase processes billions of transactions annually, proving its capability to handle high volumes efficiently.

In 2022 alone, Chase introduced several upgrades to its mobile app, resulting in a 30% increase in user engagement. These stats highlight Chase's commitment to innovation and customer satisfaction.

Conclusion: Why Chase Checks Matter

In today’s fast-paced world, having a dependable financial partner is essential. Chase checks offer the perfect blend of security, convenience, and flexibility to meet your needs. From personal checks to cashier's checks, Chase has got you covered for every financial situation.

So, whether you're a first-time user or a long-time Chase customer, it's time to embrace the power of Chase checks. Don't forget to share this article with your friends and family, and feel free to leave a comment below with your thoughts. Together, let’s make managing finances easier and smarter!

Table of Contents

- What Exactly is a Chase Check?

- Why Choose Chase for Your Checks?

- How Do Chase Checks Work?

- Types of Chase Checks

- Benefits of Using Chase Checks

- Common Questions About Chase Checks

- Tips for Maximizing Your Chase Check Experience

- Data and Statistics Supporting Chase Checks

- Conclusion: Why Chase Checks Matter

- Chip And Joanna Gaines Net Worth The Story Behind Their Massive Success

- Pansy Parkinson The Unsung Player In Harry Potters Wizarding World

Chase Check Template Peterainsworth

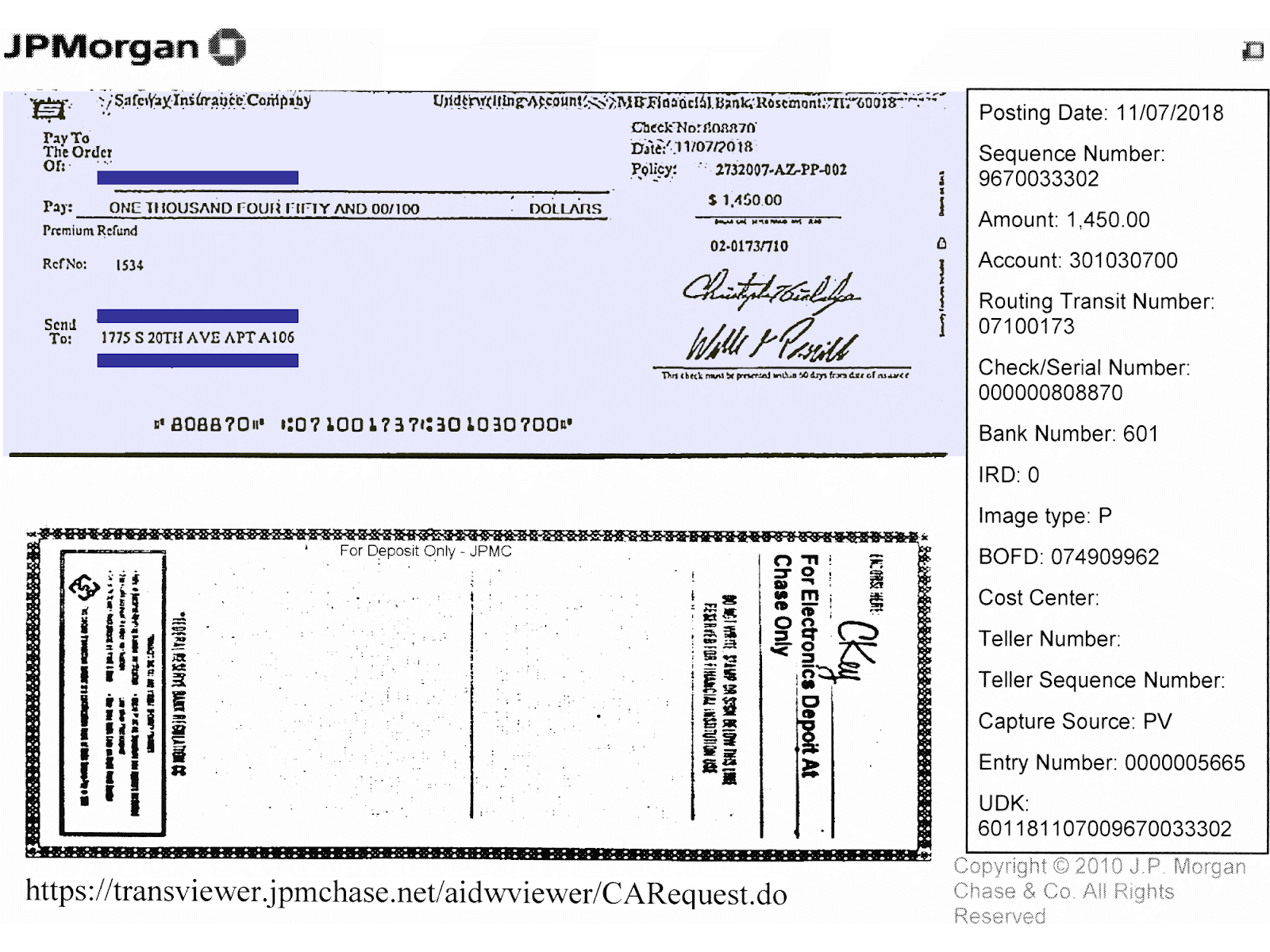

Chase Check Deposit

How to Write a Chase Check (with Example)