How Much Does A Hard Credit Inquiry Affect Your Score? Here’s The Real Deal

Ever wondered how much a hard credit inquiry can mess with your credit score? It’s like opening Pandora’s box—kinda scary but totally worth understanding if you want to keep your finances in check. Picture this: you’re applying for a loan, credit card, or even renting an apartment, and suddenly BAM—a hard inquiry hits your credit report. What happens next? Let’s break it down.

First off, hard credit inquiries aren’t some random thing that just happens. They occur when lenders or creditors check your credit report to assess your creditworthiness. And yeah, they can impact your credit score—but don’t freak out just yet. The effect isn’t as bad as most people think, and we’re here to spill all the tea on how it works.

Before we dive deep, let’s get one thing straight: your credit score is like your financial reputation. It tells lenders whether you’re responsible with money or if you’ve got a history of skipping payments. Hard inquiries are part of the equation, but they’re not the only factor. Stick around, and we’ll walk you through everything you need to know.

- Cast Of National Lampoons Christmas Vacation A Festive Look At The Beloved Movie

- Ken Miles The Racer Who Redefined Speed And Passion

What Exactly Is a Hard Credit Inquiry?

A hard credit inquiry happens when a lender or creditor checks your credit report after you apply for credit. Think of it like a background check, but for your finances. Unlike soft inquiries—which don’t affect your credit score—hard inquiries leave a mark on your credit report that can linger for up to two years.

Now, here’s the kicker: not all hard inquiries are created equal. Some might ding your score a little, while others might not even register. But why does this happen? Well, it depends on factors like your overall credit history, the number of recent inquiries, and how you manage your existing credit accounts.

Why Do Hard Inquiries Matter?

Hard inquiries matter because they signal to lenders that you’re actively seeking new credit. If you’ve got a bunch of recent inquiries, it might make lenders nervous. They could think, “Uh-oh, is this person taking on too much debt?” And that’s where the score hit comes in.

- Dealing With Itchy Bumps On Inner Thigh A Comprehensive Guide

- Jamarr Stats The Ultimate Guide To Understanding The Numbers Behind The Phenomenon

But here’s the thing: one or two hard inquiries aren’t gonna ruin your life. Most people see a small dip in their score, usually around 5 to 10 points. It’s not a huge deal, especially if your credit history is solid. But if you’ve got a thin credit file or a history of missed payments, the impact might be more noticeable.

How Much Does a Hard Credit Inquiry Affect Your Score?

Alright, let’s get to the million-dollar question: how much does a hard credit inquiry actually affect your score? The answer depends on the scoring model being used—FICO or VantageScore—but generally, the impact is mild. Most people see a drop of 5 to 10 points per inquiry, and that’s about it.

Here’s the good news: the effect fades over time. After about six months, the impact of a hard inquiry starts to lessen. And after two years? It disappears completely from your credit report. So, while it might feel like a big deal in the moment, it’s really just a temporary blip on your credit radar.

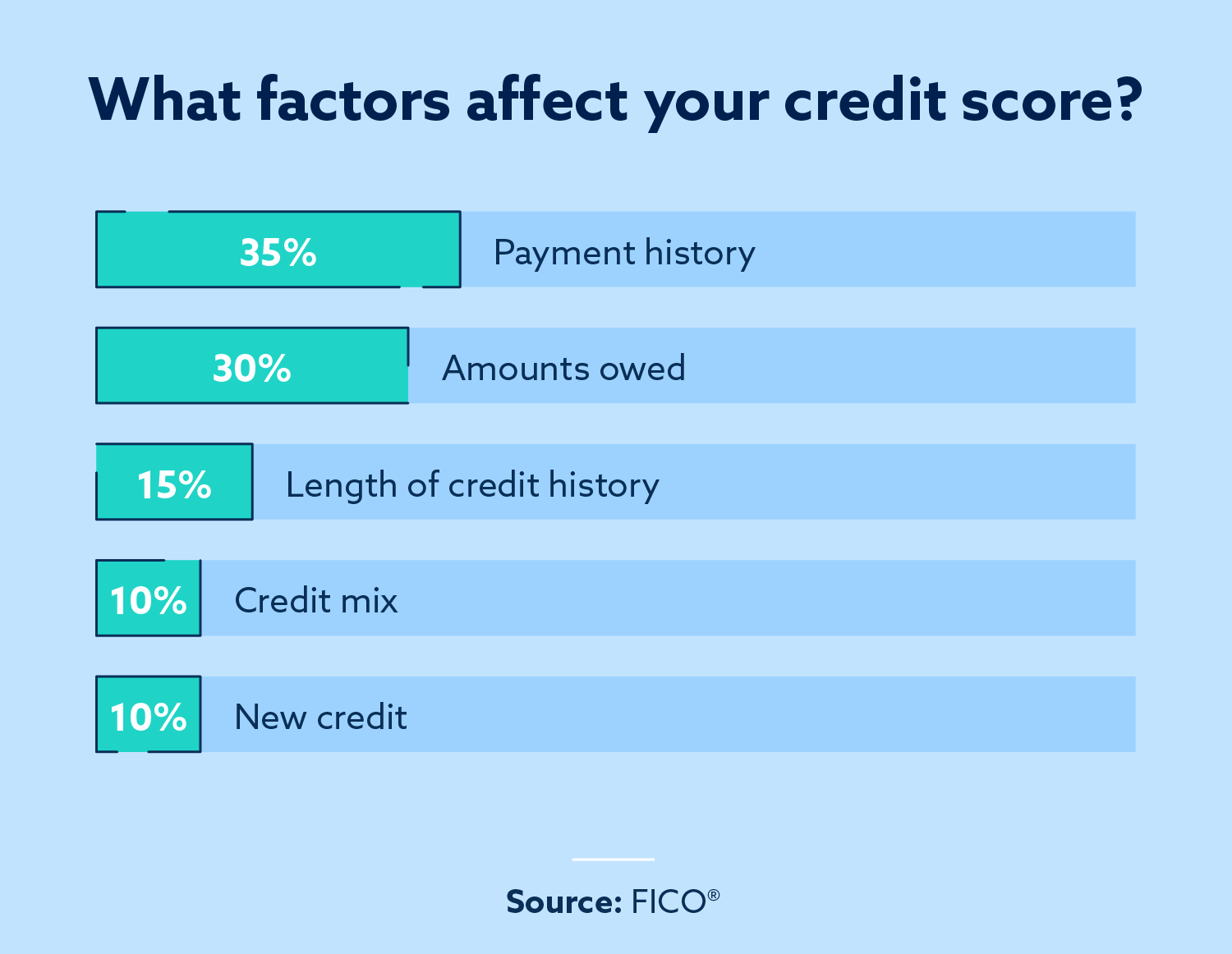

Factors That Influence the Impact

Not all hard inquiries hit your score the same way. Here are some factors that can influence the impact:

- Credit History Length: If you’ve been managing credit for years, one inquiry won’t make much difference. But if you’re new to credit, it might have a bigger effect.

- Number of Inquiries: Multiple inquiries in a short period can signal financial distress, so lenders might get wary.

- Payment History: If you’ve got a solid track record of paying bills on time, the impact of an inquiry will be minimal.

- Credit Mix: Having a diverse mix of credit accounts can offset the effect of a hard inquiry.

Soft vs. Hard Inquiries: What’s the Difference?

Let’s clear up the confusion: not all credit inquiries are hard inquiries. There’s also something called a soft inquiry, which doesn’t affect your credit score at all. Soft inquiries happen when you check your own credit, employers run background checks, or lenders pre-approve you for offers. They’re basically harmless.

Hard inquiries, on the other hand, are serious business. They require your permission and leave a mark on your credit report. Think of soft inquiries as a casual glance and hard inquiries as a deep dive. Both have their place, but only one can affect your score.

When Do Hard Inquiries Happen?

Hard inquiries occur in situations where you’re actively applying for credit. Here are a few common examples:

- Applying for a mortgage

- Opening a new credit card

- Taking out a personal loan

- Renting an apartment

- Getting a car loan

Each of these scenarios involves a lender checking your creditworthiness, which triggers a hard inquiry. And yeah, it might feel like a lot, but remember—it’s just part of the process.

Can Multiple Hard Inquiries Ruin Your Credit?

So, what happens if you’ve got a bunch of hard inquiries in a short period? Will it ruin your credit forever? Not necessarily. While multiple inquiries can raise red flags, the impact is usually mild unless you’re also mismanaging other aspects of your credit.

Here’s a pro tip: if you’re shopping around for a loan or mortgage, don’t stress too much about multiple inquiries. Most scoring models treat rate-shopping as a single inquiry if it happens within a 14- to 45-day window. So, if you’re comparing offers, do it quickly to minimize the impact.

How to Minimize the Impact of Hard Inquiries

Want to keep your credit score in tip-top shape? Here are a few strategies to minimize the impact of hard inquiries:

- Limit Applications: Don’t apply for too many credit accounts at once. Space them out to avoid overwhelming your credit report.

- Shop Smart: If you’re rate-shopping, do it within the allowed time frame to avoid multiple hits to your score.

- Monitor Your Credit: Keep an eye on your credit report to ensure there aren’t any unauthorized inquiries.

- Focus on the Big Picture: Pay your bills on time, keep credit utilization low, and build a strong credit history. These factors outweigh the impact of a single inquiry.

How Long Do Hard Inquiries Stay on Your Credit Report?

Hard inquiries stick around for two years, but here’s the kicker: they only affect your score for the first year. After that, they’re just a record of your credit activity. So, while they might linger on your report, they won’t keep dragging down your score forever.

Pro tip: if you see an unauthorized inquiry on your credit report, dispute it with the credit bureau. You’ve got the right to remove any inaccuracies, so don’t hesitate to take action.

Can You Remove Hard Inquiries from Your Credit Report?

Yes, you can remove hard inquiries—but only if they’re unauthorized or inaccurate. If a lender ran an inquiry without your permission, you can dispute it with the credit bureau. Just gather the necessary documentation and submit a formal dispute. The bureau will investigate and, if the inquiry is indeed unauthorized, it’ll be removed.

But here’s the deal: if the inquiry is legit, you can’t remove it just because you don’t like it. It’s part of your credit history, and that’s okay. Focus on building strong credit habits instead of obsessing over a single inquiry.

How to Build Credit Without Killing Your Score

Building credit is essential, but you don’t have to sacrifice your score in the process. Here are a few tips to build credit responsibly:

- Start Small: Open a secured credit card or become an authorized user on someone else’s account.

- Pay on Time: Payment history is the biggest factor in your credit score, so never miss a payment.

- Keep Balances Low: Aim for a credit utilization ratio below 30% to show lenders you’re responsible with credit.

- Monitor Your Credit: Use free credit monitoring tools to track your progress and spot potential issues early.

Building credit takes time, but it’s worth it. Stick to the basics, and you’ll be on your way to a killer credit score in no time.

Final Thoughts: Hard Inquiries Aren’t the End of the World

At the end of the day, hard inquiries aren’t something to lose sleep over. Sure, they can ding your score a little, but the impact is usually minimal and temporary. What really matters is how you manage the rest of your credit habits.

So, if you’re applying for credit, don’t sweat the small stuff. Focus on paying your bills on time, keeping balances low, and building a strong credit history. And remember: one hard inquiry won’t break the bank. It’s just part of the financial journey.

Got questions or comments? Drop them below! And if you found this article helpful, don’t forget to share it with your friends. Let’s spread the credit knowledge and help everyone build a brighter financial future.

Table of Contents

- What Exactly Is a Hard Credit Inquiry?

- Why Do Hard Inquiries Matter?

- How Much Does a Hard Credit Inquiry Affect Your Score?

- Soft vs. Hard Inquiries: What’s the Difference?

- When Do Hard Inquiries Happen?

- Can Multiple Hard Inquiries Ruin Your Credit?

- How to Minimize the Impact of Hard Inquiries

- How Long Do Hard Inquiries Stay on Your Credit Report?

- Can You Remove Hard Inquiries from Your Credit Report?

- How to Build Credit Without Killing Your Score

- Unveiling The Mysteries Of Feb 20 Zodiac Pisces Energy Explained

- 58 In Cm Height Your Ultimate Guide To Understanding And Converting

What Is A Hard Inquiry & How Does It Affect Your Credit Score? The

Hard Inquiry vs Soft Inquiry Explained Will it affect Credit Score

How does credit mix affect your credit score? Leia aqui Is credit mix