What Taxes Are Needed For FAFSA 2025-26: A Comprehensive Guide

So, you're diving into the world of FAFSA for the 2025-26 academic year, huh? If you're reading this, chances are you're trying to figure out what taxes you need to file and how they impact your financial aid application. Let’s break it down because, trust me, it’s not as scary as it sounds. FAFSA, or the Free Application for Federal Student Aid, is basically your ticket to accessing all kinds of financial aid—grants, loans, work-study programs, and more. But first, you gotta make sure your tax info is squared away. Ready? Let’s get into it!

Now, before we dive deep into the nitty-gritty, let’s set the stage. FAFSA is all about assessing your financial need to determine how much aid you qualify for. And guess what? Your tax returns play a BIG role in this process. Whether you’re a student, a parent, or both, having your tax documents ready can save you a ton of time and frustration. So, don’t skip this step—it’s crucial!

One more thing before we move on: FAFSA doesn’t just look at your income. It takes into account a bunch of other factors too, like family size, assets, and more. But taxes? They’re the foundation. So, if you’re wondering what taxes are needed for FAFSA 2025-26, stick around. We’re about to answer all your burning questions.

- Unlocking The World Of Vanilla Gift Card Numbers What You Need To Know

- Where Is Yasmine Bleeth Now Unveiling The Life Of A Beloved Star

Understanding the Basics of FAFSA Taxes

Why Taxes Matter for FAFSA

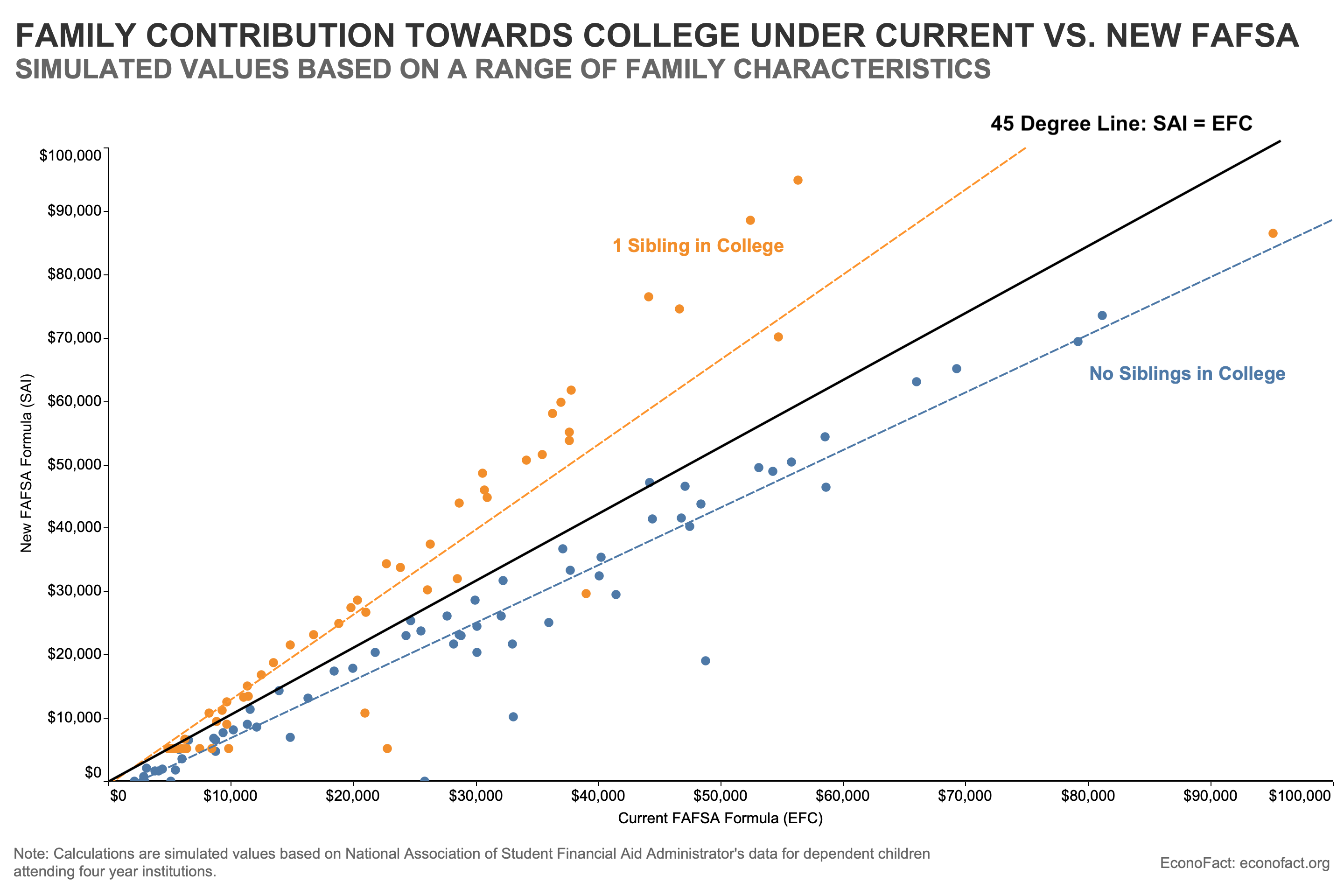

Alright, let’s talk about why taxes are such a big deal when it comes to FAFSA. It’s simple: the government uses your tax info to calculate your Expected Family Contribution (EFC). This number tells schools how much financial aid you might need. Without accurate tax info, your EFC could be way off, and that could mean missing out on some serious aid.

Here’s the deal: FAFSA typically looks at your tax info from two years prior. For the 2025-26 academic year, that means they’ll be checking out your 2023 tax returns. Why so far back? Because it gives them a stable picture of your financial situation without worrying about sudden changes.

Now, if you’re thinking, “But what if my financial situation has changed?” don’t sweat it. There are ways to appeal or update your info later on. But for now, focus on getting those 2023 taxes in order.

- Bruce Willis Pass Away The Truth Behind The Rumors

- Fight Card Mike Tyson The Unstoppable Force Of Boxing

What Taxes Are Needed for FAFSA 2025-26

Required Tax Documents

So, what exactly do you need to have on hand? Here’s the list:

- 2023 Federal Income Tax Returns (Form 1040)

- W-2 Forms

- Records of untaxed income (like Social Security benefits or veteran’s benefits)

- Bank statements

- Investment records

And if you’re a dependent student, you’ll also need your parents’ tax info. If you’re an independent student, it’s just your own info—or you and your spouse’s, if you’re married.

How to Gather Your Tax Info

Tips for Collecting Tax Documents

Now that you know what you need, how do you actually get it all together? Here are a few tips:

- Start early. Don’t wait until the last minute to dig through old files.

- Use the IRS Data Retrieval Tool (DRT). This lets you pull your tax info straight into your FAFSA application. Super convenient!

- Double-check everything. Mistakes happen, but they can mess up your application. So, take your time and make sure everything’s accurate.

And if you’re missing any docs, don’t panic. You can always request copies from the IRS or your employer. Just give yourself enough time to get everything in order.

Common Tax Questions for FAFSA

What If I Haven’t Filed My Taxes Yet?

This is a super common question, especially if you’re applying early. No worries—FAFSA allows you to estimate your tax info and update it later once your taxes are filed. Just make sure your estimates are as close to reality as possible.

Do I Need State Tax Returns?

For FAFSA itself, nope. But some states or schools might require them for additional aid programs. So, it’s always a good idea to have them handy just in case.

Special Circumstances and Tax Considerations

What If I Had a Major Financial Change?

Life happens, right? If you experienced a job loss, medical expenses, or any other significant financial change, you can appeal to your school’s financial aid office. They might be able to adjust your EFC based on your current situation.

Using the IRS Data Retrieval Tool

How It Works

The IRS Data Retrieval Tool is like a shortcut for filling out your FAFSA. Here’s how it works:

- Log in to your FAFSA account.

- When prompted for tax info, choose the option to use the IRS DRT.

- Follow the prompts to link your IRS account and transfer your tax data directly into your FAFSA.

It’s fast, secure, and eliminates the risk of manual errors. Win-win!

Dependent vs. Independent Students

Tax Requirements for Dependent Students

If you’re a dependent student, your parents’ tax info is just as important as your own. Make sure they have their 2023 tax returns ready to go. And if they haven’t filed yet, encourage them to get on it ASAP!

Common Mistakes to Avoid

Skipping the IRS DRT

One of the biggest mistakes students make is manually entering their tax info instead of using the IRS DRT. It’s way easier and less error-prone to use the tool. Trust me, it’s worth it.

Financial Aid Beyond FAFSA

Other Programs That Require Tax Info

While FAFSA is the big one, there are other financial aid programs that might ask for your tax info too. Scholarships, grants, and even some private loans might require it. So, keep those docs organized and accessible.

Final Thoughts and Next Steps

Alright, we’ve covered a lot here. To recap:

- FAFSA uses your 2023 tax info for the 2025-26 academic year.

- You’ll need federal tax returns, W-2s, and records of untaxed income.

- Use the IRS Data Retrieval Tool to make the process smoother.

- Be prepared to appeal if your financial situation has changed.

Now that you know what taxes are needed for FAFSA 2025-26, it’s time to take action. Gather your docs, file your taxes (if you haven’t already), and get that FAFSA application submitted. The sooner you do it, the better your chances of securing the financial aid you need.

And hey, if you have any questions or need more info, drop a comment below. We’re here to help!

Table of Contents

- Understanding the Basics of FAFSA Taxes

- What Taxes Are Needed for FAFSA 2025-26

- How to Gather Your Tax Info

- Common Tax Questions for FAFSA

- Special Circumstances and Tax Considerations

- Using the IRS Data Retrieval Tool

- Dependent vs. Independent Students

- Common Mistakes to Avoid

- Financial Aid Beyond FAFSA

- Final Thoughts and Next Steps

- Jamarr Stats The Ultimate Guide To Understanding The Numbers Behind The Phenomenon

- Skandar Keynes Relationships A Deep Dive Into Love Life And Connections

FAFSA 2025 Your Ultimate Guide to Free College Money!

Fafsa Application For 2025 2025 Emma Foran B.

2025 Fafsa In Review Isadora Blake