Property Tax Riverside County Tax Rate: A Comprehensive Guide To Understanding Your Payments

Property tax can be a confusing topic, especially when you're dealing with the specifics of Riverside County. Whether you're a homeowner, investor, or just curious about the financial aspects of owning property in this vibrant area, this guide is here to break it down for you. From understanding the tax rate to exploring exemptions and deductions, we've got you covered. Let's dive in and make sense of it all!

Buying a home in Riverside County is more than just finding the right space; it's also about understanding the financial responsibilities that come with it. Property taxes are one of those responsibilities, and knowing how they work can save you a lot of headaches down the road. In this article, we'll explore everything you need to know about the Riverside County property tax rate, including how it's calculated, what factors affect it, and how you can manage your payments.

We'll also touch on some useful tips and tricks to help you navigate the tax system, so you're not left scratching your head when the bill comes. So, whether you're new to the area or a long-time resident looking to refresh your knowledge, this guide has something for everyone. Let's get started!

- Unlocking The Mystery Of 003125 What It Is And Why It Matters

- Grocery Stores In Delafield Wi Your Ultimate Shopping Guide

Understanding Property Tax in Riverside County

What is Property Tax and Why Does It Matter?

Alright, let's start with the basics. Property tax is essentially a tax levied on real estate by the local government. It's used to fund essential services like schools, public safety, infrastructure, and more. In Riverside County, this tax is a crucial part of the local economy, and it's something every homeowner needs to be aware of.

But why does it matter? Well, property tax affects your overall cost of living. It's not just about the mortgage or utility bills; this tax can significantly impact your budget. Understanding how it works can help you plan better and avoid any nasty surprises.

Here are some key points about property tax:

- Judge Judy Location The Inside Scoop On Where The Magic Happens

- How To Connect Iot Remotely To Wifi Like A Pro

- It's based on the assessed value of your property.

- It varies depending on the location and type of property.

- It's paid annually or semi-annually, depending on the county's rules.

Riverside County Tax Rate Explained

How is the Tax Rate Determined?

Now, let's talk about the Riverside County tax rate. The rate is determined by a combination of factors, including the assessed value of your property, local government needs, and state regulations. As of the latest data, the average property tax rate in Riverside County hovers around 1.25% of the assessed value. However, this can vary slightly depending on the specific area and any additional assessments or fees.

It's important to note that the assessed value isn't always the same as the market value. The county assessor determines the assessed value, which is typically lower than the market value. This is done to ensure that property taxes remain manageable for homeowners.

Factors Affecting Your Property Tax

Location, Location, Location

Where you live in Riverside County can have a big impact on your property tax. Different areas have different tax rates based on the services they provide and the infrastructure they maintain. For example, areas with better schools or more public services might have slightly higher tax rates.

Other factors that can affect your tax include:

- The age and condition of your property.

- Any improvements or renovations you've made.

- Local economic conditions and property market trends.

Calculating Your Property Tax

Step-by-Step Guide

Calculating your property tax might sound intimidating, but it's actually pretty straightforward. Here's a quick step-by-step guide:

- Find out the assessed value of your property. This info is usually available through the county assessor's office.

- Apply the tax rate to the assessed value. For example, if your property is assessed at $300,000 and the tax rate is 1.25%, your tax would be $3,750.

- Factor in any additional assessments or fees specific to your area.

Remember, these calculations are estimates. It's always a good idea to double-check with the county assessor or a tax professional to ensure accuracy.

Exemptions and Deductions

Lowering Your Tax Bill

Did you know there are ways to reduce your property tax? Riverside County offers several exemptions and deductions that can help lower your bill. Here are a few:

- Homestead Exemption: If you live in your property as your primary residence, you might qualify for a $7,000 reduction in assessed value.

- Senior Citizen Exemption: Homeowners over a certain age may be eligible for reduced taxes.

- Disability Exemption: Those with disabilities might qualify for tax relief.

It's worth exploring these options to see if you qualify. A little research can go a long way in saving you money.

Paying Your Property Tax

Options and Deadlines

When it comes to paying your property tax, Riverside County offers a few options. You can pay in full or in installments, depending on what works best for you. The deadlines are usually around December and April, so make sure to mark them on your calendar.

Payment methods include:

- Online through the county's website.

- By mail with a check or money order.

- In person at the county treasurer's office.

Just remember, late payments can incur penalties, so it's best to pay on time to avoid any extra charges.

Appealing Your Property Tax Assessment

What to Do if You Disagree

If you believe your property tax assessment is too high, you have the right to appeal. The process involves submitting a formal request to the county assessor's office, along with any supporting documentation. This might include recent appraisal reports, comparable property sales, or other evidence that supports your claim.

Appealing your assessment can be a bit of a hassle, but it's worth it if you think the assessed value doesn't reflect your property's true worth. Just be prepared to provide solid evidence and follow the process carefully.

Understanding Property Tax Trends

How Rates Have Changed Over Time

Property tax rates in Riverside County have seen some fluctuations over the years. Economic conditions, population growth, and changes in state regulations all play a role in these changes. While the overall trend has been a slight increase, there have been periods of stability as well.

Keeping an eye on these trends can help you anticipate any changes in your tax bill and plan accordingly. It's also a good idea to stay informed about any new laws or regulations that might affect property taxes in the future.

Resources for Further Information

Where to Go for Help

If you have more questions about property tax in Riverside County, there are several resources you can turn to:

- Riverside County Assessor's Office: They can provide detailed information about assessments and tax rates.

- Riverside County Treasurer-Tax Collector: For payment options and deadlines.

- Tax Professionals: If you need personalized advice, a tax expert can offer guidance.

Don't hesitate to reach out if you're unsure about anything. Knowledge is power, and the more you know, the better you can manage your finances.

Final Thoughts

In conclusion, understanding property tax in Riverside County is essential for any homeowner or investor. By knowing how the tax rate is determined, what factors affect it, and how to manage your payments, you can take control of your financial future. Remember to explore exemptions, pay on time, and stay informed about any changes in the tax system.

We encourage you to share this article with others who might find it helpful. If you have any questions or comments, feel free to leave them below. And don't forget to check out our other articles for more insights into property management and finance. Thanks for reading, and happy home owning!

- Does Wax Come Off Clothes The Ultimate Guide To Removing Wax Stains

- Lil Mo And Ja Rule The Story Of Rampb And Hiphop Royalty

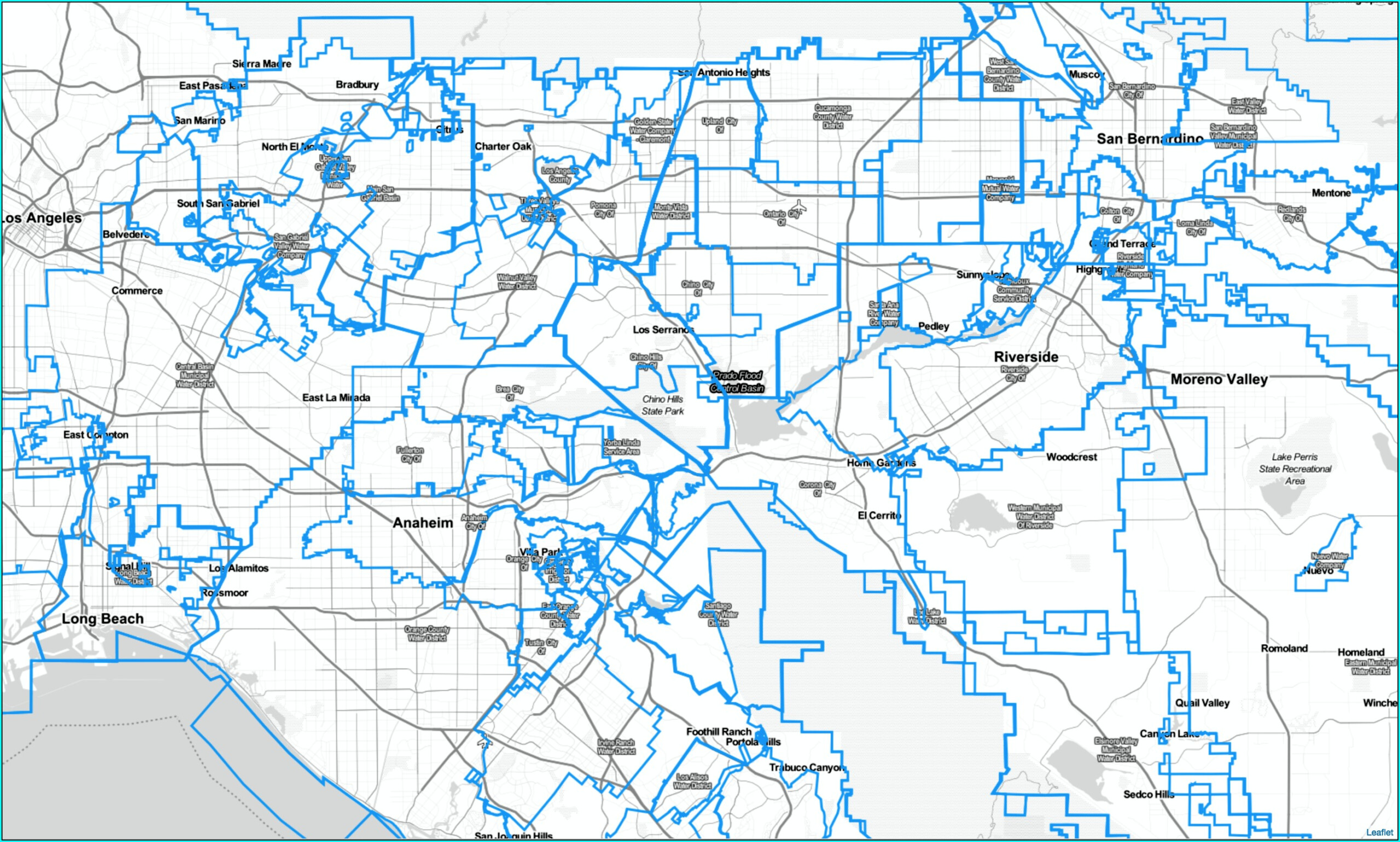

Riverside County Assessor Map Gis Map Resume Examples

Hidalgo County Property Tax Rate 2025 Pippaw Dawson

Hays County Property Tax Rate 2025 Letty Tallia