Property Tax In California Riverside County: A Comprehensive Guide For Homeowners

When it comes to property taxes in California, Riverside County has its own set of rules and regulations that can be tricky to navigate. Whether you're a new homeowner or a seasoned property owner, understanding how property tax works in this region is crucial for your financial planning. In this article, we'll break down everything you need to know about property tax in Riverside County, including rates, exemptions, and how to appeal if necessary.

Let's face it—property tax isn't exactly the most exciting topic to talk about, but it's definitely one of the most important things you need to understand as a homeowner. From the moment you purchase a property, you're automatically tied to the county's tax system. Riverside County is known for its diverse communities, from bustling urban areas to serene rural landscapes, and all these factors play a role in how much you'll pay in property taxes.

This guide is designed to help you make sense of the complexities surrounding property tax in California, specifically in Riverside County. We'll dive deep into the details so you can make informed decisions and avoid any unpleasant surprises when tax season rolls around. So, grab a cup of coffee, and let's get started!

- Where Was Stranger Things Season 1 Filmed Uncovering The Hidden Locations

- What Happened To The Original Hosts Of Wipeout A Wild Ride Down Memory Lane

Understanding Property Tax in California Riverside County

First things first—what exactly is property tax in Riverside County? Simply put, it's a tax levied on real estate properties based on their assessed value. The money collected goes toward funding essential public services, such as schools, law enforcement, fire departments, and infrastructure projects. Riverside County has a unique way of calculating property taxes, which we'll explore in more detail later.

How Property Tax Works in Riverside County

In Riverside County, property tax is calculated using the property's assessed value, which is determined by the county assessor. The assessed value is typically lower than the market value, thanks to Proposition 13, a state law that limits annual increases in assessed value to no more than 2%. This means your property tax bill won't skyrocket overnight, even if the housing market is booming.

Here's a quick breakdown of how it works:

- Fight Card Mike Tyson The Unstoppable Force Of Boxing

- How Did Rosalie Become A Vampire The Fascinating Story You Need To Know

- Property is assessed annually by the county assessor.

- The assessed value is multiplied by the tax rate, which is usually around 1% of the property's assessed value.

- Additional fees and assessments may apply, such as bond measures or special district fees.

Key Factors Affecting Property Tax Rates in Riverside County

Several factors influence how much you'll pay in property taxes in Riverside County. Location, property type, and improvements all play a role in determining your tax bill. For instance, properties in more affluent neighborhoods may have higher assessed values, resulting in higher tax payments. On the flip side, older homes or properties in less desirable areas might have lower assessments.

Location, Location, Location

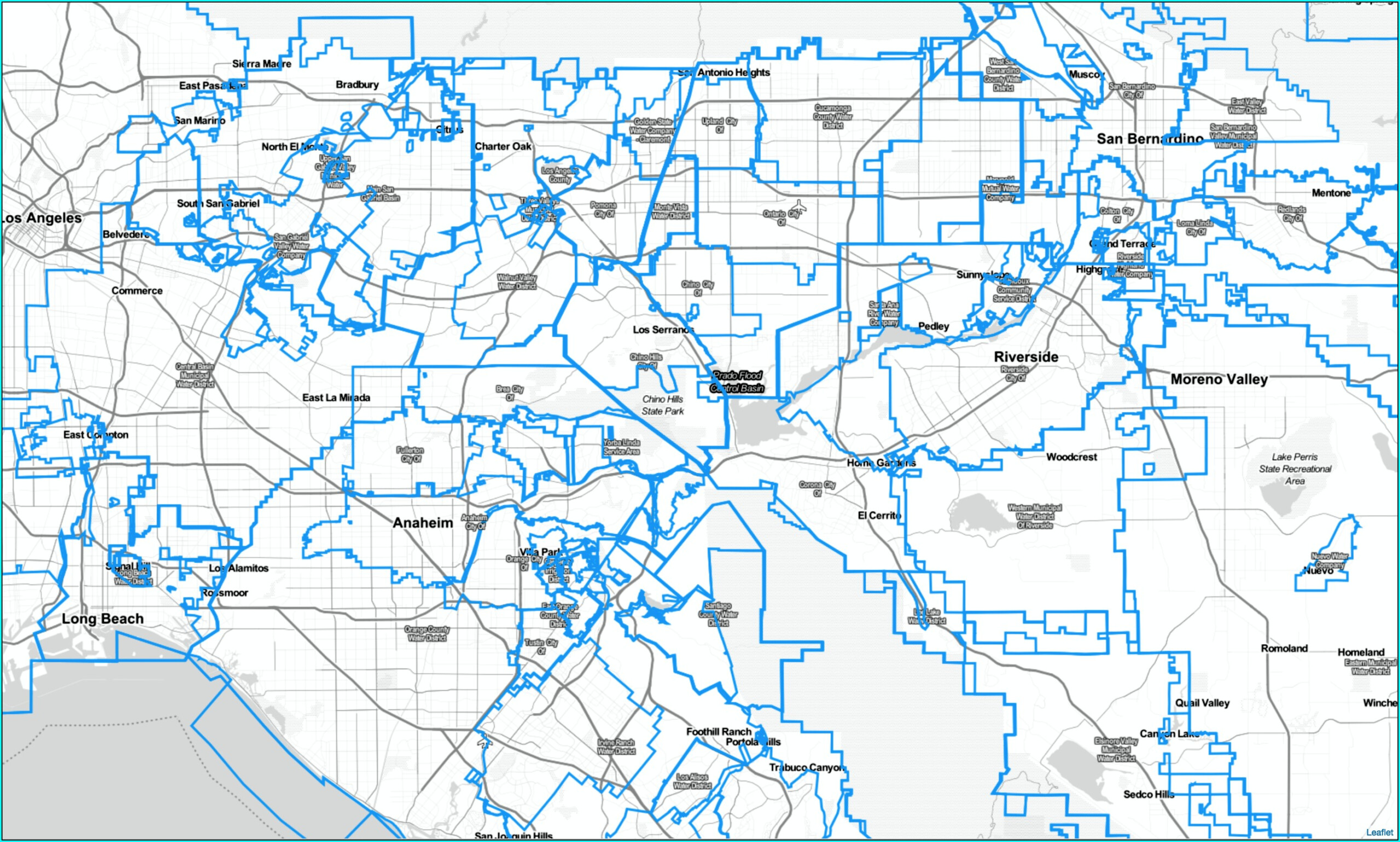

The old real estate adage holds true when it comes to property taxes. Riverside County is vast, covering cities like Riverside, Moreno Valley, and Temecula, each with its own set of tax rates and fees. Urban areas tend to have higher property taxes due to the demand for services, while rural areas may have lower rates since they require fewer resources.

Proposition 13: A Game-Changer for Property Tax in California

Proposition 13, passed in 1978, revolutionized property tax in California. It capped the property tax rate at 1% of assessed value and limited annual increases to 2%, regardless of how much the property's market value rises. This law has been a blessing for long-time homeowners, allowing them to keep their tax bills manageable even as property values soar.

Pros and Cons of Proposition 13

While Proposition 13 provides stability for homeowners, it also creates challenges for local governments, which rely heavily on property tax revenue. Here's a quick look at the pros and cons:

- Pros: Predictable tax bills, protection against rapid increases in property values.

- Cons: Reduced funding for public services, disparities between newer and older homeowners.

Property Tax Exemptions and Deductions in Riverside County

Did you know that you might qualify for property tax exemptions or deductions? Riverside County offers several programs to help homeowners reduce their tax burden. From senior citizen exemptions to disaster relief, there are plenty of opportunities to save money on your property tax bill.

Senior Citizen Exemption

Homeowners aged 55 and older may qualify for a property tax exemption if they meet certain income and residency requirements. This program allows seniors to defer a portion of their property taxes, making it easier to stay in their homes during retirement.

How to Appeal Your Property Tax Assessment in Riverside County

If you believe your property tax assessment is too high, you have the right to appeal. The process involves submitting a formal request to the Riverside County Assessor's Office and providing evidence to support your case. Keep in mind that appeals must be filed within a specific timeframe, so it's essential to act quickly if you suspect an error.

Steps to File an Appeal

Filing an appeal might sound intimidating, but it's actually a straightforward process. Here's what you need to do:

- Gather documentation, such as recent property sales in your area, to demonstrate that your assessment is unfair.

- Complete the appeal form provided by the county assessor's office.

- Attend a hearing, if necessary, to present your case.

Common Misconceptions About Property Tax in Riverside County

There are plenty of myths and misconceptions surrounding property tax in Riverside County. For example, some people believe that their taxes will automatically decrease if they make improvements to their home. In reality, improvements often lead to higher assessments and, consequently, higher tax bills. It's important to separate fact from fiction when it comes to property tax.

Myth vs. Reality

Let's debunk some common myths:

- Myth: Property tax is the same for everyone.

- Reality: Tax rates vary depending on location, property type, and assessed value.

- Myth: You can't challenge your assessment.

- Reality: You have the right to appeal if you believe your assessment is inaccurate.

Tools and Resources for Riverside County Property Owners

Fortunately, there are plenty of tools and resources available to help you manage your property tax obligations in Riverside County. From online assessment tools to taxpayer assistance programs, you'll find everything you need to stay on top of your tax responsibilities.

Online Assessment Tools

The Riverside County Assessor's Office provides an online portal where you can check your property's assessed value, view tax bills, and track payment history. This convenient resource allows you to stay informed and make informed decisions about your property.

Planning for the Future: Tips for Managing Property Tax

Managing property tax in Riverside County requires a proactive approach. By staying informed about changes in tax laws, taking advantage of available exemptions, and appealing unfair assessments, you can keep your tax bill under control. It's also a good idea to consult with a tax professional or real estate expert to ensure you're maximizing your savings.

Final Thoughts

In conclusion, property tax in Riverside County can be complex, but it doesn't have to be overwhelming. By understanding how the system works, taking advantage of available exemptions, and staying informed about changes in tax laws, you can ensure that your property tax obligations are manageable. Remember, knowledge is power, and the more you know about property tax, the better equipped you'll be to handle it.

If you found this article helpful, don't forget to share it with your friends and family. And if you have any questions or comments, feel free to leave them below. We'd love to hear from you!

Table of Contents

- Understanding Property Tax in California Riverside County

- How Property Tax Works in Riverside County

- Key Factors Affecting Property Tax Rates in Riverside County

- Location, Location, Location

- Proposition 13: A Game-Changer for Property Tax in California

- Pros and Cons of Proposition 13

- Property Tax Exemptions and Deductions in Riverside County

- Senior Citizen Exemption

- How to Appeal Your Property Tax Assessment in Riverside County

- Steps to File an Appeal

- Common Misconceptions About Property Tax in Riverside County

- Myth vs. Reality

- Tools and Resources for Riverside County Property Owners

- Online Assessment Tools

- Planning for the Future: Tips for Managing Property Tax

- Final Thoughts

- Jillian Barberie Weight A Closer Look At The Numbers And Her Journey

- Bruce Willis Pass Away The Truth Behind The Rumors

Riverside County Assessor Map Gis Map Resume Examples

1095 Midland Rd, Blythe, CA 92225 MLS 219097592

Riverside County Incidents