Chase Request Check: Your Ultimate Guide To Simplified Financial Transactions

Have you ever found yourself stuck in a situation where you needed a check from Chase but didn’t know how to request one? Well, you're not alone. Many people are confused about the process of requesting a check from Chase, especially with all the digital advancements in banking. Whether you need a replacement check or want to issue one for a specific purpose, understanding the process can save you a lot of time and hassle. In this guide, we’ll break down everything you need to know about Chase request check, step by step.

Let’s face it, checks might seem old-school in today’s digital world, but they’re still an essential part of financial transactions. Whether you're paying rent, settling a bill, or sending money to someone who doesn’t have access to online banking, checks remain a reliable option. The good news? Chase makes it easy for you to request checks whenever you need them.

Now, before we dive deep into the nitty-gritty of Chase request check, let’s clear the air. This guide isn’t just about how to request a check; it’s also about understanding the nuances of the process, potential fees, and ways to avoid common pitfalls. By the end of this article, you’ll be a pro at navigating Chase’s check request system. Ready? Let’s get started!

- Be Humble Lyrics Kendrick The Anthem That Speaks To The Soul

- Marriott Mgs The Ultimate Guide To Luxury And Comfort

What is Chase Request Check?

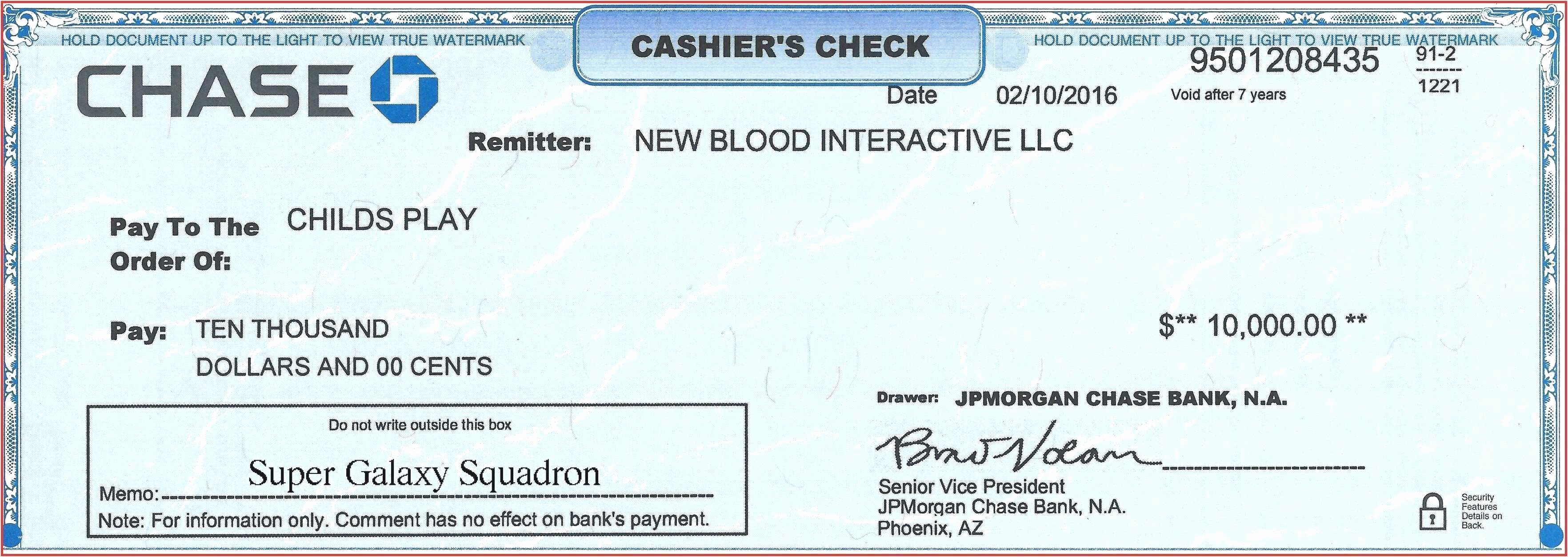

First things first, what exactly is a Chase request check? Simply put, it’s the process of ordering or requesting a check from Chase Bank. This could mean ordering a replacement checkbook, requesting a one-time check, or even asking for a cashier’s check for a significant transaction. Chase offers multiple ways to request checks, whether you prefer doing it online, over the phone, or in person at a branch.

Why would you need to request a check? There are several reasons. Maybe you’ve run out of checks in your checkbook, or perhaps you need a certified check for a large purchase. Whatever the reason, Chase has got your back. However, it’s important to note that there might be fees associated with certain types of check requests, so it’s always good to be aware of them upfront.

Why Choose Chase for Your Check Requests?

Chase is one of the largest banks in the United States, and for good reason. They offer a wide range of services that cater to both personal and business needs. When it comes to check requests, Chase stands out for its convenience, security, and customer service. Here are a few reasons why Chase is a top choice:

- Projocom Obituary A Comprehensive Guide To Honoring Lives

- Chinese New Year Animal 1995 Your Zodiac Sign Revealed And What It Means For You

- Easy-to-use online banking platform

- 24/7 customer support

- Wide network of branches and ATMs

- Secure transaction processes

- Flexible options for check requests

Whether you’re a long-time Chase customer or just starting out, their check request services are designed to make your life easier. Plus, with their mobile app, you can handle most check-related tasks right from your phone.

How to Request a Check from Chase

Now that we’ve covered the basics, let’s talk about the actual process of requesting a check from Chase. There are several methods you can use, depending on your preference and the type of check you need. Below, we’ll walk you through each option in detail.

Option 1: Requesting Checks Online

One of the easiest ways to request checks from Chase is through their online banking platform. Here’s how you can do it:

- Log in to your Chase account on their website

- Go to the "Order Checks" section under Account Services

- Select the type of checks you need (personal, business, etc.)

- Choose the quantity and design preferences

- Review your order and confirm

That’s it! Your checks will be delivered to your address within a few business days. Plus, Chase partners with trusted check printing companies to ensure quality and security.

Option 2: Requesting Checks via Phone

If you’re not comfortable ordering checks online, you can always call Chase customer service. Here’s what you need to do:

- Call the Chase customer service number on the back of your debit card

- Follow the prompts to reach the check ordering department

- Provide your account information and specify the type of checks you need

- Confirm your order and wait for delivery

Calling Chase might take a bit longer than ordering online, but it’s still a convenient option, especially if you have questions or need assistance.

Option 3: Requesting Checks in Person

For those who prefer face-to-face interactions, visiting a Chase branch is always an option. Just bring your ID and account information, and a representative will help you place your check order. This method is great if you need immediate assistance or have specific requests.

Understanding the Fees for Chase Request Check

Let’s talk about the elephant in the room: fees. While Chase offers a convenient check request service, there are certain costs associated with it. Here’s a breakdown of the fees you might encounter:

- Checkbook Orders: Typically around $20-$30, depending on the quantity and design

- Cashier’s Checks: Usually a flat fee of $8-$10 per check

- Stop Payment Fees: Around $30 if you need to cancel a check

It’s important to note that these fees can vary based on your account type and location. Always check with Chase for the most up-to-date fee information.

Common Issues with Chase Request Check

Even with a straightforward process, things can sometimes go wrong. Here are some common issues people face when requesting checks from Chase and how to resolve them:

Issue 1: Delayed Delivery

If your checks haven’t arrived within the expected timeframe, don’t panic. Chase typically takes 7-10 business days for delivery, but factors like holidays or shipping delays can affect this. If you’re concerned, contact Chase customer service for an update on your order status.

Issue 2: Wrong Checks Received

Mistakes happen, and sometimes you might receive the wrong type or quantity of checks. In such cases, contact Chase immediately and they’ll send you a replacement order at no extra cost.

Issue 3: Security Concerns

Security is a top priority for Chase, and they take several measures to ensure your checks are safe. However, if you suspect any fraudulent activity related to your checks, report it to Chase right away. They have a dedicated fraud prevention team to assist you.

Tips for Managing Your Chase Check Requests

Here are a few tips to make your Chase check request process smoother:

- Keep track of your check orders to avoid duplicate requests

- Store your checks in a secure place to prevent loss or theft

- Review your account regularly for any unauthorized transactions

- Consider setting up alerts for check activity

By following these tips, you can ensure that your check requests are handled efficiently and securely.

Chase Request Check vs. Other Banks

How does Chase stack up against other banks when it comes to check request services? Let’s compare:

Chase vs. Bank of America

Both Chase and Bank of America offer similar check request services, but Chase stands out with its user-friendly online platform and extensive branch network. Bank of America, on the other hand, might have slightly lower fees for certain check services.

Chase vs. Wells Fargo

Wells Fargo offers competitive check request services, but Chase wins points for its mobile app and customer service. If you’re looking for convenience and reliability, Chase is a solid choice.

Conclusion: Take Control of Your Chase Request Check

In conclusion, requesting checks from Chase is a straightforward and reliable process. Whether you choose to do it online, over the phone, or in person, Chase provides multiple options to suit your needs. Remember to keep track of your orders, understand the associated fees, and address any issues promptly.

We encourage you to share your experiences with Chase request check in the comments below. Did you find the process easy? Any tips for fellow readers? And don’t forget to explore other articles on our site for more valuable financial insights.

Table of Contents

- What is Chase Request Check?

- Why Choose Chase for Your Check Requests?

- How to Request a Check from Chase

- Understanding the Fees for Chase Request Check

- Common Issues with Chase Request Check

- Tips for Managing Your Chase Check Requests

- Chase Request Check vs. Other Banks

- Conclusion: Take Control of Your Chase Request Check

- How Much Is An Ez Pass In Pa The Ultimate Guide To Tolls And Travel

- Harry Potters Severus Snape Actor A Deep Dive Into His Life And Legacy

Chase Check Template Peterainsworth

英文站首页

Chase Logo LogoDix