Buy Checks Online Chase: The Ultimate Guide For Secure And Convenient Transactions

Buying checks online has never been easier, especially when you’re dealing with a trusted bank like Chase. In today’s fast-paced world, convenience is king, and Chase offers an incredible service that allows you to order checks online without stepping foot into a branch. Whether you're a business owner or a regular customer, this service can save you time and effort. But before diving headfirst into the process, it’s important to know what you're getting into and how to make the most of it.

Let’s be honest, writing checks might seem old-school to some, but there are still plenty of situations where they’re necessary. From paying rent to sending money to family members who don’t use digital wallets, checks remain a reliable option. And when you can buy checks online Chase, it becomes even more convenient. You don’t have to worry about running out of checks or finding time to visit a bank branch.

But hold up, before you hit that “buy” button, we’ve got some insider tips and tricks to share. This guide will walk you through everything you need to know about ordering checks online from Chase, including security features, customization options, and how to avoid common pitfalls. So, grab a cup of coffee, sit back, and let’s dive in!

- Whole Foods S Weymouth Your Ultimate Guide To Healthy Living

- Skandar Keynes Relationships A Deep Dive Into Love Life And Connections

Why Buy Checks Online Chase?

First things first, why should you even consider buying checks online through Chase? Well, let’s break it down. Chase is one of the most reputable banks in the U.S., and they’ve got your back when it comes to financial transactions. Ordering checks online is just another way they’re making banking easier for their customers.

Here’s the deal: when you buy checks online Chase, you’re not just getting a stack of paper. You’re getting checks with advanced security features that protect you from fraud. Plus, you can customize them to match your personal style or business needs. Whether you want to add your company logo or choose a specific color scheme, Chase has got you covered.

Convenience at Your Fingertips

Let’s talk about convenience. Who has time to go to a bank branch these days? Between work, family, and everything else on your plate, finding time to order checks in person can be a hassle. With Chase’s online platform, you can order checks anytime, anywhere. All you need is a computer or smartphone and an internet connection. It’s that simple.

- Ken Miles The Racer Who Redefined Speed And Passion

- Why Sim Failure Happens And What You Can Do About It

And here’s the best part: once you place your order, the checks are delivered straight to your door. No more waiting in line or dealing with crowded branches. It’s like having a personal assistant take care of your banking needs.

How to Buy Checks Online Chase: Step-by-Step Guide

Now that you know why buying checks online Chase is a great idea, let’s talk about how to do it. The process is straightforward, but we’ll break it down step by step to make sure you don’t miss a thing.

Step 1: Log In to Your Chase Account

The first step is to log in to your Chase online account. If you haven’t set one up yet, now’s the time to do it. Head over to the Chase website and click on “Sign In.” Enter your username and password, and you’re good to go.

Step 2: Navigate to the Check Ordering Section

Once you’re logged in, look for the “Order Checks” option. It’s usually located under the “Account Services” or “Tools” section. Click on it, and you’ll be taken to the check ordering page.

Step 3: Choose Your Check Style

Now comes the fun part—customizing your checks. Chase offers a variety of styles to choose from, so take your time and pick one that suits your needs. Whether you want a simple design or something more elaborate, you’ve got options.

- Personal checks

- Business checks

- Custom designs with logos or images

Step 4: Review and Submit Your Order

Before submitting your order, double-check all the details. Make sure the quantity is correct, the design looks good, and everything matches your preferences. Once you’re satisfied, hit the “Submit” button, and your order will be processed.

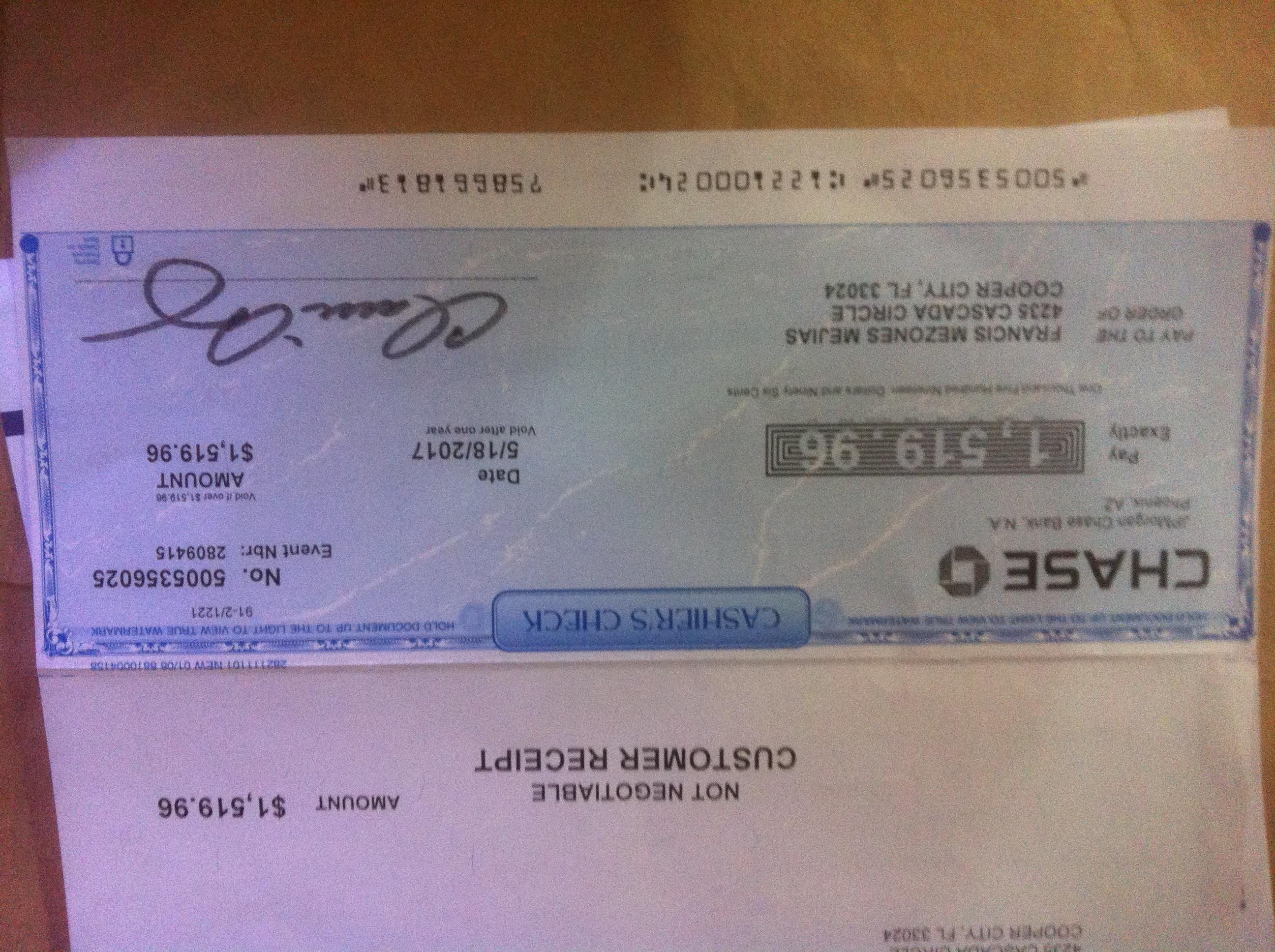

Security Features: Protecting Your Checks

Security is a top priority when it comes to financial transactions, and Chase knows that. That’s why they offer a range of security features to protect your checks from fraud. Here are some of the key features:

- Watermark protection

- Security tint

- Microprinting

- Chemical void protection

These features make it almost impossible for someone to tamper with your checks. So, you can rest easy knowing that your financial information is safe.

Costs and Fees: What You Need to Know

Let’s talk about the elephant in the room—costs. How much does it cost to buy checks online Chase? Well, it depends on the type of checks you’re ordering and the quantity. Generally, personal checks are cheaper than business checks, and ordering in bulk can save you money.

Here’s a rough estimate of what you can expect to pay:

- Personal checks: $15–$30 per pack

- Business checks: $25–$50 per pack

Keep in mind that these prices are subject to change, so it’s always a good idea to check the Chase website for the latest pricing information.

Delivery and Shipping Options

Once you’ve placed your order, the next question is: how long does it take to get your checks? Chase offers several delivery options to suit your needs. Here’s what you can expect:

- Standard shipping: 7–10 business days

- Expedited shipping: 3–5 business days

- Overnight shipping: 1 business day

Choose the option that works best for you, and your checks will be delivered straight to your door. And don’t worry, Chase uses secure packaging to ensure your checks arrive safely.

Tips for Ordering Checks Online Chase

Now that you know the basics, here are a few tips to make the process smoother:

- Order in bulk to save money

- Double-check all details before submitting your order

- Consider adding security features for extra protection

- Keep track of your checkbook to avoid running out

These tips might seem simple, but they can save you a lot of headaches in the long run. Trust us, we’ve been there.

Common Mistakes to Avoid

Let’s face it, mistakes happen. But when it comes to buying checks online Chase, some mistakes can cost you time and money. Here are a few common ones to watch out for:

- Ordering the wrong type of checks

- Not adding security features

- Forgetting to update your checkbook

By avoiding these mistakes, you can ensure a smooth and hassle-free experience.

Conclusion: Make the Most of Chase’s Check Ordering Service

Buying checks online Chase is a convenient and secure way to manage your financial transactions. Whether you’re ordering personal checks for everyday use or business checks for your company, Chase has got you covered. With advanced security features, customization options, and fast delivery, it’s no wonder so many people choose Chase for their check ordering needs.

So, what are you waiting for? Head over to the Chase website and place your order today. And don’t forget to share this guide with your friends and family. Who knows, you might just save them some time and effort. Now, go out there and conquer the world of checks!

Table of Contents

- Why Buy Checks Online Chase?

- How to Buy Checks Online Chase: Step-by-Step Guide

- Security Features: Protecting Your Checks

- Costs and Fees: What You Need to Know

- Delivery and Shipping Options

- Tips for Ordering Checks Online Chase

- Common Mistakes to Avoid

- Conclusion: Make the Most of Chase’s Check Ordering Service

- Amex Gift Cheque Your Ultimate Guide To Unlocking Exclusive Rewards

- How Did Rosalie Become A Vampire The Fascinating Story You Need To Know

Chase Checks Order Checks Online Check Print

Chase Cashier Check Online 24

Order Checks Chase Mobile App 2025 Leesa Kalina