Why Chase Request Checkbook Is A Smart Move For Your Finances

Listen up, folks. If you've been on the fence about whether or not to request a checkbook from Chase, it's time to take a closer look at what this little move could do for your financial game. Let's face it, in today's world of tap-to-pay and digital wallets, having a good old-fashioned checkbook might sound outdated. But guess what? It's still a powerful tool, especially if you're trying to manage your money like a pro. So, let's dive into why requesting a checkbook from Chase could be one of the smartest financial decisions you make this year.

Now, before we get into the nitty-gritty, let's address the elephant in the room. Chase request checkbook is not just for your grandparents anymore. In fact, it's a versatile option that can help you with everything from paying rent to managing business expenses. Whether you're a college student or a seasoned entrepreneur, having a checkbook can give you that extra layer of financial flexibility you didn't even know you needed.

Let's be real, though. With so many payment options out there, it's easy to get overwhelmed. But here's the thing: a Chase checkbook isn't just a piece of paper with your name on it. It's a tool that can simplify your life and make financial transactions easier, safer, and more organized. So, if you're ready to level up your financial strategy, keep reading because we're about to break it all down for you.

- Where Is Yasmine Bleeth Now Unveiling The Life Of A Beloved Star

- Exploring Food Dishes That Start With N A Flavorful Journey

Understanding Chase Request Checkbook: What's the Deal?

Alright, let's start with the basics. When you request a checkbook from Chase, you're essentially getting a personalized set of checks that are linked directly to your Chase account. These checks allow you to make payments without needing to use cash or a debit card. Sounds simple enough, right? But here's the kicker: it's not just about convenience. It's about control.

How Does Chase Checkbook Work?

Here's how it goes down. Once you've requested your checkbook, Chase will send it to your address within a few weeks. Each check has your account details printed on it, along with a unique number to ensure security. When you need to make a payment, just fill out the check with the recipient's name, the amount, and your signature. Voila! The money is automatically deducted from your account when the check is cashed.

But wait, there's more. With Chase's mobile app, you can even track your check activity in real-time. This means you'll always know which checks have been cashed and which ones are still out there waiting. It's like having a personal financial assistant in your pocket.

- Drakes Meat The Ultimate Guide To Savory Flavor And Quality Cuts

- Abdominal Soreness From Coughing The Pain You Didnrsquot Know You Needed To Know

Top Reasons to Request a Chase Checkbook

So, why should you bother with a checkbook in 2023? Here are some solid reasons:

- Security: Checks are harder to hack than digital payments, making them a safer option for large transactions.

- Versatility: Not everyone accepts digital payments, but almost everyone accepts checks. It's a universal solution.

- Record Keeping: With a checkbook, you have a physical record of every transaction you make. No more guessing where your money went.

- Flexibility: Need to pay rent, utility bills, or even a friend? A checkbook has got you covered.

Who Benefits Most from Chase Checkbook?

Let's break it down:

- Renters: If your landlord only accepts checks, a Chase checkbook is a must-have.

- Business Owners: Need to pay vendors or employees? Checks are often the preferred method.

- Parents: Sending money to your kids in college? A check is a reliable and safe option.

How to Chase Request Checkbook: A Step-by-Step Guide

Ready to get your hands on a Chase checkbook? Here's how you do it:

- Log in to your Chase account online or through the Chase app.

- Head over to the "Order Checks" section.

- Select the type of checkbook you want (personal or business).

- Choose the design and quantity.

- Confirm your shipping address and submit your order.

And that's it! Your checkbook will be on its way in no time. Easy peasy, right?

What to Expect When Ordering a Checkbook

Now, here's the deal. Once you place your order, Chase typically takes about 7-10 business days to process and ship your checkbook. If you need it faster, you can opt for expedited shipping for an additional fee. Just keep in mind that rush orders might not always be available, so plan ahead if you're in a hurry.

Common Questions About Chase Request Checkbook

Let's tackle some of the most frequently asked questions about Chase checkbooks:

How Much Does It Cost?

Good news! Chase doesn't charge for your first checkbook order. However, if you need additional checkbooks in the future, there might be a small fee. It's always a good idea to check with Chase for the latest pricing details.

Can I Customize My Checkbook?

Absolutely! When you order your checkbook, you can choose from a variety of designs and layouts. Whether you want something simple or something that reflects your personality, Chase has got you covered.

What Happens If I Lose My Checkbook?

No worries. If you misplace your checkbook, you can easily freeze your account through the Chase app or by calling customer service. Once you've secured your account, you can order a replacement checkbook.

The Benefits of Using a Chase Checkbook

Let's talk about the perks of having a Chase checkbook:

- No Fees: As mentioned earlier, your first checkbook is free, which is a win-win.

- Easy to Use: Filling out a check is simple, and the process is straightforward.

- Secure Transactions: Checks provide an added layer of security compared to cash or some digital payment methods.

Why Chase Over Other Banks?

Chase stands out for several reasons:

- They offer a wide range of banking products and services.

- Their mobile app is user-friendly and packed with features.

- Customer service is generally top-notch, so you can always get help if needed.

Chase Request Checkbook: Tips and Tricks

Want to get the most out of your Chase checkbook? Here are some pro tips:

- Keep It Safe: Store your checkbook in a secure place to prevent unauthorized use.

- Track Your Checks: Use the Chase app to monitor your check activity and avoid any surprises.

- Order in Bulk: If you know you'll need more checks in the future, consider ordering a larger quantity to save time and money.

How to Stay Organized with Your Checkbook

Organization is key. Here's how you can keep things tidy:

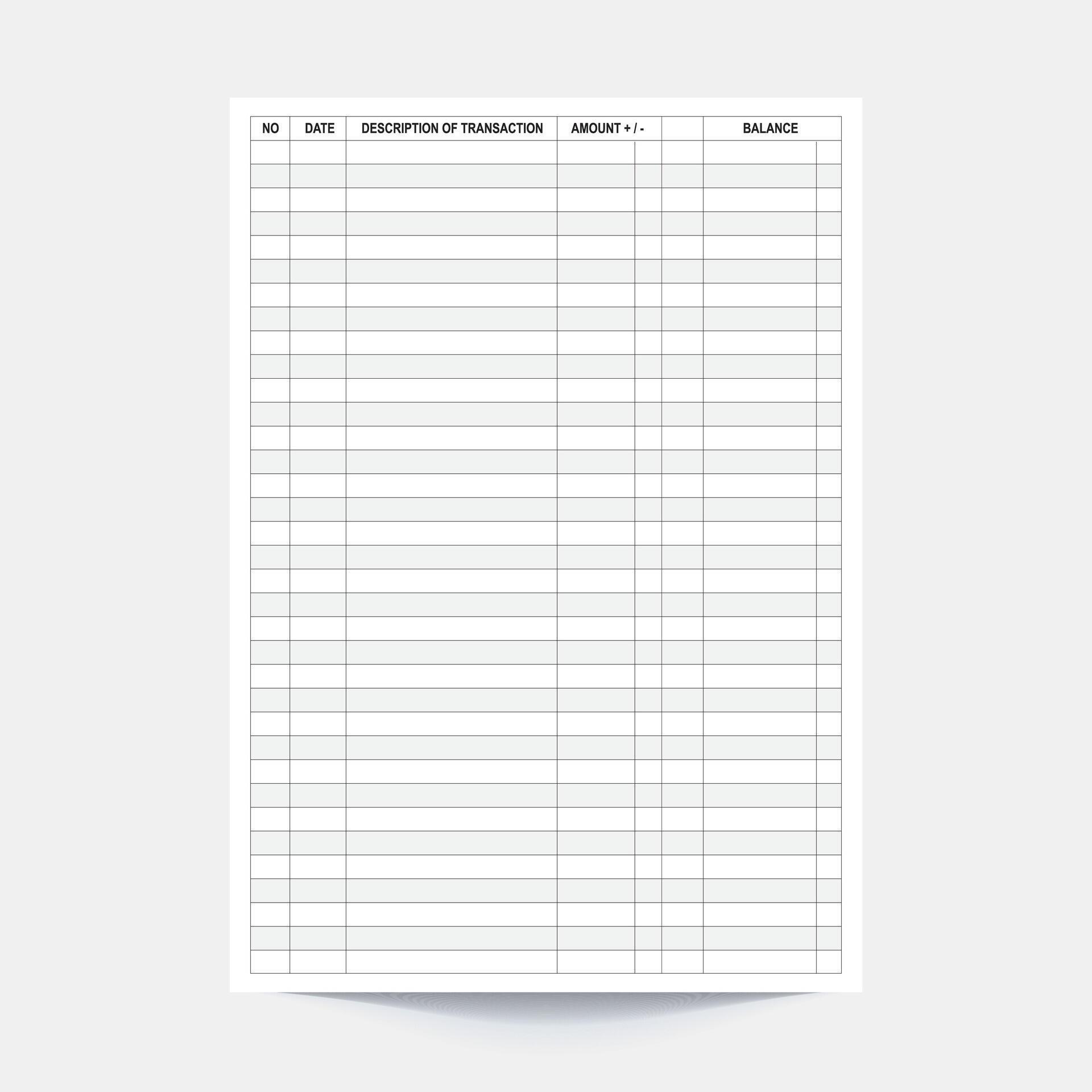

- Keep a record of every check you write in a notebook or spreadsheet.

- Set up alerts in the Chase app to notify you when checks are cashed.

- Review your bank statements regularly to ensure everything matches up.

Chase Checkbook vs. Other Payment Methods

Let's compare Chase checkbooks to other popular payment methods:

Checkbooks vs. Debit Cards

While debit cards are convenient, they can be risky if lost or stolen. Checks, on the other hand, require a signature and are harder to counterfeit. Plus, checks give you more time to stop payment if something goes wrong.

Checkbooks vs. Digital Payments

Digital payments are fast and easy, but they can be vulnerable to hacking. Checks, with their physical nature, offer an extra layer of protection. Plus, not all businesses or individuals accept digital payments, making checks a more versatile option.

Conclusion: Is Chase Request Checkbook Right for You?

So, there you have it. Requesting a checkbook from Chase could be a game-changer for your financial management. Whether you're paying rent, managing business expenses, or just want a safer way to make payments, a checkbook is a reliable tool that deserves a spot in your financial toolkit.

Now, here's the call to action: if you haven't already, head over to your Chase account and place that checkbook order. Trust me, you won't regret it. And while you're at it, why not share this article with your friends and family? Knowledge is power, and helping others make smart financial decisions is always a good thing.

Table of Contents

Understanding Chase Request Checkbook: What's the Deal?

How Does Chase Checkbook Work?

Top Reasons to Request a Chase Checkbook

Who Benefits Most from Chase Checkbook?

How to Chase Request Checkbook: A Step-by-Step Guide

What to Expect When Ordering a Checkbook

Common Questions About Chase Request Checkbook

What Happens If I Lose My Checkbook?

The Benefits of Using a Chase Checkbook

Chase Request Checkbook: Tips and Tricks

How to Stay Organized with Your Checkbook

Chase Checkbook vs. Other Payment Methods

Conclusion: Is Chase Request Checkbook Right for You?

- Male Gooch The Ultimate Guide To Understanding And Embracing

- Whatrsquos Your Star Sign For April 23rd Unlock The Secrets Of Your Zodiac

Checkbook order chase bihety

英文站首页

checkbook register,transaction register for checkbook,checkbook