Chase Check Book: Everything You Need To Know About Managing Your Finances

Let me tell you something, folks—managing your finances has never been more important. And if you're diving into the world of Chase check books, you're definitely on the right track. Whether you're a seasoned pro or just starting out, understanding how Chase check books work can be a game-changer for your financial life. So buckle up, because we're about to break it all down for you in a way that's easy to understand and packed with value.

Now, before we dive deep into the nitty-gritty, let's get one thing straight: Chase check books aren't just pieces of paper. They're tools that help you keep track of your money, pay bills, and stay organized. Think of them as your financial Swiss Army knife. In this article, we'll cover everything you need to know, from ordering your first Chase check book to using it like a pro. It's like a crash course in financial management, but way cooler.

And hey, don't worry if you're new to this whole check-writing thing. We've got your back. By the end of this article, you'll be so confident with your Chase check book that even your banker will be impressed. So let's jump right in and figure out how to make the most out of this essential financial tool.

- Amex Gift Cheque Your Ultimate Guide To Unlocking Exclusive Rewards

- Unveiling The Mystical Power Of The 1984 Chinese New Year Animal

What Exactly Is a Chase Check Book?

Alright, let's start with the basics. A Chase check book is essentially a booklet filled with pre-printed checks linked to your Chase bank account. These checks allow you to make payments directly from your account without needing cash or a card. It's kind of like having a magic wand for your finances, but instead of spells, you're writing numbers.

Each check in the book includes your account details, a unique check number, and space for you to fill in the recipient's name, payment amount, and your signature. It's super convenient for paying bills, sending money to friends, or even covering expenses when cards aren't accepted. Plus, Chase check books come with a register to help you keep track of every transaction—handy, right?

Why Should You Use a Chase Check Book?

Here's the deal: Chase check books offer several advantages over other payment methods. First off, they provide a paper trail for all your transactions, which is great for budgeting and record-keeping. Second, they're widely accepted by businesses and individuals, so you're not limited by card networks or digital payment systems. And third, they're secure because each check requires your signature to be valid.

- Unveiling The Secrets Of The 12 Zodiac Signs A Deep Dive Into Your Cosmic Identity

- Anuel Aa Siblings Unveiling The Family Dynamics Behind The Star

Some quick benefits:

- Easy to order through Chase

- Perfect for paying rent, utilities, or large purchases

- Helps maintain a detailed history of your spending

- Secure and reliable for sensitive payments

How to Order Your Chase Check Book

Ordering a Chase check book is surprisingly simple. All you need is access to your Chase account, either online or through the mobile app. Here's a step-by-step guide to make the process a breeze:

- Log in to your Chase account

- Go to the "Order Checks" section

- Select the type of check book you want (personal or business)

- Choose customization options, like colors or logos

- Submit your order and wait for it to arrive

And that's it! Your Chase check book will usually arrive within a week, depending on your location. Oh, and did I mention you can personalize the design? Yeah, that's right—you can add your favorite colors or even your company logo if you're using it for business purposes. How cool is that?

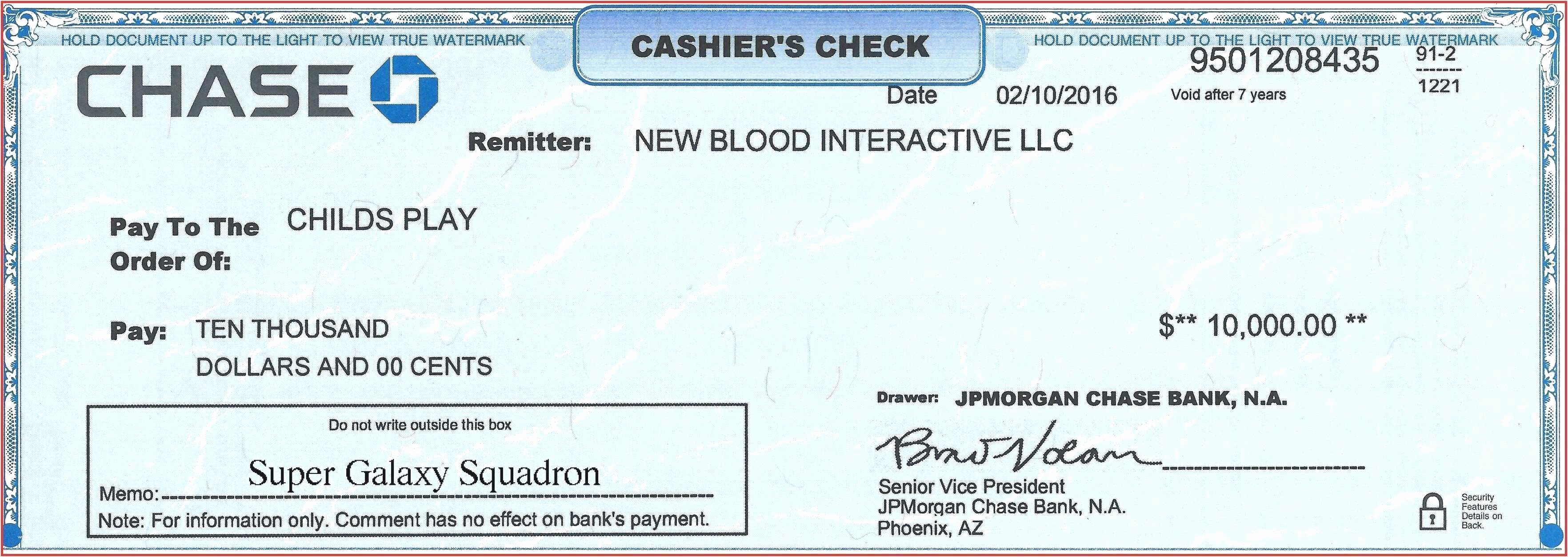

Understanding the Components of a Chase Check

Now that you've got your hands on a Chase check book, it's time to familiarize yourself with its components. Each check has specific sections that need to be filled out correctly to ensure the payment goes through smoothly. Let's break it down:

Date

This is where you write the date the check is issued. Make sure it's current or future-dated if you're planning to delay the payment.

Pay to the Order Of

Here's where you write the name of the person or business receiving the payment. Be precise—spelling mistakes could delay the process.

Amount in Numbers

Write the exact amount you're paying in numbers, like "$150.00." Keep it neat and avoid leaving spaces for anyone to tamper with it.

Amount in Words

Spell out the amount in words, like "One hundred fifty dollars and 00/100." This adds an extra layer of security.

Signature

Your signature is what makes the check official. Without it, the check is invalid. So sign it nice and clear!

Memo

This optional field is great for notes, like "Rent for March" or "Utility Bill." It helps you keep track of what the check is for.

Tips for Using Your Chase Check Book Like a Pro

Using a Chase check book effectively takes a little practice, but once you get the hang of it, it's smooth sailing. Here are some pro tips to help you out:

- Always update your check register after writing a check

- Double-check the recipient's name and payment amount

- Keep your check book in a safe place to prevent theft

- Report lost or stolen checks immediately to Chase

- Balance your checkbook regularly to avoid overdraft fees

And here's a bonus tip: if you're unsure about anything, don't hesitate to reach out to Chase customer support. They're there to help, and trust me, they've heard it all.

Common Mistakes to Avoid with Chase Checks

Even the best of us can make mistakes when writing checks. But hey, mistakes happen, and the key is learning from them. Here are some common pitfalls to watch out for:

Leaving Blank Spaces

Always fill in every section of the check. Leaving spaces can invite fraud or errors. For example, write "00/100" after the dollar amount in the "Amount in Words" field.

Forgetting to Sign

A unsigned check is like a car without gas—it's not going anywhere. Always double-check that you've signed before handing it over.

Not Updating Your Register

Your check register is your best friend when it comes to tracking expenses. Neglecting it can lead to overdrafts or unexpected fees. Stay on top of it, and you'll thank yourself later.

Security Measures for Your Chase Check Book

Security is crucial when it comes to financial tools like Chase check books. Here are some ways to protect yourself:

Store It Safely

Keep your check book in a secure location, like a locked drawer or safe. If you're traveling, consider leaving it at home unless absolutely necessary.

Monitor Your Account

Regularly check your Chase account for any suspicious activity. If you notice anything unusual, report it to Chase immediately.

Report Loss or Theft

If your check book goes missing, act fast. Contact Chase right away to cancel the checks and prevent unauthorized use.

Alternatives to Chase Check Books

While Chase check books are fantastic, they're not the only way to manage your finances. Here are some alternatives worth considering:

Online Banking

With online banking, you can pay bills, transfer funds, and manage your account all from your computer or phone. It's fast, convenient, and often free.

Mobile Banking Apps

Chase's mobile app lets you do almost everything you can do online, plus features like check deposits via your phone's camera. It's like having a bank in your pocket.

Debit Cards

For everyday transactions, debit cards are hard to beat. They're accepted almost everywhere and offer similar security features to checks.

Conclusion: Mastering Your Chase Check Book

So there you have it, folks—a comprehensive guide to Chase check books. From ordering your first book to using it like a pro, we've covered everything you need to know. Remember, managing your finances doesn't have to be complicated. With the right tools and knowledge, you can take control of your money and achieve your financial goals.

Now, here's the fun part: take action! If you haven't already, order your Chase check book today. Practice writing checks, update your register, and explore the other financial tools Chase offers. And don't forget to share this article with friends or leave a comment below. We'd love to hear your thoughts!

Table of Contents

- Chase Check Book: Everything You Need to Know About Managing Your Finances

- What Exactly Is a Chase Check Book?

- Why Should You Use a Chase Check Book?

- How to Order Your Chase Check Book

- Understanding the Components of a Chase Check

- Tips for Using Your Chase Check Book Like a Pro

- Common Mistakes to Avoid with Chase Checks

- Security Measures for Your Chase Check Book

- Alternatives to Chase Check Books

- Conclusion: Mastering Your Chase Check Book

- Unpacking The Legacy Of The Twins From The Cosby Show A Deep Dive

- How To Decode Your Ez Pass Transponder Number Like A Pro

Chase Check Template Peterainsworth

英文站首页

How to Write a Chase Check (with Example)