What Year Tax Return For FAFSA 2025-26: A Simple Breakdown For Students

Let’s get straight to the point, shall we? If you’re wondering what year tax return for FAFSA 2025-26 is required, you’re in the right place. This guide is all about demystifying the process so you can focus on what matters—your education. Whether you’re a first-time applicant or someone who’s been through the process before, the FAFSA tax requirements can be tricky. But don’t worry, we’ve got you covered.

FAFSA, or the Free Application for Federal Student Aid, is like the golden ticket to financial aid. It’s your key to scholarships, grants, and loans that can make college a reality. But before you dive into filling out the form, you need to know which tax year to use for the 2025-26 academic year. Let’s break it down step by step so you don’t get lost in the paperwork jungle.

Now, if you’re like most students or parents, the idea of dealing with tax returns might seem overwhelming. But trust me, it’s not as bad as it sounds. By the end of this article, you’ll have a clear understanding of the tax year requirements and how to navigate the FAFSA process with ease. So, grab your favorite snack, and let’s get started!

- Who Is The Lead Singer Of Journey Discover The Voice Behind The Iconic Rock Anthems

- How Much Is An Ez Pass In Pa The Ultimate Guide To Tolls And Travel

Why Does the Tax Year Matter for FAFSA?

Let’s face it, taxes can be confusing, but when it comes to FAFSA, the tax year matters a lot. The FAFSA form uses your financial information from a specific tax year to determine how much aid you qualify for. This means you need to use the right tax year to ensure accuracy. Using the wrong year could delay your application or result in incorrect aid calculations.

For the 2025-26 FAFSA, the tax year you’ll need to use is the 2023 tax year. That’s right, the IRS wants to see your 2023 tax returns because they want to assess your financial situation based on data that’s already finalized. It’s like looking at a snapshot of your finances from the previous year to predict what you’ll need for the upcoming academic year.

Understanding the Base-Year Concept

FAFSA operates on something called the “base-year” concept. This means the financial information used for your application is always two years prior to the academic year you’re applying for. For the 2025-26 FAFSA, the base year is 2023. This gives the government enough time to process your taxes and ensures that the data is accurate and up-to-date.

- Foodtown Davie Florida Your Ultimate Foodie Destination You Never Knew You Needed

- Peewee Longway Jail The Untold Story Behind The Hype

Here’s a quick breakdown:

- For the 2025-26 FAFSA, use 2023 tax returns.

- For the 2026-27 FAFSA, use 2024 tax returns.

- See the pattern? It’s always two years prior.

What Documents Do You Need?

Alright, so now that we’ve established which tax year to use, let’s talk about the documents you’ll need. Gathering the right paperwork beforehand will save you a ton of time and frustration. Here’s a list of the essentials:

For Students:

- 2023 Federal Tax Returns (Form 1040)

- W-2 Forms

- Records of untaxed income, like child support or veterans benefits

- Bank statements and investment records

For Parents:

- 2023 Federal Tax Returns (Form 1040)

- W-2 Forms

- Business and farm records, if applicable

- Records of untaxed income

Pro tip: If you’re filing as a dependent student, you’ll need both your and your parents’ tax information. So, make sure everyone’s on the same page before you start the application.

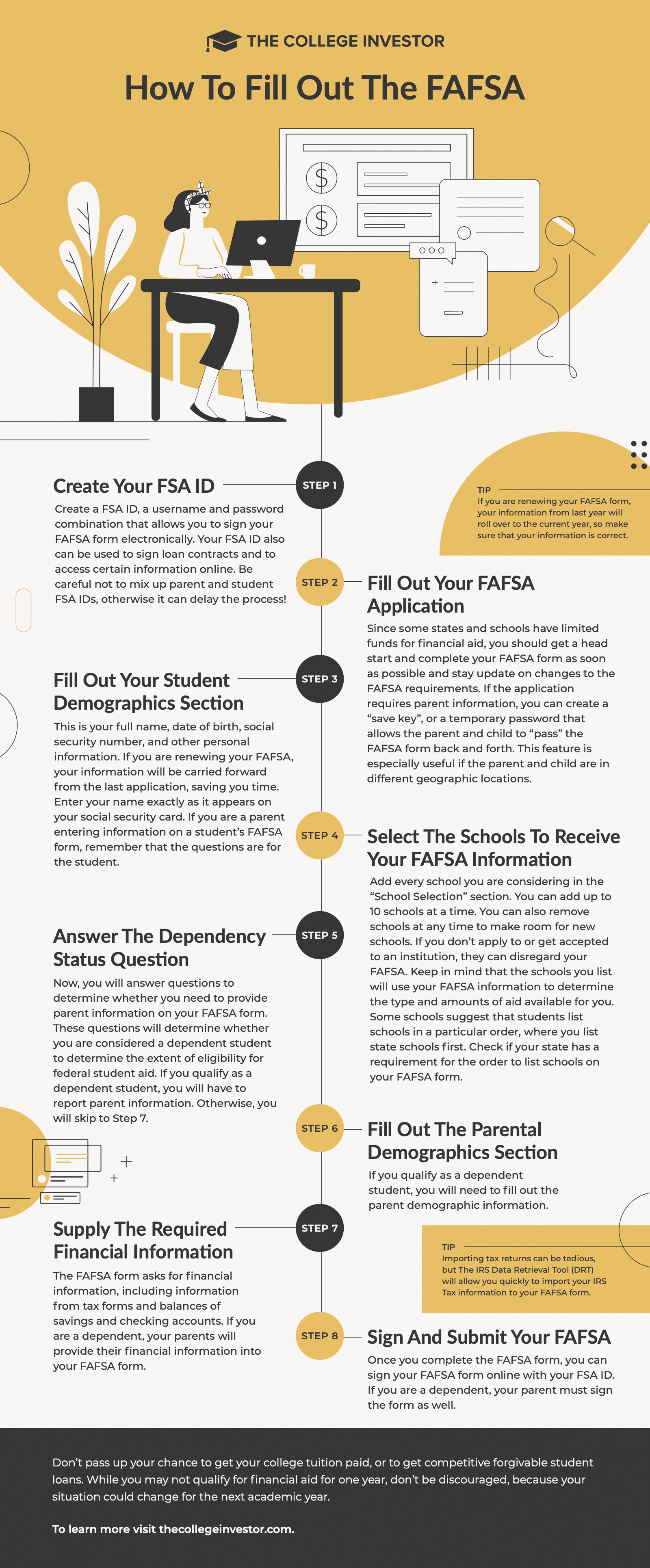

How to Input Your Tax Information

Now that you’ve gathered all the necessary documents, it’s time to input your tax information into the FAFSA form. Here’s where the IRS Data Retrieval Tool (DRT) comes in handy. The DRT allows you to automatically transfer your tax data from the IRS to your FAFSA application. It’s like a magic button that saves you from manually entering everything.

Here’s how it works:

- Sign in to your FAFSA account.

- When prompted, select “Link to IRS” to access the DRT.

- Follow the prompts to authorize the IRS to send your tax information.

- Voilà! Your tax data will populate automatically.

Not only does this save time, but it also reduces the chances of making errors. And who doesn’t love that?

Common Mistakes to Avoid

Before we move on, let’s talk about some common mistakes people make when submitting their FAFSA. Avoiding these pitfalls can save you a lot of headaches down the road.

Using the Wrong Tax Year

Remember, for the 2025-26 FAFSA, you need to use your 2023 tax returns. Using the wrong year can lead to delays or incorrect aid calculations. Double-check your paperwork before hitting submit.

Forgetting to Sign

Believe it or not, forgetting to sign your FAFSA is a surprisingly common mistake. Make sure both you and your parents (if applicable) sign the form using your FSA IDs. Without a signature, your application won’t be processed.

Not Filing Early Enough

FAFSA funds are awarded on a first-come, first-served basis. The earlier you file, the better your chances of securing the aid you need. Don’t wait until the last minute—start early!

What Happens If You Don’t Have Tax Returns?

Life happens, and sometimes you might not have filed taxes for the required year. Maybe you didn’t earn enough income to require filing, or perhaps you’re still waiting on your return. Whatever the reason, don’t panic. There are options available to help you complete your FAFSA.

If you didn’t file taxes in 2023, you can still estimate your income and expenses based on W-2 forms or other financial records. Just make sure to update your FAFSA once you have your official tax return. And if you’re still waiting on your return, you can use the IRS Get Transcript tool to obtain your tax information.

How Does FAFSA Use Your Tax Information?

Now that we’ve covered the nitty-gritty of tax requirements, let’s talk about how FAFSA actually uses your tax information. The FAFSA formula takes into account several factors, including your income, assets, family size, and number of family members in college. This information is used to calculate your Expected Family Contribution (EFC), which determines how much financial aid you’re eligible for.

Here’s a simplified version of the process:

- Your tax information is entered into the FAFSA form.

- The FAFSA formula calculates your EFC.

- Your EFC is sent to the schools you’re applying to.

- The schools use your EFC to determine your financial aid package.

It’s a bit like a puzzle, but once you understand how the pieces fit together, it all makes sense.

What If Your Financial Situation Has Changed?

Life is unpredictable, and sometimes your financial situation might change after you’ve filed your FAFSA. Maybe you lost your job, or perhaps you experienced a significant drop in income. In cases like these, you can appeal to the financial aid office at your school to have your FAFSA reassessed.

Here’s what you need to do:

- Contact the financial aid office at your school.

- Explain your situation and provide documentation to support your claim.

- Request a review of your FAFSA based on your updated financial information.

While there’s no guarantee your aid package will change, it’s always worth asking. After all, financial aid officers are there to help you succeed.

How to Maximize Your Financial Aid

Let’s talk about maximizing your financial aid. The more accurate and complete your FAFSA is, the better your chances of receiving the aid you need. Here are a few tips to help you optimize your application:

File Early

As we mentioned earlier, filing early increases your chances of securing more aid. Many states and schools have their own deadlines, so make sure you’re aware of them.

Use the IRS DRT

The IRS Data Retrieval Tool is your best friend when it comes to FAFSA. It ensures accuracy and saves you time. Plus, it reduces the likelihood of errors.

Minimize Assets

While you shouldn’t hide assets, minimizing them can help lower your EFC. For example, consider paying off debts or saving money in a parent’s name instead of the student’s name, as student assets are weighted more heavily in the FAFSA formula.

Final Thoughts

Alright, let’s wrap this up. The FAFSA process might seem intimidating at first, but with the right information and preparation, it’s totally manageable. For the 2025-26 FAFSA, you’ll need to use your 2023 tax returns. Gather your documents, use the IRS DRT, and file early to maximize your chances of receiving financial aid.

Remember, the goal of FAFSA is to help you achieve your educational dreams without breaking the bank. So, take a deep breath, follow the steps outlined in this guide, and don’t hesitate to reach out for help if you need it. Whether it’s contacting the financial aid office or seeking advice from a counselor, there are plenty of resources available to support you.

Now, it’s your turn. Share this article with your friends, leave a comment below, or check out some of our other articles for more tips on navigating the college application process. Here’s to your success!

Table of Contents

- Why Does the Tax Year Matter for FAFSA?

- Understanding the Base-Year Concept

- What Documents Do You Need?

- How to Input Your Tax Information

- Common Mistakes to Avoid

- What Happens If You Don’t Have Tax Returns?

- How Does FAFSA Use Your Tax Information?

- What If Your Financial Situation Has Changed?

- How to Maximize Your Financial Aid

- Final Thoughts

- Mastering The Fourier Inverse Transform Table Your Ultimate Guide

- Pat Wayne The Rising Star In Music And Beyond

Tax Form For Fafsa 202526 Max E. Winfrey

Navigating the FAFSA Changes for the 202526 Academic Year What

Can You File FAFSA If Your Parents Didn’t File A Tax Return?