Property Tax Riverside County: A Comprehensive Guide For Smart Homeowners

When it comes to property tax in Riverside County, understanding the ins and outs can feel like navigating a maze. But don’t worry—we’ve got your back! Property tax Riverside County is a crucial aspect of homeownership, and knowing how it works can save you both headaches and money. Whether you’re a first-time homeowner or a seasoned property owner, this guide will break it down for you in simple terms. Let’s dive in and make sense of those tax numbers once and for all.

Property tax is one of those things that everyone talks about but few truly understand. It’s like that mysterious fee on your utility bill—present but often overlooked. Riverside County, with its booming real estate market, has its own set of rules when it comes to property taxes. If you’re living or planning to buy a home here, it pays to know what you’re dealing with.

From assessing your property value to figuring out exemptions, this article will cover everything you need to know about property tax Riverside County. By the end of this read, you’ll be armed with the knowledge to handle your tax responsibilities like a pro. No more surprises, no more confusion—just clear answers to your questions. So, grab a coffee, sit back, and let’s get started!

- Mls Playoff Seeds The Ultimate Guide To Unlocking The Secrets Of The Soccer Season

- Jessica Springsteen Boyfriend The Inside Story Yoursquove Been Waiting For

Understanding Property Tax Riverside County

Alright, let’s talk about the basics. Property tax Riverside County is essentially a levy imposed by the local government on real estate within the county. Think of it as a contribution toward maintaining public services like schools, roads, and emergency services. The amount you pay depends on the assessed value of your property, which we’ll get into later. For now, just know that property tax is a big deal—it’s one of the primary sources of revenue for local governments.

How Is Property Tax Calculated?

The calculation process might sound complicated, but it’s actually pretty straightforward. First, the county assessor determines the assessed value of your property. This value is usually a percentage of the market value. In California, thanks to Proposition 13, the assessed value can only increase by a maximum of 2% annually unless there’s a change in ownership or new construction. Once the assessed value is set, the tax rate is applied to calculate your final tax bill. Simple, right?

Property Tax Rates in Riverside County

Now, here’s where things get interesting. The property tax rate in Riverside County varies depending on the location and the specific services provided in the area. On average, homeowners can expect to pay around 1% of their property’s assessed value. However, additional fees and assessments might bump up the total rate. These could include things like water district fees or school bonds. Always check with your local tax office to get the exact rate for your area.

- Cast Of National Lampoons Christmas Vacation A Festive Look At The Beloved Movie

- Abdominal Soreness From Coughing The Pain You Didnrsquot Know You Needed To Know

Key Factors Affecting Property Tax Riverside County

Several factors come into play when determining your property tax. Understanding these can help you anticipate changes and plan accordingly.

Location, Location, Location

Where your property is located within Riverside County can significantly impact your tax bill. Areas with more amenities or better schools might have higher tax rates. It’s all about supply and demand—if an area is desirable, the property values tend to be higher, leading to higher taxes.

Property Type and Size

The type and size of your property also matter. Larger homes or commercial properties generally have higher assessed values, resulting in higher taxes. Even the age and condition of your property can influence the assessment. So, if you’ve been thinking about that major renovation, keep in mind that it might affect your tax bill.

Market Trends

Real estate markets are constantly changing, and these changes can affect property tax Riverside County. If property values in the county rise, so might your taxes. That’s why it’s important to stay informed about market trends and how they could impact your wallet.

Assessing Your Property Value

One of the most critical steps in determining your property tax is the assessment process. Here’s how it works:

- Initial Assessment: When you first purchase a property, the county assessor will evaluate its market value at the time of sale.

- Annual Reassessment: After that, your property is reassessed annually, but remember, thanks to Proposition 13, the increase is capped at 2%.

- Special Assessments: If you make significant improvements to your property, it might trigger a reassessment. This could lead to an increase in your assessed value and, consequently, your tax bill.

It’s important to review your assessment annually to ensure it’s accurate. If you believe your property has been overvalued, you have the right to appeal the assessment.

Appealing Your Property Tax Assessment

Appealing your assessment might seem daunting, but it’s a straightforward process. Start by gathering evidence to support your claim. This could include recent sales data of similar properties in your area or a professional appraisal. Then, file an appeal with the county assessor’s office. They’ll review your case and, if justified, adjust your assessment. It’s a great way to ensure you’re not paying more than your fair share.

Exemptions and Deductions for Property Tax Riverside County

Here’s some good news—there are several exemptions and deductions available that could lower your property tax bill. Let’s take a look at some of the most common ones:

- Homeowner’s Exemption: If you use your property as your primary residence, you might qualify for a $7,000 reduction in assessed value.

- Senior Citizen Exemption: Qualified seniors can apply for a property tax deferral program, allowing them to defer payment until they sell the property.

- Disability Exemption: Homeowners with disabilities might be eligible for reduced property taxes.

Don’t forget to check with your local tax office for additional programs that might apply to your situation. Taking advantage of these exemptions can make a significant difference in your annual tax bill.

How to Apply for Exemptions

Applying for exemptions usually involves filling out a form and providing supporting documentation. The process can vary slightly depending on the type of exemption, so it’s important to follow the specific guidelines for each one. Once approved, your tax bill will reflect the reduction. It’s a small step that can lead to big savings.

Property Tax Deadlines in Riverside County

Knowing the deadlines for property tax payments is crucial to avoid penalties. In Riverside County, property taxes are due in two installments:

- First Installment: Due by November 1 and delinquent if unpaid by December 10.

- Second Installment: Due by February 1 and delinquent if unpaid by April 10.

Missing these deadlines can result in penalties, so it’s essential to plan ahead. If you’re unable to pay on time, contact the tax collector’s office to discuss your options.

Payment Options

Paying your property tax has never been easier. Riverside County offers several payment methods, including online payments, mail-in checks, and in-person payments at the tax collector’s office. Some homeowners even choose to escrow their taxes through their mortgage lender. Whatever method you choose, just make sure it’s on time!

Common Misconceptions About Property Tax Riverside County

There are a lot of myths floating around about property tax Riverside County. Let’s clear some of them up:

- Myth: Property taxes only increase when property values rise. Fact: While rising property values can lead to higher taxes, other factors like additional assessments or changes in tax rates can also affect your bill.

- Myth: You can’t challenge your property tax assessment. Fact: As we discussed earlier, you absolutely can appeal your assessment if you believe it’s incorrect.

- Myth: Property taxes are the same throughout Riverside County. Fact: Tax rates can vary significantly depending on the specific area and services provided.

Knowing the facts can help you avoid costly mistakes and ensure you’re paying the right amount.

Why Understanding Property Tax Matters

Property tax might seem like just another bill, but it plays a vital role in maintaining your community. The revenue generated funds essential services that benefit everyone. By understanding your tax responsibilities, you’re not only protecting your financial interests but also contributing to the well-being of your neighborhood.

Strategies for Managing Property Tax

Managing your property tax doesn’t have to be stressful. Here are a few strategies to help you stay on top of things:

Budgeting for Property Tax

Treat your property tax as a regular expense and include it in your household budget. Knowing the deadlines and expected amounts can help you plan accordingly. Consider setting aside a portion of your income each month to cover your tax bill when it’s due.

Stay Informed

Keep up with changes in property tax laws and regulations. Subscribe to newsletters or follow local government updates to stay informed about any changes that might affect your tax bill.

Consult a Professional

If you’re unsure about anything related to property tax Riverside County, don’t hesitate to consult a professional. Tax advisors or real estate experts can provide valuable insights and help you navigate the process.

Conclusion: Take Control of Your Property Tax

In conclusion, property tax Riverside County doesn’t have to be a mystery. By understanding how it works, knowing your rights, and taking advantage of available exemptions, you can manage your tax responsibilities effectively. Remember, staying informed and proactive is key to avoiding surprises and ensuring you’re paying the right amount.

So, what’s next? We encourage you to share this article with friends and family who might find it helpful. And if you have any questions or insights, feel free to leave a comment below. Together, let’s make property tax less intimidating and more manageable for everyone!

Table of Contents

- Understanding Property Tax Riverside County

- Key Factors Affecting Property Tax Riverside County

- Assessing Your Property Value

- Exemptions and Deductions for Property Tax Riverside County

- Property Tax Deadlines in Riverside County

- Common Misconceptions About Property Tax Riverside County

- Strategies for Managing Property Tax

- Conclusion: Take Control of Your Property Tax

- Bill Waltons Cancer Journey How Long Did He Battle The Disease

- Unlocking The World Of Vanilla Gift Card Numbers What You Need To Know

The Riverside County... Riverside County Sheriff's Office

Riverside Borough 150 Year Celebration Riverside PA

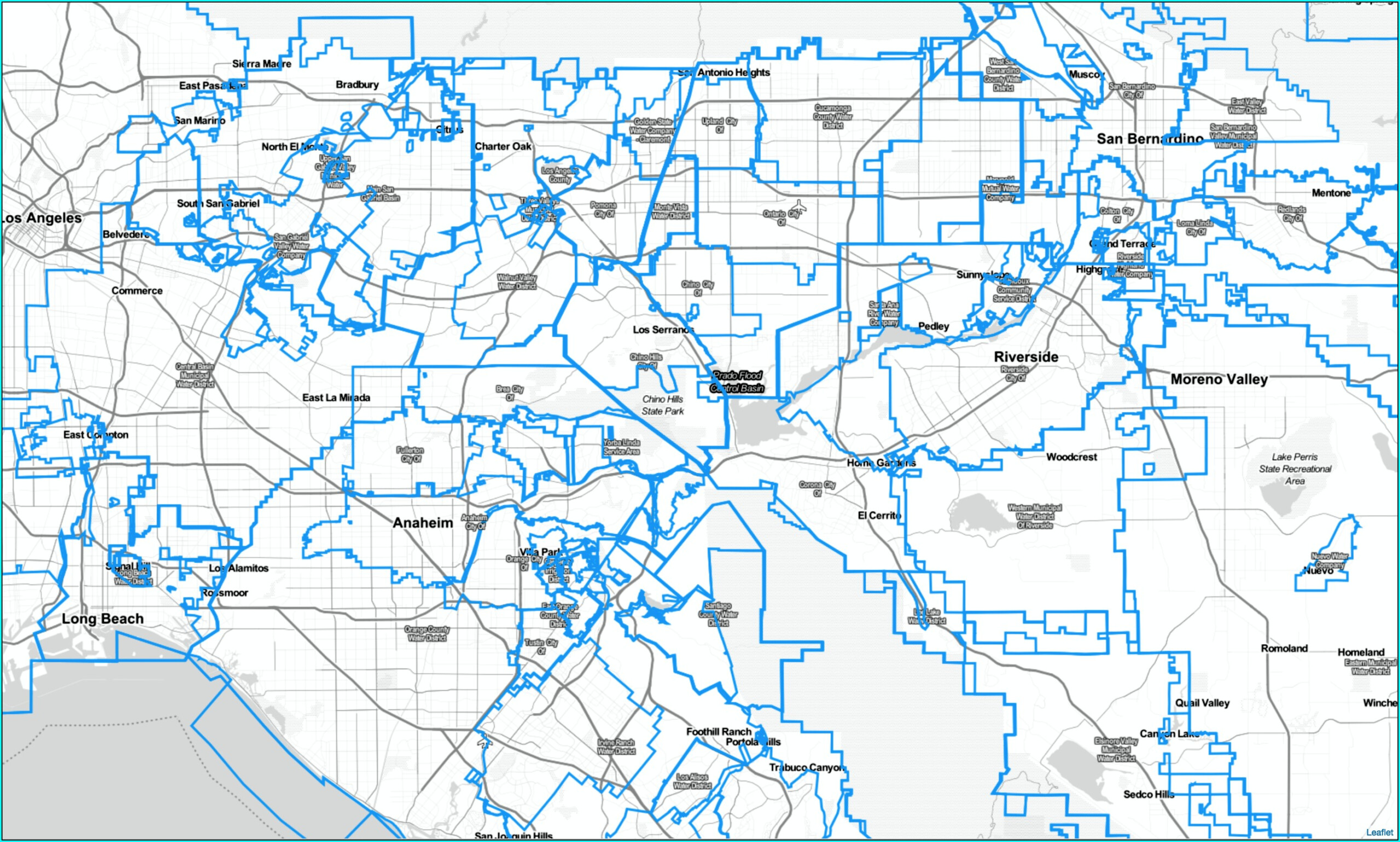

Riverside County Assessor Map Gis Map Resume Examples