2024 To 2025 FAFSA Tax Year: What You Need To Know Before Filing

So, you’re thinking about filing for FAFSA in 2024 or 2025, huh? Well, let me break it down for you. The FAFSA tax year is a big deal because it determines the kind of financial aid you might qualify for. Whether you're a high school senior or already in college, understanding the tax year requirements can save you a ton of stress and maybe even some cash. So, grab a cup of coffee, sit back, and let’s dive into the nitty-gritty of FAFSA and how it relates to the 2024 to 2025 tax year.

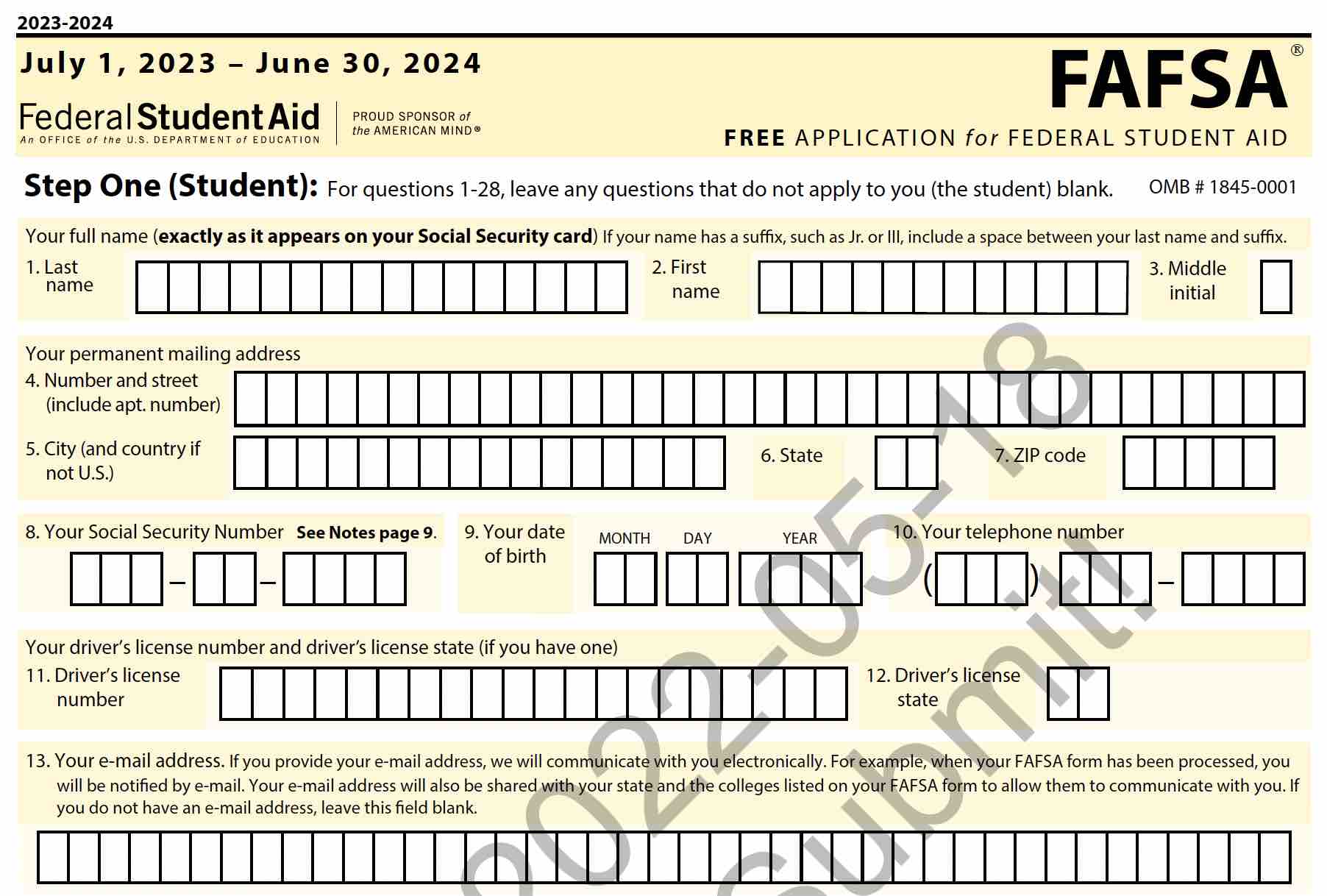

FAFSA, or the Free Application for Federal Student Aid, is basically the golden ticket to financial aid. It’s what schools use to figure out how much financial assistance you can get. And guess what? Your tax info plays a huge role in determining that. For the 2024 to 2025 FAFSA tax year, it’s super important to know which tax year they’re looking at and what info you need to gather.

Now, before we go any further, let’s get one thing straight: FAFSA doesn’t just randomly pick a tax year. There’s a method to the madness, and it’s all about making sure the financial info they review is as accurate as possible. By the end of this article, you’ll have a clear picture of what you need to do to ace your FAFSA application for the 2024 to 2025 academic year.

- Capetillo Jr The Rising Star In The Spotlight

- What Do Red Carnations Symbolize A Deep Dive Into Their Meaning And Significance

Understanding the FAFSA Tax Year

Alright, let’s talk about what the FAFSA tax year actually means. When you apply for FAFSA, they need to know how much money you—or your family—have been making. That’s where taxes come in. For the 2024 to 2025 FAFSA, they’re gonna be looking at your 2022 tax returns. Why 2022? Because it gives them a solid baseline of your financial situation without waiting for the latest tax filings.

Think of it like this: FAFSA wants to make sure they’re not rushing you to file taxes just to meet deadlines. By using the previous year’s tax info, they give you more time to focus on your application. So, if you’re filing in 2023 for the 2024 to 2025 academic year, don’t stress about 2023 taxes—2022’s got you covered.

Why Does the Tax Year Matter?

Here’s the deal: the tax year matters because it directly impacts your eligibility for financial aid. The info on your tax return helps determine your Expected Family Contribution (EFC), which is like a scorecard for how much financial aid you might qualify for. If your family’s income changed significantly in 2022, it could affect how much aid you get.

- Wade Wilson Teeth Broken The Untold Story Behind The Iconic Smile

- Mark Twain Winners Celebrating The Legends Of American Literature

For example, if your parents lost their jobs or had a drop in income in 2022, that might work in your favor when it comes to financial aid. On the flip side, if 2022 was a booming year financially, you might not qualify for as much aid. It’s all about the numbers, and the tax year is the key to unlocking those numbers.

2024 to 2025 FAFSA Deadlines

Now that we’ve got the tax year sorted, let’s talk deadlines. The FAFSA filing window for the 2024 to 2025 academic year opens on October 1, 2023. Mark that date on your calendar because the earlier you file, the better your chances of getting the most financial aid. Some states and schools have their own deadlines, so it’s crucial to check those too.

Here’s a quick rundown of important dates:

- FAFSA opens: October 1, 2023

- Federal deadline: June 30, 2024 (for the 2024 to 2025 academic year)

- State deadlines: Vary by state—check your state’s specific deadline

- School deadlines: Can also vary, so double-check with your school

Tips for Meeting Deadlines

Pro tip: don’t wait until the last minute to file. Gather all your documents ahead of time, including your 2022 tax returns, W-2 forms, and any other financial info you’ll need. The FAFSA process can take a bit of time, so the sooner you start, the better off you’ll be.

What Documents Do You Need?

When it comes to FAFSA, having your ducks in a row is essential. Here’s a list of documents you’ll need to gather:

- Your 2022 federal income tax returns

- W-2 forms for 2022

- Records of untaxed income, like child support or veterans benefits

- Bank statements and records of investments

- SSN or alien registration number (if you’re not a U.S. citizen)

For dependent students, you’ll also need to gather the same info for your parents. It might seem like a lot, but trust me, it’s worth it. Having everything ready will make the filing process smoother and faster.

Using the IRS Data Retrieval Tool

If you’re feeling overwhelmed by all the paperwork, there’s a tool that can make your life easier: the IRS Data Retrieval Tool (DRT). This tool lets you transfer your tax info directly from the IRS to your FAFSA application. It’s fast, secure, and eliminates the need to manually enter all your info. Just be sure your 2022 taxes are already filed before using the DRT.

Common Mistakes to Avoid

Let’s be real: filling out FAFSA can be confusing, and mistakes happen. But some errors can cost you big time. Here are a few common ones to watch out for:

- Missing deadlines: Don’t let procrastination bite you in the butt. File early!

- Incorrect Social Security Number: Double-check this one—it’s crucial.

- Forgetting to list schools: Make sure you include all the schools you’re applying to.

- Not signing the application: You gotta sign it to make it official!

Take your time when filling out the form, and don’t be afraid to ask for help if you’re unsure about something. There are tons of resources available to guide you through the process.

How to Avoid Costly Errors

One of the best ways to avoid mistakes is to use the FAFSA help resources available online. The official FAFSA website has tons of tips and FAQs to help you navigate the process. Plus, many schools offer workshops or tutoring sessions to assist students with their applications. Take advantage of these resources—they’re there to help you succeed!

Financial Aid Options for 2024 to 2025

Once you’ve filed your FAFSA, you’ll start seeing what kind of financial aid you qualify for. Here are some common options:

- Federal Pell Grants: These are grants for undergrads with financial need.

- Subsidized and Unsubsidized Loans: Loans that help cover education costs, with different interest rates and repayment terms.

- Work-Study Programs: Jobs on or off campus that help you earn money while you study.

- Scholarships: Merit-based or need-based awards that don’t need to be repaid.

Each option has its own benefits and requirements, so it’s important to explore them all and see which ones fit your needs best.

Maximizing Your Aid

Here’s the secret to getting the most aid possible: apply early, apply often, and don’t be afraid to appeal. If your financial situation changes after you file, you can contact your school’s financial aid office to request a review. They might be able to adjust your aid package based on new info.

Tax Considerations for FAFSA

Taxes play a huge role in FAFSA, so it’s important to understand how they affect your application. For the 2024 to 2025 FAFSA tax year, the IRS has some specific guidelines you should be aware of:

- Tax credits and deductions: Certain education-related credits and deductions can impact your EFC.

- Income exclusions: Some types of income, like scholarships or grants, might not count toward your taxable income.

- Dependent status: If you’re claimed as a dependent on someone else’s taxes, that can affect your FAFSA eligibility.

It’s a good idea to consult with a tax professional or financial advisor if you’re unsure about how your taxes will impact your FAFSA. They can help you navigate any tricky situations and make sure you’re maximizing your aid potential.

How Tax Changes Could Impact Your Aid

If there are any significant changes in your tax situation between 2022 and 2023, it’s worth noting. For example, if you or your family experienced a major life event—like a job loss or medical emergency—that could affect your financial aid eligibility. Keep track of these changes and be prepared to provide documentation if needed.

State and Institutional Aid

Don’t forget that in addition to federal aid, many states and schools offer their own financial aid programs. These can include grants, scholarships, and work-study opportunities. Some of these programs require you to file FAFSA, while others might have their own application processes.

It’s a good idea to research what’s available in your state and at your school. You might be surprised by how much extra aid you can qualify for just by doing a little extra legwork.

How to Find Additional Aid Sources

Here are a few tips for finding extra aid:

- Check your state’s department of education website for info on state-specific programs.

- Visit your school’s financial aid office to learn about institutional scholarships and grants.

- Use online scholarship search tools to find private scholarships that match your profile.

Every little bit helps, so don’t be afraid to cast a wide net when looking for financial aid options.

Final Thoughts

Alright, we’ve covered a lot of ground here. The 2024 to 2025 FAFSA tax year might seem overwhelming at first, but with the right info and a little preparation, you can tackle it like a pro. Remember to file early, gather all your documents, and don’t hesitate to reach out for help if you need it.

And here’s the most important takeaway: FAFSA is your ticket to financial aid, so don’t skip it! Whether you’re applying for grants, loans, or scholarships, completing your FAFSA is the first step toward making college more affordable. So, go ahead and get started—you’ve got this!

Got questions? Leave a comment below or share this article with a friend who might find it helpful. Together, we can make college dreams a reality!

Table of Contents

- Understanding the FAFSA Tax Year

- 2024 to 2025 FAFSA Deadlines

- What Documents Do You Need?

- Common Mistakes to Avoid

- Financial Aid Options for 2024 to 2025

- Tax Considerations for FAFSA

- State and Institutional Aid

- Final Thoughts

- Where Are The Cmas The Ultimate Guide To Unveiling The Cmas In 2023

- Dealing With Itchy Bumps On Inner Thigh A Comprehensive Guide

Fafsa 2024 2025 Deadline Texas Vikky Jerrilyn

FAFSA 2025 Your Ultimate Guide to Free College Money!

Fafsa Application For 2025 2025 Emma Foran B.